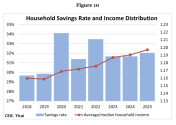

i would argue it is indicative, considering most reports and articles are using this measurement

i'm no economist but if money sure isn't spent, surely it is saved or invested?

weirdly Urban Household Savings didn't give any concrete numbers either, only sentiment

but by eyeballing:

2004 q3 (awful formatting)

32.3 percent of the surveyedconsidered consumption (including through borrowing) the “most sensible”choice,

33.4 percent surveyedconsidered "to save more" the most sensible choice,

7.9 percent surveyed considered"to buy stocks or mutual funds

2010

At the current price, interest rate and income level,

45.2 percent of respondents preferred “more investment” (such as purchases of bonds, shares and mutual fund units),

37.6 percent chose “more savings deposits” and

17.3 percent were in favor of “more consumption”.

2011

82.8 percent of respondents preferred to save money, with

39.7 percent went for bond, stock and fund investments as an alternative to deposits and

43.1 percent for deposits. About

17.2 percent were in favour of “more consumption”

2018

26.0% of respondents were in favor of “more consumption”, up 1.3 percentage points from the previous quarter;

44.3% preferred “more savings”, up 0.7 percentage point from the previous quarter;

29.7% tended to make “more investment”,

2019

27.7 percent preferred more consumption, up 1.3 percentage points from the previous quarter;

44.5 percent were in favor of more savings deposits, down 1.0 percentage point quarter on quarter; and

27.8 percent were inclined to make more investment, down 0.4

2023

21.9 percent preferred more consumption, down 2.6 percentage points quarter on quarter;

62.2 percent were in favor of more savings deposits, up 4.2 percentage points quarter on quarter; and

15.9 percent were inclined to make more investment,

2024

24.4 percent preferred more consumption, down 0.8 per- centage points quarter on quarter;

64.0 percent were in favor of more savings deposits, up 2.5 percentage points quarter on quarter; and

11.6 percent were inclined to make more investment,

2025

19.2 percent preferred more consumption, down 4.1 per- centage points quarter on quarter;

62.3 percent were in favor of more savings deposits, down 1.5 percentage points quarter on quarter; and

18.5 percent were inclined to make more investments,

TLDR

i suppose you have a point, though major shift seems to be from investment to saving

though no distinction between the 2 is cites and only sentiments are track i would take it with a grain of salt