You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Renminbi (RMB)/Yuan Appreciation & Internationalization

- Thread starter supercat

- Start date

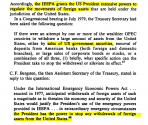

So I have seen that tweet.Seems US president can stop China from selling its vast Treasury holdings under emergency circumstances. China should unwind its holdings faster

View attachment 129984

but realistically speaking, I don’t know if this guy has actual experience with treasuries trading but if China was really selling 200b in treasuries in 1 day. It can easily do so without triggering any alarm in the system

The risk of using SWIFT is secondary. The real problem is the dollar accounts in various western banks. SWIFT and CIPS are just communication networks connecting banks, if the banks follow the order of US government the dollar is frozen in the account.IMO, China should make CIPS a very top priority because the way things are going with the US, sanctions could head into the financial sphere.

On the other hand, American companies in China are equally vonerable as Chinese in a retalitory act by China, they would not be able to convert their earnings in China from RMB to dollar then sent home. Same to any western entities in China. Everyone is holding throats of others, unless the west has far less investments in China than China has in the west.

Last edited:

The guy is high on something. Treasure bond are debt of feit currency (dollar in this case), all of them are just IOUs. They are only valuable IF the issuer honors them, otherwise they are just waste papers and can be easily replaced.Seems US president can stop China from selling its vast Treasury holdings under emergency circumstances. China should unwind its holdings faster

View attachment 129984

Here is an analog, say you own money to a guy who except the debt has nothing else to trade with you, you can refuse to pay and the guy can do nothing about it. But if you own debt to a farmer who provide you food, he can at least stop providing food to you, what are you going to do with the paper money that you owe to the farmer? You can't eat it. Yes the farmer will loose the past money which he didn't need anyway, but you loose food immediately. This is over simplified analog, in real world there are other famers. But looking from a higher level, China is the number one producer of goods, China also have some large resource producer in her camp, many "alternatives" export to US also import components from China. China will refuse to accept further dollar payments from these "alternative". This camp is like the largest farmer in town, how is US going to bypass? With China and her camp refusing further dollar payment, those treasure bond and the dollar in circulation that the bond represents will severely devaluate to the level of toilet paper and their place will be replaced by any currency that China accept. Taking this action by the US is like a self-revolution.

The act is only useful if it is targetting countries whose production and trade is neglectable in the world market, against China it is suicidal.

Last edited:

China is definitely pushing more countries to move to CIPS and using RMB. Getting them to buy panda bonds will make it increasingly more attractive as a reserve asset

Bank of China's Serbian branch conducts its first cross-border remittance in RMB.

This remittance was to a Hebei based steel manufacturing group called HBIS Group. The money was from revenue earned by the century-old Smederevo Steelworks in Serbia that the group recently revived in 2016.

Xinhua article about this with more details:

Last edited:

Been sort of following mBridge which on the surface sounds very promising. The only thing that never sat well with me is that it is sponsored by BIS, which is basically the realm of the Western banking elites. For instance in 2022, Russia's membership was suspended from the BIS network. I think better if BRICs copy mBridge and make its own system.Saudi Arabia just joined Project mBridge (which of course has China as the key member) as a full participant of the cross-border payments network. Expect the platform to be used for non-dollar commodity settlement.