China's memory industry resisting impact of US trade sanctions

The US government's expanded restrictions on the Chinese semiconductor industry have posed a significant challenge to the development of the local memory industry. However, through strong financial support from the government, the use of local semiconductor equipment products, and IPOs to raise capital, China's local industry is resisting the US sanctions and proceeding forward.

Industry research institute Yole Group stated that in recent years, memory has always been a strategic focus for China's economic development. In 2022, the total amount of money spent by Chinese suppliers on buying DRAM and NAND from IDMs accounted for 30% and 33% of the global market share respectively, behind only suppliers in the Americas.

However, the self-sufficiency rate of China's memory products is still below 15%. This large self-sufficiency gap is what's driving NAND and DRAM wafer fabrication to remain one of the top priority items for China.

When the US government announced its new wave of trade sanctions back in October 2022, not only did it create a strong resistance to the autonomous development of China's memory sector but it also had a serious impact on local IDM leaders in YMTC and CXMT in terms of the capacity expansion and product roadmap realization required for making progress and improving market competitiveness.

As of now, YMTC's 64 and 128-layer NAND is already shipped in the local market. The 232-layer NAND that uses the innovative Xtacking 3.0 architecture has also entered the early production phase. With the company being placed on the US government's trade blacklist, without the support of key equipment suppliers, YMTC's wafer capacity may be stuck at 11,500–12,000 units per month. Its previous development roadmap has also been put on hold.

To address this situation, YMTC has been seeking equipment suppliers in Japan, South Korea, and Taiwan to provide semiconductor equipment and materials. In addition, it's also strengthening its collaboration with local equipment suppliers through local government funds and a secret project titled "Wudang Mountain."

Previous rumors stated that YMTC could be placing key orders with local equipment makers including Naura. This is to ease the impact of the US sanctions that resulted in US manufacturers like Applied Materials and Lam Research stopping providing equipment, technology, and services.

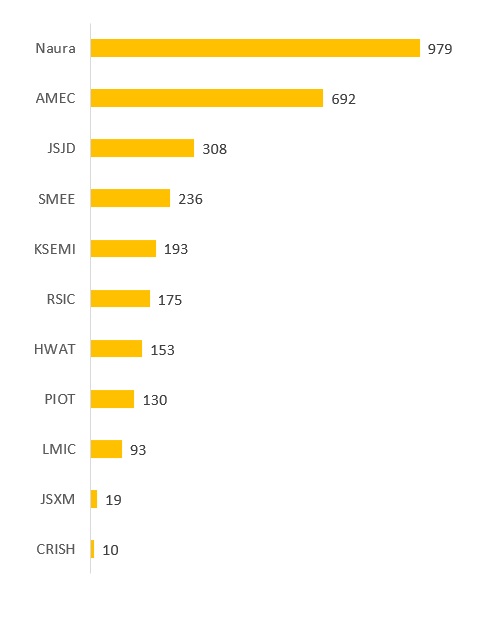

Naura is China's largest semiconductor equipment manufacturer, with its main products being etching and deposition devices. Its 2022 revenue reached US$979 million, significantly higher than AMEC, which was ranked second.

2022 revenue for China's main chipmaking equipment manufacturers (in million US$)

Source: Yole Intelligence, compiled by DIGITIMES, May 2023

As with CXMT, although the company is not on the trade blacklist, the US export sanctions still posed significant challenges for the company's product roadmap realization. Right now, CXMT's 27nm memory density equivalent DDR4 and LPDDR4 have already hit the market. The third generation of products, equivalent to 1xnm, is also accelerating development. However, the existing roadmap may also be severely slowed due to the export sanctions.

To break out of this difficult situation, CXMT is actively chasing all kinds of necessary resources. Previous media reports pointed out that besides seeking an exemption from the export restrictions, CXMT was also pushing for an IPO at the Shanghai Stock Exchange STAR Market to obtain the funds required to expand its capital expenditures.

For now, the future of China's memory industry remains uncertain and the ongoing efforts of YMTC and CXMT may face even tougher challenges with the US government further tightening the trade restrictions. However, given that memory is a strategic focus of China's semiconductor ecosystem, it's expected that the local government and manufacturer will try everything they can to maintain the survival and operation of YMTC and CXMT.