China's Japanese Lesson For Fighting Trump's Trade War

U.S President Donald Trump has threatened to increase the next round of new tariffs on $200 billion Chinese imports from 10% to 25%. This would be a serious escalation if it comes to pass. Will China begin to back down under rising American pressure, which is presumably what Trump wants to see? In this context, it is instructive to re-examine the trade war that the U.S. waged against Japan in the 1980s, largely forgotten today by many, but evidently not by Beijing. What happened to Japan then is precisely what Beijing is determined to avoid now. What is this Japanese lesson?

Japan recorded its first post-war trade surplus with the U.S. in 1965 on the back of rapidly expanding export-oriented manufacturing. It continued to mount in the following two decades, peaking in 1986 at 1.3% of America’s GDP, according to IMF data. America started to grumble in the early 1970s about Japan’s rising trade surplus. But its was the dramatic increase in the world price of oil in the aftermath of the oil shocks of the 1970s that triggered the American trade war against Japan.

The lightening rod was Japan’s auto exports. Post oil shocks, fuel efficient and well made Japanese cars rapidly gained market share in the U.S. at the expense of American auto makers. By 1979, Chrysler, then one of the largest American auto makers, was about to fold. It needed a $1.5 billion bailout loan from the government to avoid bankruptcy. Suddenly, there was a crescendo of complaints about Japan’s unfair trade practices jeopardizing America’s national security and putting American workers out of work. Sound familiar?

Between 1976 to 1989, the U.S. launched 20 investigations under Section 301 of the U.S. Trade Act of 1974 (the very same Section 301 that the Trump administration is now invoking) against Japan’s exports to the U.S., not only in autos, but also in steel, telecom, pharmaceutical, semiconductors, and others. The Japanese government backed down and agreed to a series of oxymoronically termed “voluntary restraints” on exports on all the disputed items.

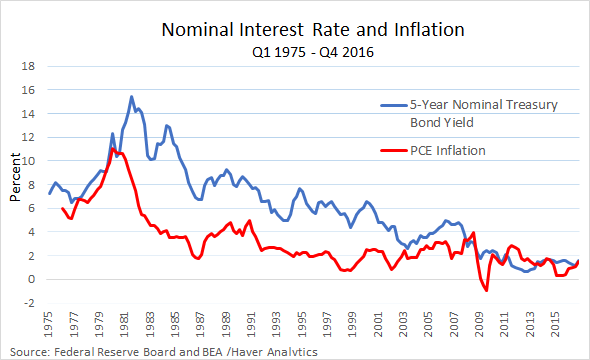

When America’s trade deficit with Japan failed to decline despite such voluntary restraints, the U.S. government then pressured Japan to import more from the U.S. Again, the Japanese government accommodated America’s demand by loosening monetary policy to encourage more domestic consumption. Japanese domestic consumption did rise, especially in the property market, fueled by rising debts based on low interest rates, but didn’t do much to increase imports from America.

This led to the third and last act of the trade war. The U.S. government accused Japan of manipulating its currency, keeping the yen’s exchange rate low against the U.S. dollar, thus giving Japanese exporters an unfair advantage. Japan was coerced to appreciate its currency at the Plaza Accord in September 1985. This was the agreement engineered by the U.S. as the chief currency manipulator with Japan, France, West Germany, and the U.K. as accomplices to varying degrees of reluctance, to jointly depreciate the U.S. dollar against the yen and the German mark. As far as currency manipulation goes, the Plaza Accord worked. Between 1985 and 1988, the yen appreciated 88% against the U.S. dollar, according to data from the U.S. Federal Reserve.

Still, America’s trade deficit with Japan did not go away. But by then it had also become irrelevant. Years of ultra-loose monetary policy created massive asset bubbles in Japan, most notably in its stock and property markets; and this bubble economy burst in 1989. The crash and subsequent recession was made worse by Japan’s cozy corporate networks that made clearing the market for a fresh start extremely difficult. What followed was two decades of economic stagnation. Even though America’s trade deficit with Japan persisted, there was not much the U.S. can do with a prostrate Japan mired in recession.

Beijing cannot fail to take note that America’s trade deficit with Japan did not disappear even though the Japanese government caved in to all the demands from the U.S.

From Beijing’s perspective, the lessons learned from the U.S.-Japan trade war are clear: don’t yield to U.S. pressure as Japan did, and don’t become solely dependent on America as an export market as Japan was. And China today is in a much stronger position to put into practice these lessons learned. While Japan’s GDP was only at 40% of America’s in the mid-1980s, China’s GDP was close to 70% of America’s last year, according to the IMF. Japan’s total import has never been big enough for it to wield real international influence, whereas China today is the biggest market for a growing list of countries including Japan, Australia, Brazil, Russia, South Africa, and South Korea.

In the trade war with the U.S., China will not become another Japan.