I did post this article way back when just to refresh it I re post it again still available from bloomberg

This is the engine that get delay and still face problem. This is just one engine which is more than the total capitalization of the new Chinese engine company of 7 billion $. Now think of GE, Honeywell, Lycoming? How much are they spending?

The Little Gear That Could Reshape the Jet Engine

A simple idea’s almost 30-year, $10 billion journey to the aircraft mainstream.

The Jet Engine of the Future

Pratt & Whitney’s new PurePower Geared Turbofan aircraft engines are impressive beasts. Scheduled to enter commercial service before the end of the year, they burn 16 percent less fuel than today’s best jet engines, Pratt says. They pollute less. They have fewer parts, which increases reliability. And they create up to 75 percent less noise on the ground, enabling carriers to pay lower noise fees and travel over some residential areas that are no-fly zones for regular planes. Airbus, Bombardier, Embraer, Irkut, and Mitsubishi have certified the engines for use on their narrowbody craft. JetBlue, Lufthansa, Air New Zealand, Malaysia’s Flymojo, and Japan Airlines are among the engine’s 70 buyers in more than 30 countries.

To people outside the aircraft business, what may be most remarkable about the engines is that they took almost 30 years to develop. That’s about 15 times as long as the gestation period of an elephant and unimaginably longer than it takes to pop out a smartphone app.

Could Pratt have gotten the hardware out faster? Probably. But industrial innovation on the scale of a commercial jet engine is inevitably and invariably a slog—one part inspiration to 99 parts perspiration.

In Pratt’s case, it required the cooperation of hundreds of engineers across the company, a $10 billion investment commitment from management, and, above all, the buy-in of aircraft makers and airlines, which had to be convinced that the engine would be both safe and durable. “It’s the antithesis of a Silicon Valley innovation,” says Alan Epstein, a retired MIT professor who is the company’s vice president for technology and the environment. “The Silicon Valley guys seem to have the attention span of 3-year-olds.”

Graphic by Bloomberg Businessweek; Data: Compiled by Bloomberg

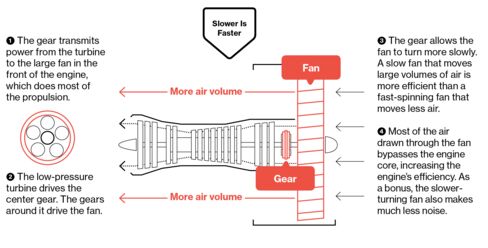

The PurePower GTF began to take shape in 1988, when Pratt staffers in East Hartford, Conn., including a 28-year-old engineer named Michael McCune, started developing a gizmo to slow the fan—the big rotating blades at the front of the engine that provide most of a jetliner’s propulsion. For planes flying at typical speeds, a slow fan that moves large volumes of air at a moderate velocity is more efficient than a fast-spinning fan that accelerates a smaller volume of air. (The slow fan’s also quieter.)

The problem was that the fan was attached to the same shaft as two other parts of the jet engine, the low-pressure turbine and low-pressure compressor. Those parts would be more efficient if they ran faster, not slower. Sharing a shaft was a compromise that hurt each part’s performance and left nobody happy.

The solution McCune and his co-workers pursued was one that had already been used successfully on turboprop planes: a gearbox between the shaft and the fan that lets the fan run slower while the compressor and turbine run faster. The gearing approach hadn’t been tried at the scale of a commercial jetliner because the conventional wisdom was that it would be too heavy and wear out too quickly. “We started studying all gearboxes in service” to determine what the obstacles really were, says McCune.

The biggest challenge in scaling up was how to keep the gearbox, which is about 20 inches in diameter and weighs about 250 pounds, from being torn apart if there was a shock that wrenched the fan in one direction and the shaft in another. Adding steel for stiffness would make the engine too heavy. To put some give into the system, McCune’s team attached the gearbox rigidly to the fan but somewhat loosely, with bendable metal baffles, to the compressor/turbine shaft and the engine case.

Pratt engineers borrowed technology and ideas from other divisions of parent United Technologies: notes on gears from Sikorsky, which makes turbine-powered helicopters; bearing know-how from Pratt & Whitney Canada, which makes the geared PT6 engine for smaller turboprop aircraft; and simulations of how lubricants move through the gear from the United Technologies Research Center. It also got special parts from Timken, the 116-year-old bearing maker, and permission from NASA to use its wind tunnels in California and Ohio.

At times, the extent of the operation had to be protected from bean-counting Pratt executives, says Epstein. “Sometimes we spent a lot. In other years we hid him [McCune] behind the curtain and slipped him some sandwiches so management wouldn’t know what the investment was,” he jokes.

By 2008 the engine was ready for testing. Pratt engineers deliberately broke a prototype, letting a fan blade fly off to test whether the accident would destroy the gears. Afterward, Epstein says, “we took the gearbox apart, and it looked brand-new. You could even see the machining marks on the gears.”

“There were a lot of false starts there, but they knew they had a concept that would work,” says Ernest Arvai, a partner in commercial aviation consultant AirInsight. “I’m amazed that they kept the research going as long as they did. I think they’ve got a winner there.”

Epstein gives much of the credit for the project to McCune, who has 66 patents to his name. “Mike has succeeded in what many people thought was an impossible challenge,” he says.

Close all those tabs. Open this email.

Get Bloomberg's daily newsletter.

One consequence of the engine’s decades-long development is that it’s missed the window to be considered for inclusion on the latest generation of widebody jets, says George Ferguson, a senior analyst at Bloomberg Intelligence. In the more important market for narrowbody jets, Ferguson says, the large fan makes the engine too big for Boeing’s 737 Max, which has low wings. On the plus side, Pratt & Whitney has fought General Electric nearly to a draw on airlines’ orders for engines for the Airbus A320neo family (46 percent vs. 54 percent, respectively, among orders in which an engine was chosen). And the PurePower GTF is the exclusive engine for the new narrowbodies from Bombardier, Embraer, and Mitsubishi. The jet engine market-share war plays out over decades. Speaking of the new engine, United Technologies Chief Executive Officer Gregory Hayes told analysts earlier this year: “Long-term, we like where we are.”

The bottom line: The GTF’s almost 30-year incubation period cost Pratt some big customers, but the engine’s efficiency has attracted other