Its David vs Goliath, just landing in third place within 5 years is good enough.

from cnTechPost

How big is the gap between SMIC and TSMC?

2020-07-09 20:45:35 GMT+8 | cnTechPost

1

As a leading Chinese foundry, Semiconductor Manufacturing International Corporation (SMIC) has been doing its best to catch up with TSMC.

This year, SMIC has significantly narrowed the gap with TSMC in its main business.

At the beginning of the year, SMIC beat TSMC to win orders from Huawei HiSilicon for 14nm FinFET process chips.

So what is the current gap between SMIC and TSMC? CITIC Securities has answered in a research note.

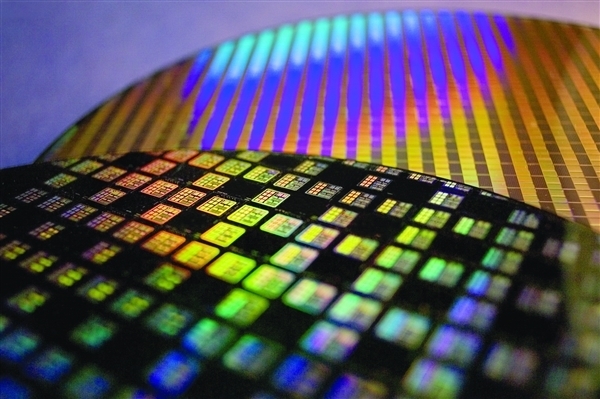

In terms of chip manufacturing process level, TSMC started mass production of 5nm products this year, which is the highest level in the industry.

In the 7nm and 10nm process areas, there are also two headline companies, Intel and Samsung Electronics.

SMIC is one of the major players, with Gershon (USA) as the remaining player. (GlobalFoundries) and Taiwan-based UMC.

In China, SMIC is the only wafer maker mass producing 14nm wafers, about 4 years behind TSMC.

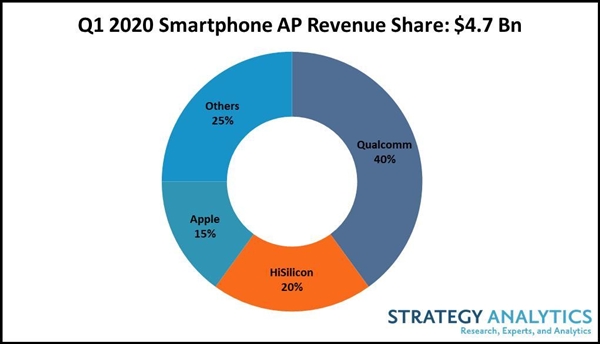

Based on 2019 global sales, TSMC and Samsung Electronics are the top tier companies. TSMC's market share is close to 50%, well ahead of Samsung (18%).

SMIC is in the second tier, with a market share of just 4.4%.

China Hua Hong Semiconductor is in the third echelon, with a market share of only 1.5%.

In terms of development history, TSMC's breakthrough in the global market stems from a milestone event.

In 2014, Apple began to hand over foundry orders to TSMC, thus making TSMC's market share from the previous years, the number of orders to TSMC has been reduced to 1.5 percent. Over 40% is over 50% in one fell swoop. Apple is TSMC's #1 customer.

SMIC didn't get Huawei HiSilicon until January of this year because Huawei suffered a major setback overseas. The order for the 14nm process has taken some of the markets away from TSMC.

Currently, HiSilicon is SMIC's largest customer. CITIC Securities expects that more than 80% of SMIC's 14nm wafer production this year will be supplied to HiSilicon. SMIC's revenue contribution is between 17% and 25%.

SMIC has built three 8-inch wafer fabs and four 12-inch wafer fabs.

The total capacity is 233,000 wafers/month for 8" and 108,000 wafers/month for 12". The total capacity is 476,000 wafers/month (8-inch equivalent).

TSMC plans to further expand its 8-inch capacity and advanced process capacity.

In comparison, TSMC has several times the capacity of SMIC. TSMC has 562,000 wafers/month of 8" capacity, nearly two and a half times the capacity of SMIC, and 745,000 wafers/month of 12" capacity. TSMC's advanced process revenue is seven times that of SMIC.

In terms of the contribution of different process products to the company's revenue, TSMC's advanced processes contribute significantly to the company's revenue, while SMIC's advanced processes contribute significantly to the company's revenue. The revenue structure of SMIC is relatively balanced.

According to CITIC Securities, SMIC's revenue contribution is split 50-50 between 12" and 8". 40nm and earlier nodes are maturing, and SMIC's revenue contribution is relatively balanced. Processes below 28nm are still losing money.

TSMC's 12" process contributes 88% of revenue, 16nm and below advanced processes contribute 56% of revenue, 7nm contributes about 40% of revenue, and the 28nm process is still losing money. With 35% of revenue, the advanced process has a monopoly of 80% share in the world.

The global market concentration of 8-inch products is not high, with TSMC's market share at 26% and SMIC's at 8%.

SMIC's production capacity of such products is 233,000 wafers per month, ranking third in the world after TSMC and UMC, accounting for 50% of the company's total capacity and 45% of revenue contribution. The average net profit margin is about 5%, lower than the industry average of 15%.

While 12-inch products correspond to 7nm-16nm nodes, the market concentration is high, with TSMC as the global dominant player, with an average of It has a market share of nearly 80%, is priced higher than SMIC, and contributes up to 88% of TSMC's revenue to SMIC.

In terms of financial metrics, TSMC is well ahead of its competitors, generating $35.7 billion in revenue and $11.5 billion in net income in 2019.

It is the world's largest semiconductor company by market capitalization, with a market capitalization of $300 billion.

During the same period, SMIC had revenues of $3.116 billion, a net profit of $235 million, and a total market capitalization of more than HK$230 billion.

![[IMG] [IMG]](https://www.globaltimes.cn/Portals/0/attachment/2018/2018-12-06/e9ea9f3c-ac4c-4de3-bd77-ee0287fb9221.jpeg)

![[IMG] [IMG]](https://n.sinaimg.cn/sinakd20200508ac/224/w640h384/20200508/70c7-iteyfww4496163.jpg)

![[IMG] [IMG]](https://i2.wp.com/asiatimes.com/wp-content/uploads/2020/07/TokyoElectron.jpeg?fit=1200%2C676&ssl=1)

![[IMG] [IMG]](https://i1.wp.com/asiatimes.com/wp-content/uploads/2020/07/image.png?w=780&ssl=1)

![[IMG] [IMG]](https://i0.wp.com/asiatimes.com/wp-content/uploads/2020/07/image-1.jpeg?w=780&ssl=1)