You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

News on China's scientific and technological development.

- Thread starter Quickie

- Start date

Skywatcher

Captain

Halt the exodus? Fat chance of that.hi SKYWATCHER

Some points taken from our owned SUPERSNOOP from HK thread

However, it is just a symbolic gesture anyway. Taiwan’s wages are awful. I read somewhere that they lose something like nearly 50% of college grads to China, and 80% of grad students that study outside of Taiwan never return. Really just insane numbers.

Do you have an idea if China is able to exploit the talent needed in Taiwan, I had a contrasting report that Ms TSAI had been able to halt the exodus.

Though it's likely that eventually the Mainland employment market will get saturated/Taiwan will run out of people capable enough of leaving to Mainland/rest of the world.

hi SKYWATCHER

There seem some people doubting the profitability of SMIC 14NM, Im no tech expert but for China having the tech is important, what can you say about this article from cnTechPost.

Can SMIC's 14nm bet be profitable?

2020-06-25 20:11:21 GMT+8 | cnTechPost

1

Controversy is brewing around Semiconductor Manufacturing International Corporation (SMIC), the biggest chipmaker on the Chinese mainland, after it received approval to list on China's Sci-Tech innovation board (STAR Market).

SMIC's Hong Kong-listed shares have surged to record highs since the Shanghai Stock Exchange disclosed the registration draft of its prospectus on June 22.

The current focus from analysts and industry insiders is on one question: the company is putting twice as much money as net profit into a technology that generates less than 1% of revenue - the 14nm process.

So can the technology deliver a significant value expansion for the company? Currently, stakeholders are divided on the issue.

The 14nm advanced process largely represents a growth opportunity for the company. Guoyuan Securities SMIC has an opportunity to expand its value in the 14nm era, according to the competitive landscape.

One person who has been involved in the chip foundry industry for many years said that companies still face the risk of greater market competition in the 14-nanometer era.

Investing in 14nm

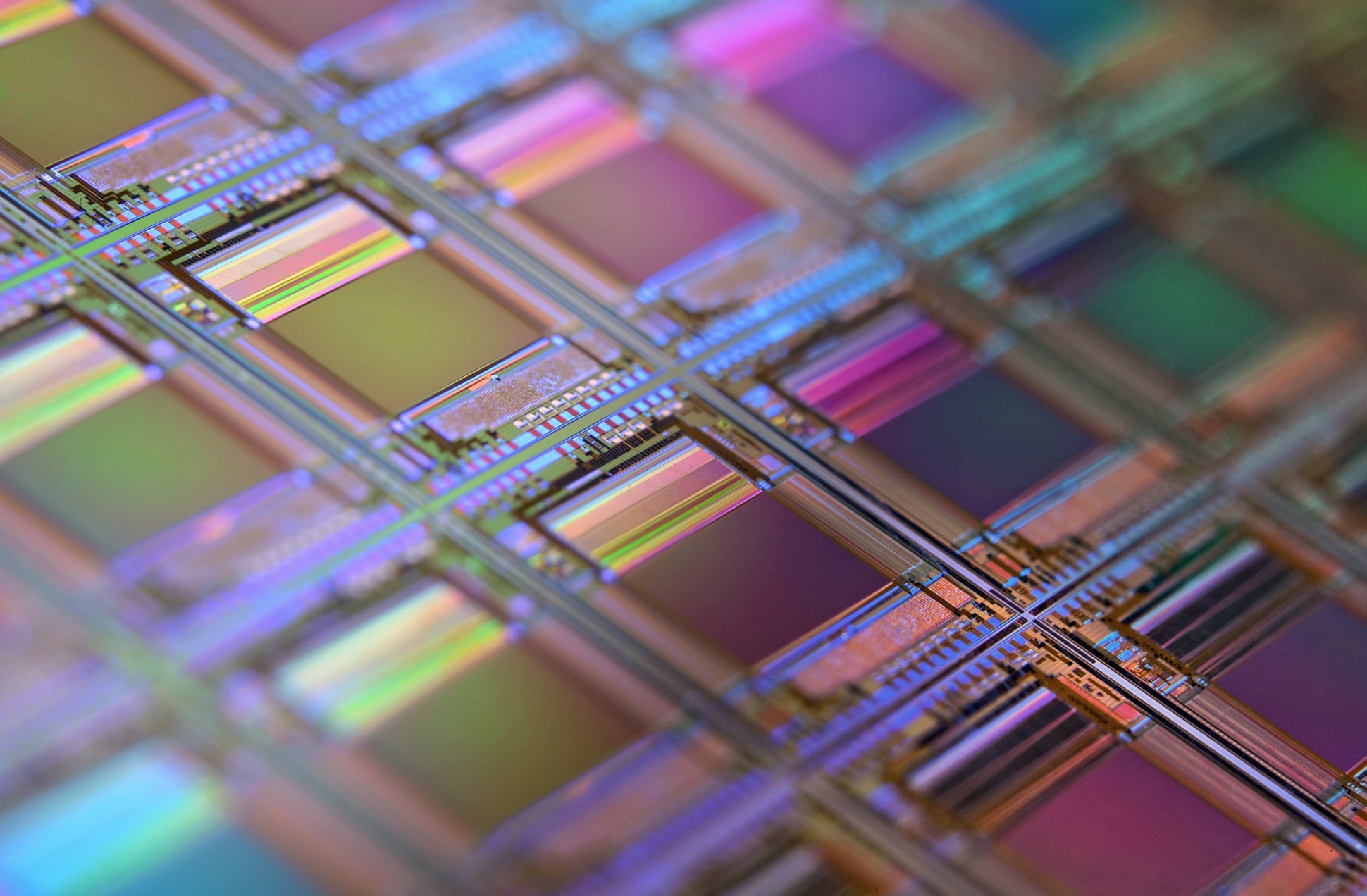

The smaller the IC size and the higher the process level, the more chips can be made on the same area of the wafer, or the smaller the footprint of a chip with the same transistor size.

The 14nm process is SMIC's most advanced process available today, and can be used in smartphones, tablets, set-top boxes, AI, radio frequency (RF) and other applications. The process is still far from the world's most advanced process development progress of 5nm and 7nm. However, the process is still far from the world's most advanced process development progress of 5nm and 7nm.

The 14-nanometer process to achieve mass production in Q4 2019, the project revenue of less than 1% of the total revenue, is currently in the initial stage of construction.

However, the company invested about 3.32 billion yuan in the 14-nanometer and below process that year, equivalent to twice the net profit of that year.

It can be said that the company chose to focus its capital on advanced processes rather than on mature processes such as 28nm.

Regarding the value space at 14nm, Guoyuan Securities believes that the company will have an opportunity for value expansion in the 14nm era.

Their rationale is that the company's market space and competitive landscape for the 14nm process is far superior to the 28nm process.

In terms of the landscape, they argue that Moore's Law evolves to below 14nm, and the process landscape has changed significantly.

The only players left at 14nm and below are SMIC, United Microelectronics Corporation, GlobalFoundries, TSMC, Samsung, and Intel.

In contrast, there are many players in the 28nm node. This leads to excess capacity at 28nm and significant competitive pressure.

According to SMIC's prospectus, the number of pure-play foundries with the technical capability to provide 14nm technology nodes has been reduced from five to four globally from 28nm, and only three of them are pure-play foundries with actual output.

Guoyuan Securities said that TSMC has entered a period of high growth in profitability and market capitalization after entering the 16nm FinFET process node (equivalent to 14nm node) since 2015.

14nm profitability controversy

A person who has been involved in the chip foundry industry for many years believes that the 14nm market landscape is challenging for SMIC.

The foundry's industry chain position and business model make it difficult to differentiate itself, and it is the norm for latecomers to follow the leader.

TSMC was able to make a profit on the process because, as the leader, it was able to mass-produce the technology ahead of its rivals and lead customer standards.

But that's not the case for followers. That's why United Microelectronics Corporation, GlobalFoundries' withdraw from competition in the advanced process market.

The person said that in the chip foundry market, for each generation of advanced process, the leader generally chooses to launch a general-purpose platform first.

When the latecomers follow, they will drop the price of the original platform, and then upgrade the original platform by making minor improvements and launch a Plus version.

This approach can both bind customers deeply and make rivals lose market competitiveness.

From the customer's point of view, they also want OEMs to launch standardized products.

According to IHS statistical forecasts, the IC foundry market for more advanced processes at 14nm and below will continue to grow rapidly, with the global market size expected to reach $38.6 billion in 2024, at a compound growth rate of 19% from 2018 to 2024.

Both the brokerage firm and the person believe that 14nm still has a good market space.

Guoxin Securities believes that chip design costs for advanced processes will become increasingly high and unaffordable for design companies, so even if 7nm is introduced, many companies will not migrate to 7nm from a cost and revenue perspective.

These people also believe that, because the cost of upgrading to the next generation of consumer electronics is too expensive, so the chip design companies for some process nodes will stay for a long time.

The person said that the gross margin level of 14nm should be judged from the three aspects of equipment depreciation, yield rate and customer quality in the future, which requires further disclosure of more information.

There seem some people doubting the profitability of SMIC 14NM, Im no tech expert but for China having the tech is important, what can you say about this article from cnTechPost.

Can SMIC's 14nm bet be profitable?

2020-06-25 20:11:21 GMT+8 | cnTechPost

1

Controversy is brewing around Semiconductor Manufacturing International Corporation (SMIC), the biggest chipmaker on the Chinese mainland, after it received approval to list on China's Sci-Tech innovation board (STAR Market).

SMIC's Hong Kong-listed shares have surged to record highs since the Shanghai Stock Exchange disclosed the registration draft of its prospectus on June 22.

The current focus from analysts and industry insiders is on one question: the company is putting twice as much money as net profit into a technology that generates less than 1% of revenue - the 14nm process.

So can the technology deliver a significant value expansion for the company? Currently, stakeholders are divided on the issue.

The 14nm advanced process largely represents a growth opportunity for the company. Guoyuan Securities SMIC has an opportunity to expand its value in the 14nm era, according to the competitive landscape.

One person who has been involved in the chip foundry industry for many years said that companies still face the risk of greater market competition in the 14-nanometer era.

Investing in 14nm

The smaller the IC size and the higher the process level, the more chips can be made on the same area of the wafer, or the smaller the footprint of a chip with the same transistor size.

The 14nm process is SMIC's most advanced process available today, and can be used in smartphones, tablets, set-top boxes, AI, radio frequency (RF) and other applications. The process is still far from the world's most advanced process development progress of 5nm and 7nm. However, the process is still far from the world's most advanced process development progress of 5nm and 7nm.

The 14-nanometer process to achieve mass production in Q4 2019, the project revenue of less than 1% of the total revenue, is currently in the initial stage of construction.

However, the company invested about 3.32 billion yuan in the 14-nanometer and below process that year, equivalent to twice the net profit of that year.

It can be said that the company chose to focus its capital on advanced processes rather than on mature processes such as 28nm.

Regarding the value space at 14nm, Guoyuan Securities believes that the company will have an opportunity for value expansion in the 14nm era.

Their rationale is that the company's market space and competitive landscape for the 14nm process is far superior to the 28nm process.

In terms of the landscape, they argue that Moore's Law evolves to below 14nm, and the process landscape has changed significantly.

The only players left at 14nm and below are SMIC, United Microelectronics Corporation, GlobalFoundries, TSMC, Samsung, and Intel.

In contrast, there are many players in the 28nm node. This leads to excess capacity at 28nm and significant competitive pressure.

According to SMIC's prospectus, the number of pure-play foundries with the technical capability to provide 14nm technology nodes has been reduced from five to four globally from 28nm, and only three of them are pure-play foundries with actual output.

Guoyuan Securities said that TSMC has entered a period of high growth in profitability and market capitalization after entering the 16nm FinFET process node (equivalent to 14nm node) since 2015.

14nm profitability controversy

A person who has been involved in the chip foundry industry for many years believes that the 14nm market landscape is challenging for SMIC.

The foundry's industry chain position and business model make it difficult to differentiate itself, and it is the norm for latecomers to follow the leader.

TSMC was able to make a profit on the process because, as the leader, it was able to mass-produce the technology ahead of its rivals and lead customer standards.

But that's not the case for followers. That's why United Microelectronics Corporation, GlobalFoundries' withdraw from competition in the advanced process market.

The person said that in the chip foundry market, for each generation of advanced process, the leader generally chooses to launch a general-purpose platform first.

When the latecomers follow, they will drop the price of the original platform, and then upgrade the original platform by making minor improvements and launch a Plus version.

This approach can both bind customers deeply and make rivals lose market competitiveness.

From the customer's point of view, they also want OEMs to launch standardized products.

According to IHS statistical forecasts, the IC foundry market for more advanced processes at 14nm and below will continue to grow rapidly, with the global market size expected to reach $38.6 billion in 2024, at a compound growth rate of 19% from 2018 to 2024.

Both the brokerage firm and the person believe that 14nm still has a good market space.

Guoxin Securities believes that chip design costs for advanced processes will become increasingly high and unaffordable for design companies, so even if 7nm is introduced, many companies will not migrate to 7nm from a cost and revenue perspective.

These people also believe that, because the cost of upgrading to the next generation of consumer electronics is too expensive, so the chip design companies for some process nodes will stay for a long time.

The person said that the gross margin level of 14nm should be judged from the three aspects of equipment depreciation, yield rate and customer quality in the future, which requires further disclosure of more information.

hi SKYWATCHER

There seem some people doubting the profitability of SMIC 14NM, Im no tech expert but for China having the tech is important, what can you say about this article from cnTechPost.

Can SMIC's 14nm bet be profitable?

2020-06-25 20:11:21 GMT+8 | cnTechPost

1

Controversy is brewing around Semiconductor Manufacturing International Corporation (SMIC), the biggest chipmaker on the Chinese mainland, after it received approval to list on China's Sci-Tech innovation board (STAR Market).

SMIC's Hong Kong-listed shares have surged to record highs since the Shanghai Stock Exchange disclosed the registration draft of its prospectus on June 22.

The current focus from analysts and industry insiders is on one question: the company is putting twice as much money as net profit into a technology that generates less than 1% of revenue - the 14nm process.

So can the technology deliver a significant value expansion for the company? Currently, stakeholders are divided on the issue.

The 14nm advanced process largely represents a growth opportunity for the company. Guoyuan Securities SMIC has an opportunity to expand its value in the 14nm era, according to the competitive landscape.

One person who has been involved in the chip foundry industry for many years said that companies still face the risk of greater market competition in the 14-nanometer era.

Investing in 14nm

The smaller the IC size and the higher the process level, the more chips can be made on the same area of the wafer, or the smaller the footprint of a chip with the same transistor size.

The 14nm process is SMIC's most advanced process available today, and can be used in smartphones, tablets, set-top boxes, AI, radio frequency (RF) and other applications. The process is still far from the world's most advanced process development progress of 5nm and 7nm. However, the process is still far from the world's most advanced process development progress of 5nm and 7nm.

The 14-nanometer process to achieve mass production in Q4 2019, the project revenue of less than 1% of the total revenue, is currently in the initial stage of construction.

However, the company invested about 3.32 billion yuan in the 14-nanometer and below process that year, equivalent to twice the net profit of that year.

It can be said that the company chose to focus its capital on advanced processes rather than on mature processes such as 28nm.

Regarding the value space at 14nm, Guoyuan Securities believes that the company will have an opportunity for value expansion in the 14nm era.

Their rationale is that the company's market space and competitive landscape for the 14nm process is far superior to the 28nm process.

In terms of the landscape, they argue that Moore's Law evolves to below 14nm, and the process landscape has changed significantly.

The only players left at 14nm and below are SMIC, United Microelectronics Corporation, GlobalFoundries, TSMC, Samsung, and Intel.

In contrast, there are many players in the 28nm node. This leads to excess capacity at 28nm and significant competitive pressure.

According to SMIC's prospectus, the number of pure-play foundries with the technical capability to provide 14nm technology nodes has been reduced from five to four globally from 28nm, and only three of them are pure-play foundries with actual output.

Guoyuan Securities said that TSMC has entered a period of high growth in profitability and market capitalization after entering the 16nm FinFET process node (equivalent to 14nm node) since 2015.

14nm profitability controversy

A person who has been involved in the chip foundry industry for many years believes that the 14nm market landscape is challenging for SMIC.

The foundry's industry chain position and business model make it difficult to differentiate itself, and it is the norm for latecomers to follow the leader.

TSMC was able to make a profit on the process because, as the leader, it was able to mass-produce the technology ahead of its rivals and lead customer standards.

But that's not the case for followers. That's why United Microelectronics Corporation, GlobalFoundries' withdraw from competition in the advanced process market.

The person said that in the chip foundry market, for each generation of advanced process, the leader generally chooses to launch a general-purpose platform first.

When the latecomers follow, they will drop the price of the original platform, and then upgrade the original platform by making minor improvements and launch a Plus version.

This approach can both bind customers deeply and make rivals lose market competitiveness.

From the customer's point of view, they also want OEMs to launch standardized products.

According to IHS statistical forecasts, the IC foundry market for more advanced processes at 14nm and below will continue to grow rapidly, with the global market size expected to reach $38.6 billion in 2024, at a compound growth rate of 19% from 2018 to 2024.

Both the brokerage firm and the person believe that 14nm still has a good market space.

Guoxin Securities believes that chip design costs for advanced processes will become increasingly high and unaffordable for design companies, so even if 7nm is introduced, many companies will not migrate to 7nm from a cost and revenue perspective.

These people also believe that, because the cost of upgrading to the next generation of consumer electronics is too expensive, so the chip design companies for some process nodes will stay for a long time.

The person said that the gross margin level of 14nm should be judged from the three aspects of equipment depreciation, yield rate and customer quality in the future, which requires further disclosure of more information.

Fuck the shareholders. This process will have all the profit they want when the US finally does the chip embargo. Until then the State should subsidize it.

Reminder that "shareholder first" business logic destroyed GE and countless great American companies.

Skywatcher

Captain

Long as SMIC has a sufficient captive/near captive domestic market, it shouldn't be hard to run a profit.

Additionally, as a second mover in 14nm, SMIC's costs today won't be as high as TSMC's was in say, 2015 or so.

Additionally, as a second mover in 14nm, SMIC's costs today won't be as high as TSMC's was in say, 2015 or so.

hi SPOOPYSKELETONFuck the shareholders. This process will have all the profit they want when the US finally does the chip embargo. Until then the State should subsidize it.

Reminder that "shareholder first" business logic destroyed GE and countless great American companies.

Your right and the majority of new investors are china VC or China state capital, what I know is they had a TECH road map to R&D the 5nm , 7nm is due this year. I may ask SKYWATCHER, WTAN, SUPERDOG and other tech expert of their opinion.

Hi SkywatcherLong as SMIC has a sufficient captive/near captive domestic market, it shouldn't be hard to run a profit.

Additionally, as a second mover in 14nm, SMIC's costs today won't be as high as TSMC's was in say, 2015 or so.

Is 14nm a profit driver node, what I read is that 7nm is where the money is especially with 5G.

HI Skywatcher

If SMIC is able to provide the 7nm chips to Huawei at the end of the year or maybe next year, and Trump may cancel the chip ban. Do you think Huawei will trust TSMC , is the relationship severed.? Huawei is TSMC major customer and you dont treat it like that.

If SMIC is able to provide the 7nm chips to Huawei at the end of the year or maybe next year, and Trump may cancel the chip ban. Do you think Huawei will trust TSMC , is the relationship severed.? Huawei is TSMC major customer and you dont treat it like that.

HI Skywatcher

If SMIC is able to provide the 7nm chips to Huawei at the end of the year or maybe next year, and Trump may cancel the chip ban. Do you think Huawei will trust TSMC , is the relationship severed.? Huawei is TSMC major customer and you dont treat it like that.

The trust is gone. But China should still give some business to TSMA, on the condition that they have to be manufactured in TSMC's wafer fab(s) in China. This is the way to reestablish mutual trust.

Last edited: