Ye Tianchun: China's integrated circuit industry needs a new strategy, and getting rid of path dependence from technology is the way out.

In the past few years, the average annual growth rate of China's integrated circuit foundry field was only 5.57%, while the growth rate of mainland China’s local manufacturing industry was 23%. This is mainly because the proportion of domestic IDM is still small. Next, with IDM With the growth of scale, the domestic manufacturing structure may undergo a relatively large change.

With the growth of scale, the number of domestic foundry companies is also increasing, from 5 in 2016 to 10 now.

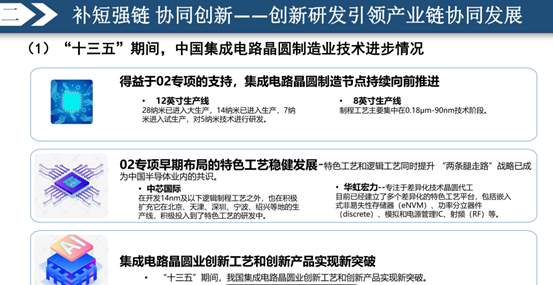

From the perspective of the industrial chain, thanks to the support of major national special projects, China's integrated circuit wafer manufacturing nodes continue to move forward. Specifically, in terms of the 12-inch production line, 28-nanometer has entered mass production, 14-nanometer has entered production, 7-nanometer has entered trial production, and 5-nanometer technology has been researched and developed. The 8-inch production line process technology is mainly concentrated in the 0.18um-90nm technology stage.

Ye Tianchun said that at present, it can be seen that the market competitiveness of domestic foundry is greatly improved. With the continuous enrichment of product types and continuous improvement of quality, these characteristic processes have begun to become internationally competitive; at the same time, domestic mainstream processes have also With the development of new technological varieties and categories, the technical level of its series of products is gradually improving, and the market competitiveness is gradually improving.

In terms of equipment, local equipment has begun to enter a period of rapid development. The R&D layout of the integrated circuit manufacturing equipment category has been completed, and the subdivided varieties have been continuously enriched. At the same time, the supporting capacity of local parts and components has been gradually improved. As the construction of domestic production lines has entered a period of rapid growth, the demand for equipment has also grown rapidly.

Data show that China's semiconductor equipment revenue will reach 24 billion in 2020. Among them, IC equipment sales revenue reached 10.7 billion, an increase of 48.6% year-on-year. It is expected that this year's growth rate will exceed 50%, but the scale of the equipment industry is still not enough, and the global share is very low.

The Chinese are researching and developing semiconductor manufacturing equipment at a staggering pace.

More importantly, getting rid of path dependence technically is the way out. At present, the size reduction will continue until after 2030. The approach to the physical limit will lead to a sharp increase in technical difficulty, and will also force "path innovation", bringing opportunities to technologies such as FDSOI; at the same time, the integration method will change from flat to three-dimensional. It has become a new way of technological evolution, and the trend of functional integration will expand new spaces; in addition, technological innovations such as architecture innovation, electronic design tool (EDA) intelligence, and hardware open source have become new focuses.