I'm not an expert in this domain. However, I do know that allowing the yuan to become a reserve currency would increase demand for the yuan in the global currency market, putting upward pressure on the value of the yuan while maintaining the current value would require more yuan would have to be printed, causing inflation in China. So, allowing the value to appreciate would eliminate China's trade advantage and makes its peoducts less competitive globally. Therefore, i think that's why China still maintains capital controls to keep demand for the yuan limited, or I'm I mistaken?

Plus, there's also the outsized role played by the United States in capital markets, trade and debt reinforces the status quo.

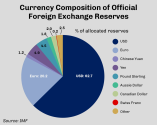

Else it's unreasonable that despite China's large economy and beings the world's top trader, its share of RMB in use for world trade/reserve currency is even below that of our currency the pound and even Japanese Yen.

View attachment 110271

View attachment 110270

I think it's also because of the reason I mentioned above? To be honest, as long as this is the case, I don't see the Yuan ever being a significant challenge to the US Dollar. Unless the global economy undergoes a complete overhaul(which is unlikely anytime soon).

That's all Western cope you are spitting. China's government definitely wants the yuan to replace or considerably strengthen against the dollar, at least to a very large extent, in the coming years. They made it clear in a form of numerous statements from various institutions and then direct actions that followed. It is because China can't achieve common prosperity, one of the quintessential party goals, without doing it, any time soon, I mean in decades, or if ever. And not everything regarding common prosperity is about money, meaning the crude size of people's paychecks, it's also about what kind of jobs people perform. This will all increase the party's standing and legitimacy (positive feelings) amongst the people. They want for their citizens to get more money, but also work better, easier, more engaging jobs than simply factory work. Look how the US has all those influencers, marketers, salespeople, etc. That is the true standard of living, easier jobs, and purchasing power for the common populace.

Yuan must be stronger, allowing China's Central Bank to print it more safely, lower interest rates, and give it to the government on social programs, and infrastructure, hence injecting more money into citizens' pockets in that way. Making them wealthier and making their economy more service-based, and more consumption-driven, so they can work less hard jobs in factories, and do less demanding kinds of jobs while simultaneously getting more money for that. However, this is mostly about low-end industrial, manufacturing jobs as they bring the lowest salaries and are the hardest to work at, China will probably relocate all of that to its allies and iron friends when that happens. I mean when the yuan manages to overthrow the dollar to a large extent. To ASEAN, Africa, Latin America, and other developing countries across the world. That's how China will manage to keep their eyes closed when it dethrones the dollar, and get them all to accept the yuan. It will get have more political power over them in that way, so not everything is lost. Just imagine the clout the Chinese government will have at that time, the queue will be endless. Imagine those FDI agreements' potential and the Chinese middle-income market in the eyes of those countries. At that time China will truly become the center of the world in every kind of way.

Meanwhile, they will keep the high-end manufacturing which won't be affected much by yuan internalization and appreciation. They learned a history lesson of how the US is collapsing and will disintegrate if they put all of their eggs into one basket, and just live in service-based and consumption-driven economic activity. But, China won't allow that, China is smarter, has 5000 years of civilization history as opposed to the US 250 years long history, and China has the means to make sure that it actually controls any of its large corporations, that it wants, and China has legal and sociological leverage over them as they are an autocracy as opposed to the American democratic oligarchy in which the US corporations control the government for example. In China, it's the opposite, the government controls its corporation. And high-end manufacturing is mostly about innovation, education, and intelligence, better salaries, and is more engaging, than low-end production. China will keep the high-end manufacturing sector, it will be immune to yuan appreciation before there is less supply of those products in the world, therefore it will still be sold internationally despite the yuan's stronger exchange rate. China also has the best infrastructure and political system in the world, and R&D will remain in China alongside high-quality production just due to those benefits mainly. But, China's government could also blackmail and potentially ban Chinese companies that want to relocate abroad, and form its domestic market, at that time the strongest in the world, unlike the cuck America in which the corporations control political parties through their lobbying and election interference. America's high-end manufacturing also fled the country, but China's won't. China won't allow their South Koreas, Germanies, and Japans to form like US.

Therefore, to make everything clear, I think China's economic model for the future will be service-based + only high-end manufacturing. I think only with this approach, China can truly transform its 1.4 billion people population into a truly wealthy society. As for how the de-dollarization and yuanization will play out, we see it today. China lessening banking regulations, giving more and more offshore yuan clearing and settlement permission to banks in various countries, increasing circulation of yuan, lessening pegging to the dollar, internationalizing its banks, more government-to-government trade agreements in yuan, more loans in yuan, more other offshore financial and banking services offered in yuan, leveraging its position to get more third-party cross-border trade to happen in yuan, getting more countries to hold yuan in their central bank reserves, more sovereign funds to hold Chinese yuan, promoting CIPS, e-yuan, etc. It's all happening now. China is even doing its own mini version of petroyuan with Russia, and possibly Saudi Arabia and others. And not to your point, China doesn't care if this will all upset Western feelings. They have their own country to run and they don't give a damn about their feelings. If the US and the EU collapse due to hyperinflation due to their currency devaluation, then it's even better for China. It's their mistakes that they run their economies like Ponzi schemes for decades basically. They are also today enemies of China in all aspects. Just to be clear, China has a way more efficient system, and they could always restart low-end production too if a similar situation like a de-yuanization occurs, they have a way more effective leadership. But the West can't do that. China will do currency internalization right, by studying their mistakes, just like China did the Leninist government right after studying USSR's mistakes.