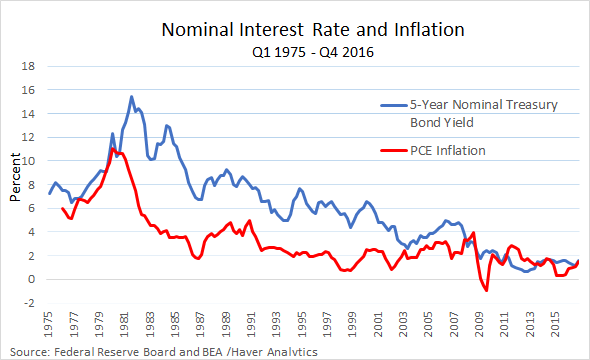

Holds on to your seat ! 1970 repeat stagflation. How they are going to fund the deficit if not issuing IOU aka treasury And some one has to buy those IOU. If not than it has to jack up rate (inflation)

US bond yield rise to 5% could wreck Asia’s economic year

With Asia's central banks holding massive stashes of US Treasuries, a yield rise could be devastating – and could trigger a regional panic sell

By

AUGUST 7, 2018 7:03 PM (UTC+8)

JP Morgan Chase's Chairman and CEO Jamie Dimon's prediction has many worried. Photo: AFP/Eric Piermont

Jamie Dimon just said what’s on the minds of many Asian central bankers. More to the point, he previewed the worst thing that could befall their balance sheets this year: 5% US bond yields.

The

is worrisome because, odds are, he’s right. As Dimon said over the weekend in Aspen, Colorado: “I think rates should be 4% today. You better be prepared to deal with rates 5% or higher – it’s a higher probability than most people think.”

US Treasuries: Asset or liability?

The most immediate concern is the $3 trillion-plus of US Treasury securities sitting on central bank balance sheets. Though that mostly means China and Japan – holding $1.2 trillion and $1.1 trillion, respectively. Hong Kong is exposed to the tune of $197 billion. Taiwan owns $181 billion, India $127 billion, Singapore $108 billion, South Korea $100 billion, Thailand $67 billion, and so on.

Bond prices and yields move in opposite directions. This means that if a central bank wanted to sell dollars in the future to, say, protect local currencies, their holdings are worth less.

A 200-plus basis point surge from Tuesday’s 2.94% 10-year would have scrambling to sell to avoid accelerating losses. It might be too late, of course, once Beijing or Tokyo – the investment whales in this narrative – pulled the trigger on massive dollar sales. But the rush for the exits would be messy, destabilizing and hard to hedge against.

The most interesting question is what might catalyze the surge in rates. Dimon appears to be eyeing a 4% US growth rate and a sub-4% unemployment rate. The Federal Reserve is in the middle of a tightening cycle. And the US experienced a rare burst of late-cycle stimulus from December’s $1.5 trillion tax cut.

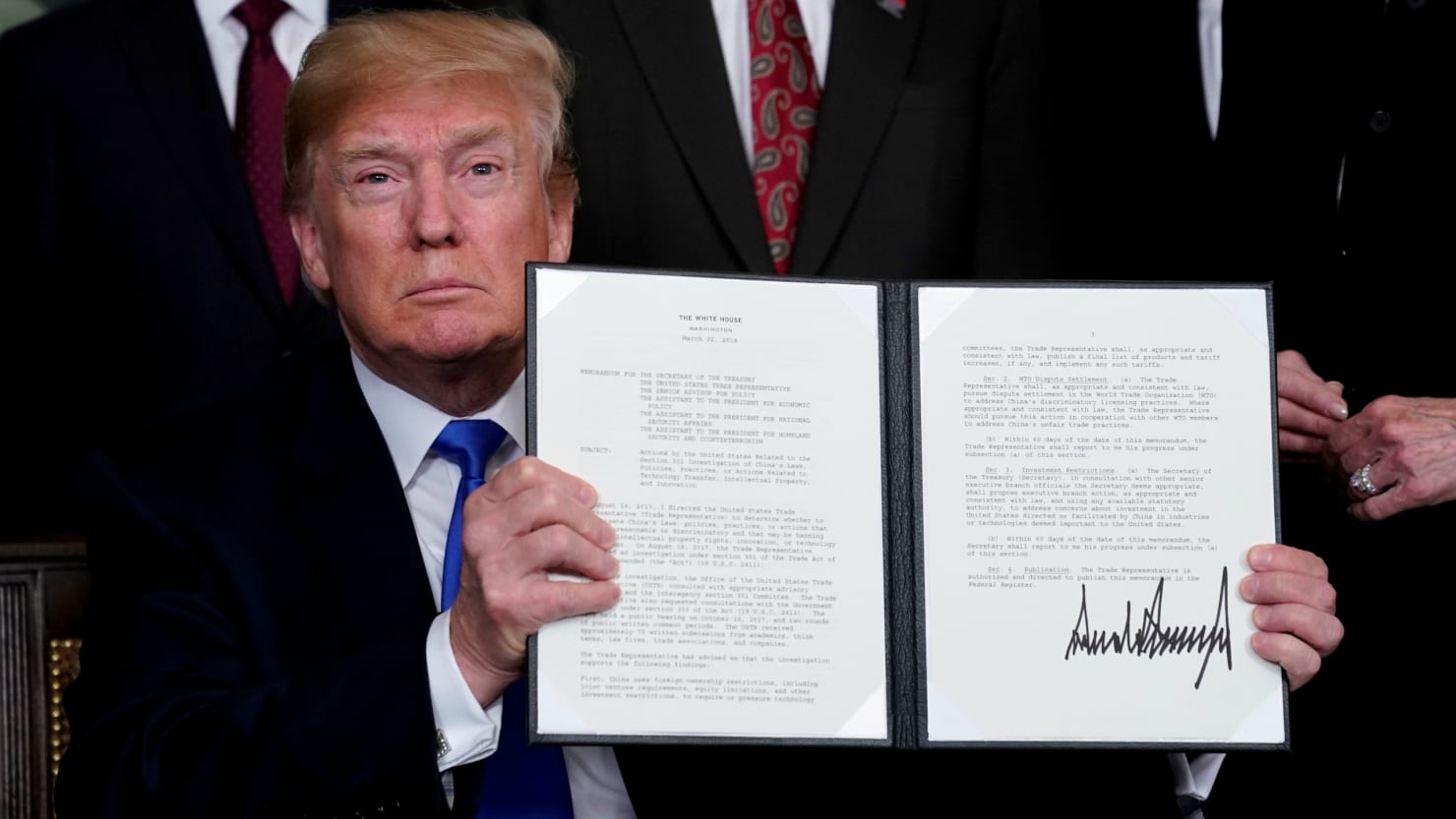

Shocks could just as easily come from the other direction. That massive tax cut by President Donald Trump’s Republican Party raised alarm bells in Beijing. In March, China’s ambassador to the US, Cui Tiankai, hinted that China might scale back on dollar-debt purchases.

Xi is not for kowtowing – or is he?

On top of concerns about fiscal losses, Beijing also grasps the leverage it has over Trump’s White House – the ability to call its loans to Washington. So far, President Xi Jinping has avoided using the so-called

of dumping dollars to punish Trump. While it is countering Trump’s tariff arms race tit-for-tat, Beijing is treading carefully. Surging rates would hurt US consumers, reducing their wherewithal to buy mainland goods.

Even so, China’s strongest leader in decades might face legitimacy questions if he bows to Trump. Hence, a new editorial by state-mouthpiece Global Times assures all of

. It calls Trump’s trade war “an act that aims to crush China’s economic sovereignty, trying to force China to be a US economic vassal just like Japan accepted the Plaza Accord.”

The reference here is to a 1985 deal between industrialized powers to weaken the dollar and strengthen the yen to correct perceived imbalances. It was hashed out at New York’s Plaza Hotel – which then-businessman Trump would later own for a spell. Clearly, China isn’t about to acquiesce to US complaints about a weaker yuan. Not with Beijing accusing the White House of “blackmail.”

Of course, Beijing could return the favor on Wednesday when the US Treasury auctions $78 billion of three-, 10- and 30-year debt. It’s a piece of the biggest so-called since 2010, a by-product of Trump’s giant tax cut. If Beijing boycotts, the bond rate the US needs to pay investors could skyrocket.

Any banker can be wrong. Look no further than Wall Street’s 2008 crash. And there are indeed holes in Dimon’s 5% scenario. He expects, for example, that the bull run in stocks could “actually go for two or three more years.”

Economic dissonance, given how surging yields might end Tuesday’s expansion? Perhaps. But when a CEO as smart and influential as Dimon raises a warning flag, it’s worth listening, whether you’re in New York or Shanghai. Bond market turmoil could be coming to an exchange near you.