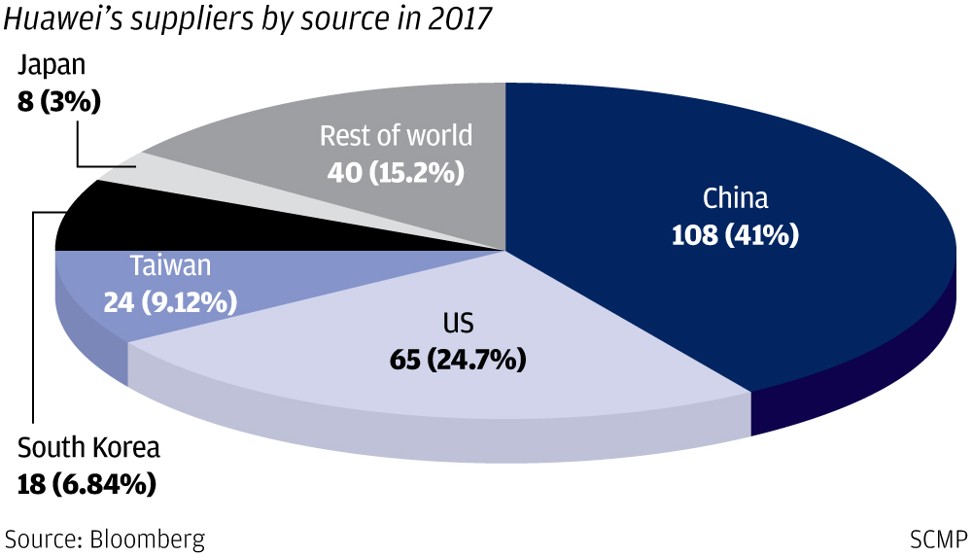

More info about Huawei suppliers:

Meanwhile, three companies that do big business with Huawei are likely to get creamed, placing NeoPhotonics (), Lumentum Holdings (), and II-VI () at risk. All three of Huawei’s suppliers have already seen their stock prices plummet.

Huawei’s Fiber-Optic Network Suppliers Suffer

MKM Partners believes it is now more probable than not that the Chinese equipment maker is entirely cut off from buying U.S. components. This spells bad news for Huawei’s suppliers in the optical-components market, which provide key parts for its fiber-optic network infrastructure. MKM managing director Michael Genovese estimates that Huawei accounts for roughly 15% of the industry's total revenues.

The DOJ’s announcement is particularly painful for companies like San Jose, Calif.-based NeoPhotonics, which generates more than 40% of revenues from Huawei. U.S. based suppliers Lumentum and II-VI both generate more than 15% of their total revenues from the Shenzhen-based tech titan.

Chinese makers of telecom equipment are reportedly pre-ordering extra inventory in anticipation of a purchasing ban, per Barron’s.

“According to our checks, Huawei, ZTE, and FiberHome are currently building optical-component inventory,” Genovese wrote in a report published Tuesday morning. “While near-term results for the industry are likely to be upbeat, investors are unlikely to give much credit unless and until Huawei is explicitly not banned by the U.S. as part of a trade agreement and/or DOJ settlement.”

Huawei stockpiles key parts ahead of 5G and foldable phone debut

Chinese maker also looking to diversify suppliers as US ramps up pressure

CHENG TING-FANG, Nikkei staff writerFEBRUARY 22, 2019 18:58 JST

While many other smartphone makers are reportedly scaling back orders amid a general industry downturn, Huawei appears to be doing the opposite. Camera lens providers Sunny Optical and Largan Precision have seen orders from Huawei increase 30% on the year this quarter, sources told the Nikkei Asian Review. The smartphone maker is reportedly incorporating more advanced camera features into its new handsets.

Novatek, the world's biggest provider of display driver integrated circuits, Chunghwa Precision Test Tech, which provides core processor testing services, and fingerprint chip designer Goodix have all seen demand from Huawei pick up since the end of last year despite the overall dip in the smartphone market in 2018, Nikkei has also learned.

According to sources familiar with Huawei's plans, the company has also asked its procurement team to explore more potential suppliers than in recent years.

"Previously Huawei worked only with the top-tier suppliers that Apple also uses, but now it is more open to qualifying more suppliers to give itself some buffers and alternatives should it one day be banned from using American-made components," a source familiar with Huawei's internal strategy said.

Last edited: