Hendrik_2000

Lieutenant General

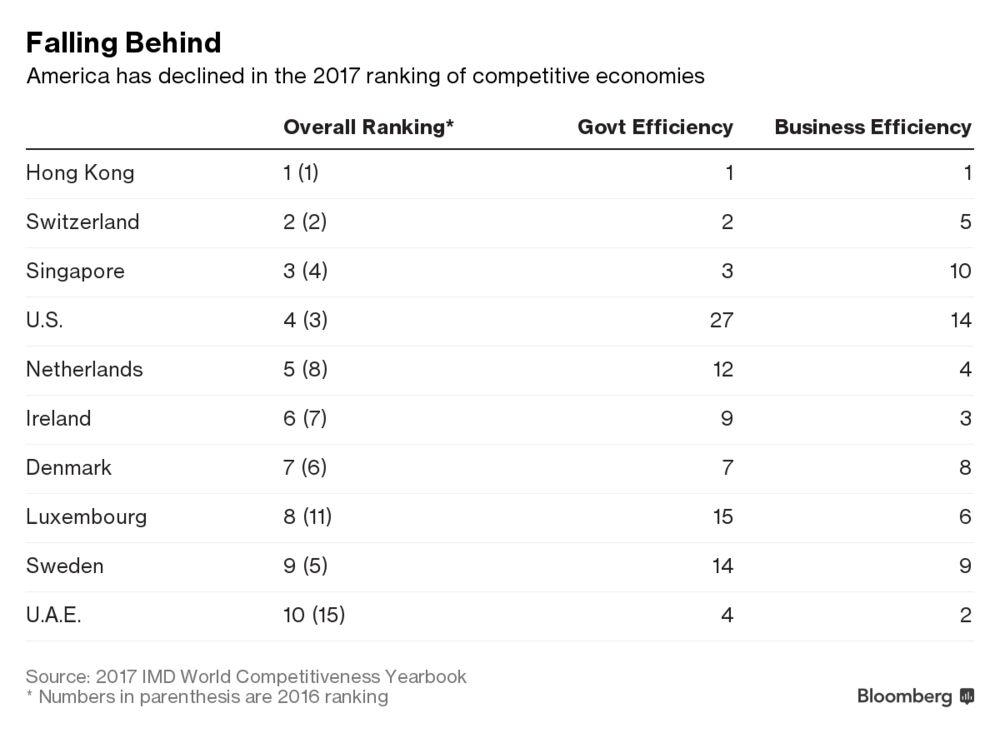

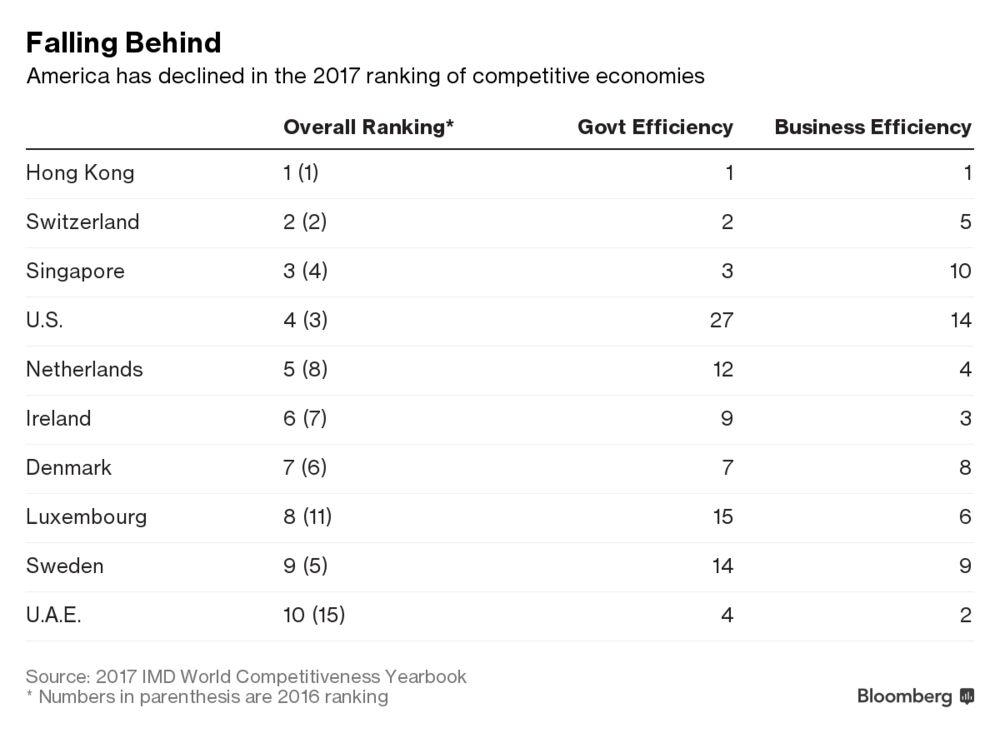

interesting just today they report that India growth fell to 6.1% even with socalled engineered Index Anyway here is the competitiveness rank China move up while US move down

China top the lower income country competitiveness ahead of Malaysia and Thailand

U.S. Slips in Global Competitiveness Ranking as China Shoots Up

The world's biggest economy dropped and Hong Kong seized first place

by

Randy Woods

May 31, 2017, 11:12 AM PDT

The U.S. fell out of the top three in a global competitiveness ranking, as executives’ perception of the world’s biggest economy deteriorated after Donald Trump’s election.

The U.S. slipped one spot to fourth in an annual ranking published by the IMD World Competitiveness Center, a research group at IMD business school in Switzerland. It trails Hong Kong, Singapore and Switzerland. The U.S. last took top spot in the 2015 ranking.

The results are based on 261 indicators, with about two-thirds coming from so-called “hard data,” gathered mainly last year, such as employment and trade statistics. The balance came from more than 6,250 executive-opinion surveys conducted this year. The report ranks 63 economies based on a sliding scale, with 100 being the most competitive.

The U.S. drop largely reflects survey results, as global executives questioned by IMD ranked the country lower in categories including government and business efficiency. Respondents saw a greater risk of political instability and protectionism, which offset the country’s progress in reducing unemployment and stabilizing inflation, according to the report.

“I was puzzled about the United States, to be honest, because it’s usually pretty consistently in the top three,” said Jose Caballero, senior economist at the IMD World Competitiveness Center. “It’s obvious that there is an increasing negative perception about the country,” he said when asked whether Trump’s election factored into the drop. The survey strives to remain politically neutral, he added.

Caballero said next year’s report will provide a better look at the Trump’s impact on the country’s competitive standing, as it will include both survey results and hard data from his time in office. His administration’s efforts to roll back regulations and cut taxes also may benefit the U.S. ranking, as executives rated the government’s competency and tax regime low in a list of the American economy’s advantages.

Meanwhile the U.S.’s closest economic rival is gaining ground. China climbed seven places to 18th overall, topping the list of countries with per-capita gross domestic product of less than $20,000, followed by Asian peers Malaysia and Thailand. Venezuela was last among 63 economies in the overall ranking, after a year marred by political upheaval and recession.

China top the lower income country competitiveness ahead of Malaysia and Thailand

U.S. Slips in Global Competitiveness Ranking as China Shoots Up

The world's biggest economy dropped and Hong Kong seized first place

by

Randy Woods

May 31, 2017, 11:12 AM PDT

The U.S. fell out of the top three in a global competitiveness ranking, as executives’ perception of the world’s biggest economy deteriorated after Donald Trump’s election.

The U.S. slipped one spot to fourth in an annual ranking published by the IMD World Competitiveness Center, a research group at IMD business school in Switzerland. It trails Hong Kong, Singapore and Switzerland. The U.S. last took top spot in the 2015 ranking.

The results are based on 261 indicators, with about two-thirds coming from so-called “hard data,” gathered mainly last year, such as employment and trade statistics. The balance came from more than 6,250 executive-opinion surveys conducted this year. The report ranks 63 economies based on a sliding scale, with 100 being the most competitive.

The U.S. drop largely reflects survey results, as global executives questioned by IMD ranked the country lower in categories including government and business efficiency. Respondents saw a greater risk of political instability and protectionism, which offset the country’s progress in reducing unemployment and stabilizing inflation, according to the report.

“I was puzzled about the United States, to be honest, because it’s usually pretty consistently in the top three,” said Jose Caballero, senior economist at the IMD World Competitiveness Center. “It’s obvious that there is an increasing negative perception about the country,” he said when asked whether Trump’s election factored into the drop. The survey strives to remain politically neutral, he added.

Caballero said next year’s report will provide a better look at the Trump’s impact on the country’s competitive standing, as it will include both survey results and hard data from his time in office. His administration’s efforts to roll back regulations and cut taxes also may benefit the U.S. ranking, as executives rated the government’s competency and tax regime low in a list of the American economy’s advantages.

Meanwhile the U.S.’s closest economic rival is gaining ground. China climbed seven places to 18th overall, topping the list of countries with per-capita gross domestic product of less than $20,000, followed by Asian peers Malaysia and Thailand. Venezuela was last among 63 economies in the overall ranking, after a year marred by political upheaval and recession.