You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Chinese Economics Thread

- Thread starter Norfolk

- Start date

The US economy is indeed a consumption driven economy with a very large proportion in services provided by finance, insurance and real estate. The massive US GDP is the results of the services created (produced) by these industries in response to consumers' demands( consumptions) . All the values of the services provided are added together with the values of all goods created to make up the GDP. I hope you understand now and I am ending this subject.Obviously there are rules for counting and certain things that are excluded (indeed you want to avoid double counting which is why GDP is about the sale of FINAL goods/services), but typically 70% or more of the US economy is consumption and most of that is the consumption of services. If you don't like that figure go and argue it with the Fed or the World Bank.

Last edited:

The problem is that there will never be a proper time. Because the whole sector is a giant house of cards.local governments don't want the hot potato of a property tax, especially at this time

By weight, the human body produces more heat than the sun

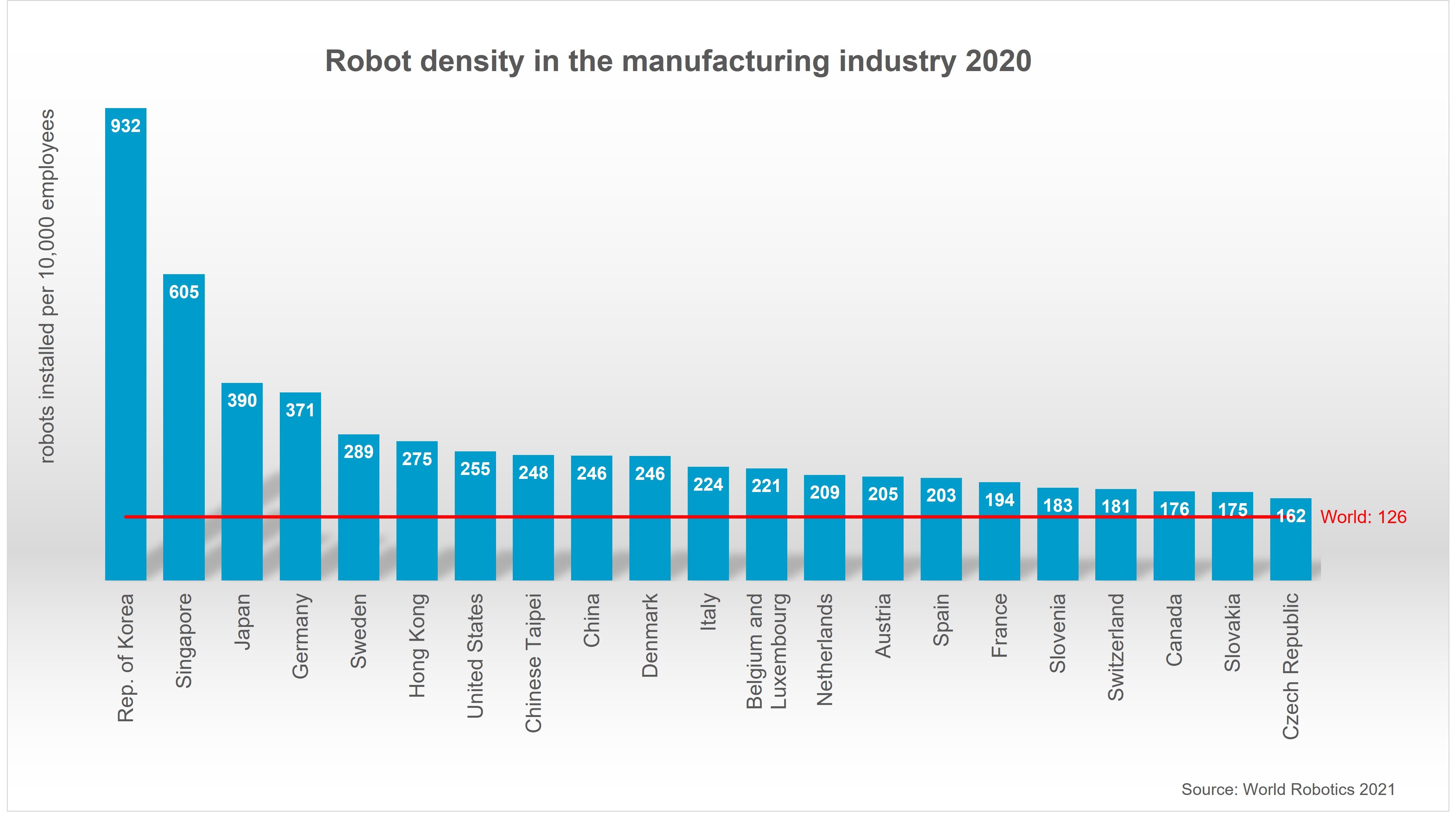

Korea is just 3% of world total

As opposed to US petrodollar hegemony not being the pinnacle of inflated house of cards?The problem is that there will never be a proper time. Because the whole sector is a giant house of cards.

As EROEI keeps deminishing, its a negative sum game and cannalbalization is the new theme...

China's rise will come from efficiences gained by cannalbalizing America's own unsustainable and order of magnitude larger house of cards....

I think a lot of people are still led to a popular misconception about " a consumption driven economy" viv-a-via "a consumer spending driven economy". I believe this whole confusion just tell me how China's communist old guards grasp the concept of modern economy much better than anybody else in developing countries, or anywhere else. They got it right. They knew what to aim for and where to start experimenting. They figured it out how to finance it and look for technology to get it going.

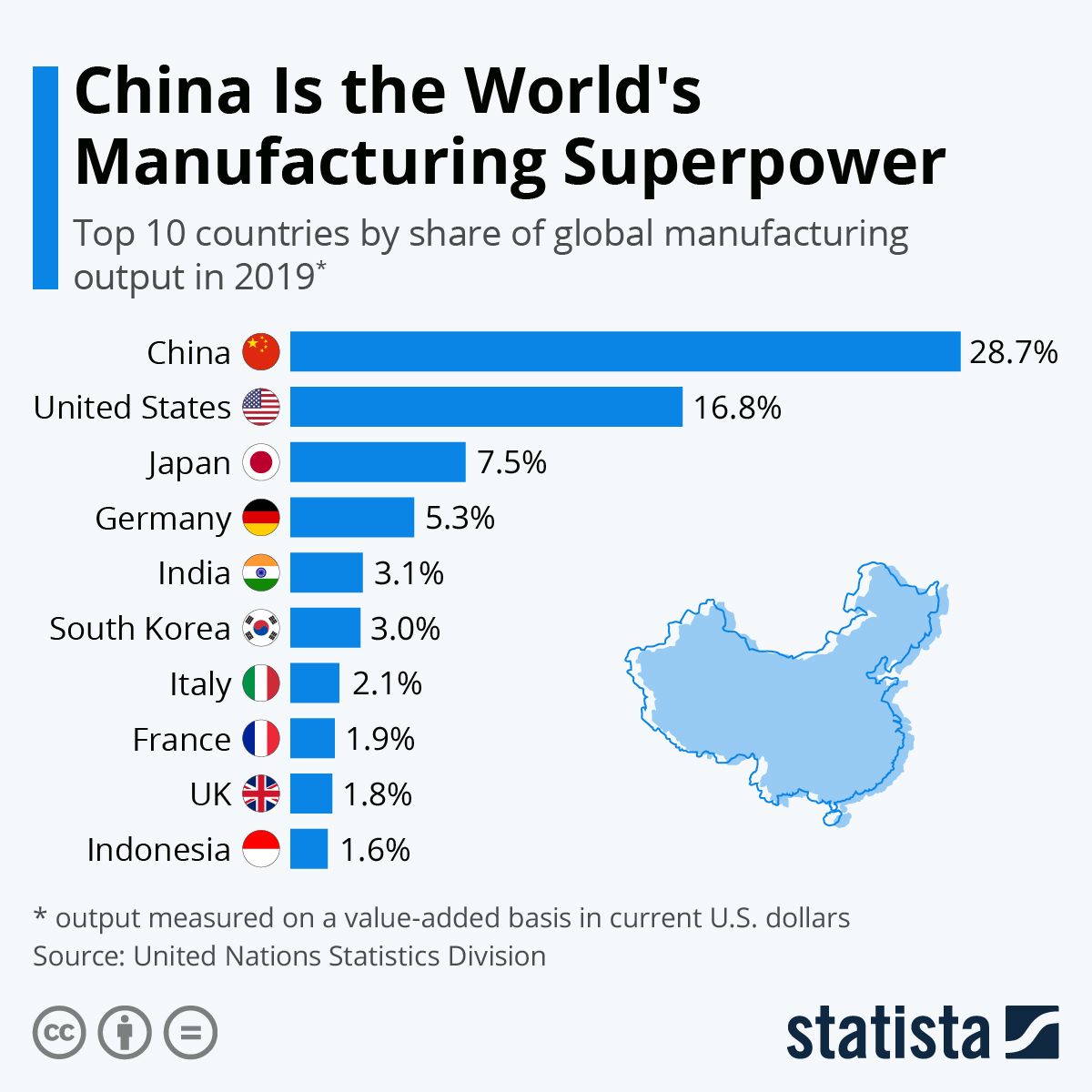

Consumption and consumer spending/expenditure are two separate concepts. One is what you use in your household, while the other is more specific about what you spend as final purchase for the products and services produced in the current year, drawing down the current year inventory. This is what it counts; creating an inventory first and drawing it down as an expenditure, it counts as part of GDP, not consumption. Consumption is like, say for a simple example, you go buy a bread. It's made with flour made in the previous season, with raisins harvested in previous years. You consumed it, but these stuff don't get into GDP. Your consumption of that bread, apart from some value added, just adds to velocity of money, affecting money supply. Do it often enough, it might add up to inflation, without more production/inventory in the current year for wheat. That's exactly why consumption precedes the inflation in poor third world countries, like Zimbabwe. It is the other one, consumer spending/expenditure, by its definition, that is critical to GDP growth, what you spend for current year production. Why important? So that you can plan your current year production/inventory. That's why China became factory floor of the world. China makes things, she lets her citizens earn the purchasing power/spending power first, while expanding her aggregate demand to the entire world. She will not give up manufacturing or making a lot of stuff never ever. Belt and Road is another attempt at expanding her aggregate demand, so that she could make more stuff, all the stuff that goes into current production, adding up to GDP. China is now really into advanced manufacturing and high tech, all priming up for a larger aggregate demand, preempting potential bottlenecks in production.

So in a nutshell, if you cannot grasp the consumption trap, you'll forever be stuck in another India. If you got it right like China, you would have a runway like hers for your growth. China is aiming for far larger aggregate demand, not consumption, as popularly conceptualized. A lot of misconceptualization come from developed western countries, especially US. Look at us, it's the consumption that make us rich. And China didn't get trapped into that. It's the aggregate demand and reserve currency status that make them still rich.

Consumption and consumer spending/expenditure are two separate concepts. One is what you use in your household, while the other is more specific about what you spend as final purchase for the products and services produced in the current year, drawing down the current year inventory. This is what it counts; creating an inventory first and drawing it down as an expenditure, it counts as part of GDP, not consumption. Consumption is like, say for a simple example, you go buy a bread. It's made with flour made in the previous season, with raisins harvested in previous years. You consumed it, but these stuff don't get into GDP. Your consumption of that bread, apart from some value added, just adds to velocity of money, affecting money supply. Do it often enough, it might add up to inflation, without more production/inventory in the current year for wheat. That's exactly why consumption precedes the inflation in poor third world countries, like Zimbabwe. It is the other one, consumer spending/expenditure, by its definition, that is critical to GDP growth, what you spend for current year production. Why important? So that you can plan your current year production/inventory. That's why China became factory floor of the world. China makes things, she lets her citizens earn the purchasing power/spending power first, while expanding her aggregate demand to the entire world. She will not give up manufacturing or making a lot of stuff never ever. Belt and Road is another attempt at expanding her aggregate demand, so that she could make more stuff, all the stuff that goes into current production, adding up to GDP. China is now really into advanced manufacturing and high tech, all priming up for a larger aggregate demand, preempting potential bottlenecks in production.

So in a nutshell, if you cannot grasp the consumption trap, you'll forever be stuck in another India. If you got it right like China, you would have a runway like hers for your growth. China is aiming for far larger aggregate demand, not consumption, as popularly conceptualized. A lot of misconceptualization come from developed western countries, especially US. Look at us, it's the consumption that make us rich. And China didn't get trapped into that. It's the aggregate demand and reserve currency status that make them still rich.

The key industries for China right now include ship building, robots, EV batteries, cosmetics and other so-called luxury brand name products.As opposed to US petrodollar hegemony not being the pinnacle of inflated house of cards?

As EROEI keeps deminishing, its a negative sum game and cannalbalization is the new theme...

China's rise will come from efficiences gained by cannalbalizing America's own unsustainable and order of magnitude larger house of cards....