I think all this focus on the Chinese stock market is misleading for 3 reasons.

1) The West has an irrational worship on 'the market', effectively venerating it as some all knowing, infallible diety. There is a general feeling in the west that the Chinese economy must be in real trouble if the market gods have turned its face from them. It is nothing remotely close.

The market brings a lot of benefits, but is far from perfect, and any first year economics student can list plenty of textbook examples of market failure.

The stock market is an especially risky area of the economy for market forces because so much of it is unsubstantiated. I know that there are all sorts of economic and performance indicators good investors could and should use to judge the worth of companies and shares, but that's not how the stock market works in reality.

There is a massive amount of speculation and downright betting going on, even in the largest and most professional investment firms. With some of the bigges names in the industry having been caught actually fixing key economic indicators to make a quick profit.

I could write an essay at least on how flawed the market is, but to cut to the quick, look back to basics, what is the stock market supposed to represent and what is its foundation?

The stock market is supposed to allow ordinary investors to get a piece of the corporate pie, by being allowed to buy a small piece of listed companies, and so benefit from their success. The listed companies benefit from being able to raise huge amounts of funds to aid their expansion and modernisation.

However, when was the last time any stock market tracked its host economy in an accurate way?

In my book, as soon as you see instances where companies' stock value is growing disproportionate to its actual real world performances, and does so consistently over a number of years, you need to worry.

'Value added' is the word financial analysis to love to bandy about to characterise their work, but much of it is make work or downright fiction.

What a company's market value grows way beyond what it's recognisable accounting value is, that difference, in my view, is only explained by market failure. I whimsically call it 'greed premium' made possible and sustained by wishful thinking and self deception.

This is where a stock raises beyond all reason and hope, and keeps on going, so the greedy pour their money in, hoping to ride this inexplicable rise and being able to cash out before the inevitable fall.

This is how fortunes are made, and what separates the 'exceptional' lowly traders from the average. But it's more down to luck rather than reason for someone to get their buy and sell timing right.

The stock will continue to rise so long as the market expects It to keep rising, but as soon as, for whatever reason, the market looses that confidence, such stocks can plummet and wipe out fortunes as quickly as it made them.

In many ways, this aspect of the stock market is a tool for wealth redistribution rather than creation. One man only wins out because another looses out. When a 'winner' cashes out at the perfect time, just before the stock nose dives, he doesn't sell his shares to some imaginary entity called the market, he sells to another person, who then sees the value of the new shares he/she bought get wiped out.

That's just the small fry. They truly big players, who can consistently deliver, does so because they effectively abuse the very market itself.

Many of the top players and firms are so large and powerful, that when they make a move, it actually skews the market. So a whole new sub game has effectively developed where the biggest players tries to trick the market into behaving the way the want with massive transactions, and a lot of the small fry tries to guess what the big boys are up to so they can use that to their own advantage in deciding what and when to trade.

Of course, all of this is deeply in the 'greed premium' side of the market, so when the big boys win big, it comes at the expense of vast number of little guys loosing.

Needless to say, I think the world stock markets are desperately in need of a fundamental overhaul.

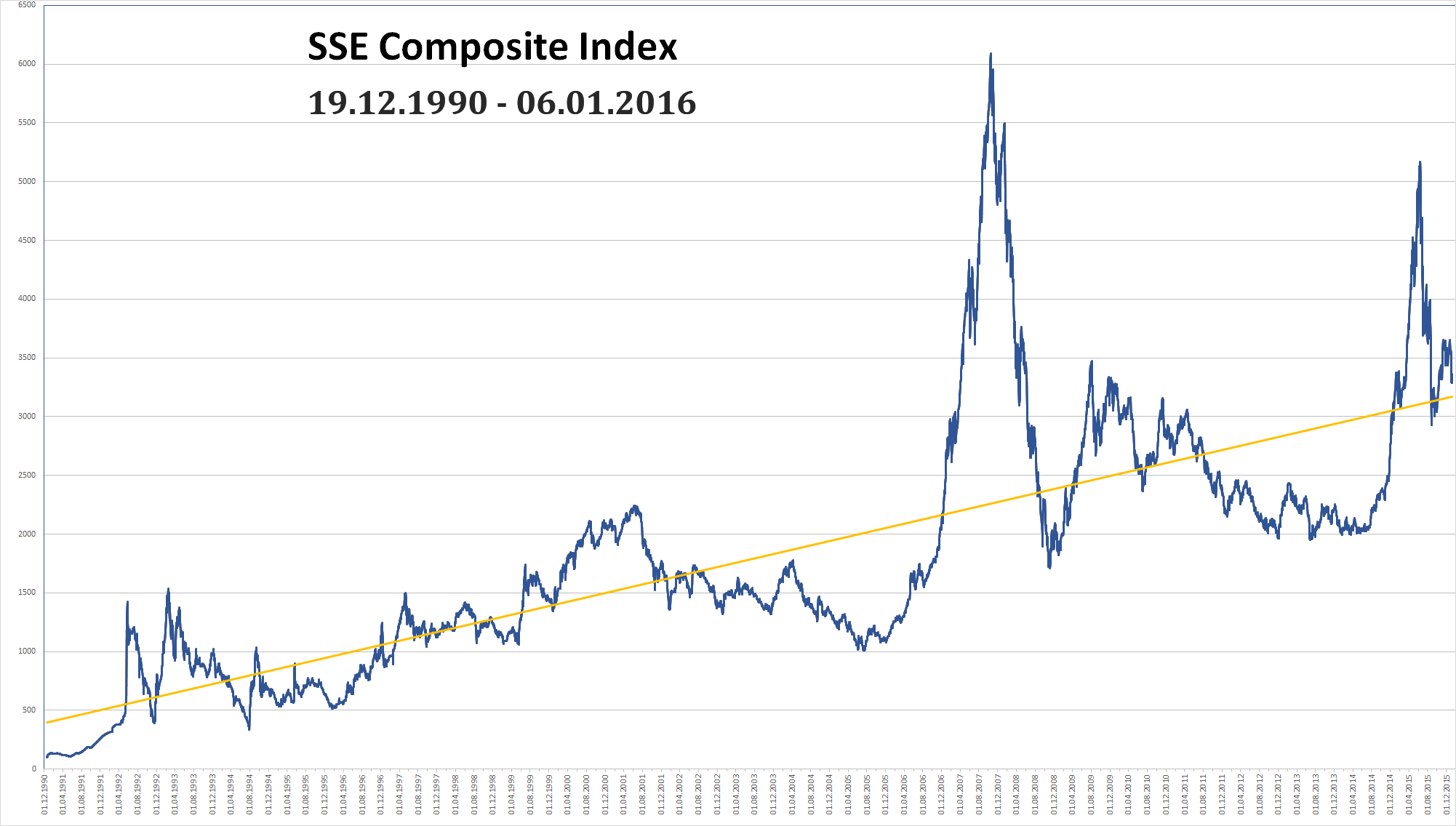

2) On top of all these deep structural and conceptual flaws with modern stock markets in general, the Chinese stock market has additional weaknesses which goes a long way to explaining its volatility.

Firstly, there is a strong and widespread perception that performance indicators and accounting data of Chinese companies are unreliable. It doesn't matter if it's true or not, so long as the market believes that, it will have the same effect irrespective of the truth.

Secondly, unlike in the west, where individual investors typically trust their money to a hedge fund or brokerage firm, who trade on their behalf (and can leverage their combined wealth and size to play in the big leagues), Chinese domestic stock holders typically trade themselves.

Lastly, say what you will about big funds and 'whales', they employ some of the best minds in the industry and spend huge amounts of money on hardware, software and external firms to analyse vast quantities of data and employ all sorts of complicated analytical and predictive models to aid them in their choices.

Even if those models and projections are all wrong, because all the biggest players believe in them and are using largely the same methods and data, they will mostly all arrive at the same or very similar conclusions.

That convergence of belief and expectations, even if wrong, is usually enough to shape the general direction the market will go in, so im effect, it's a self fulfilling prophecy, so if you can get enough of the biggest players to believe something will come true, they will make it come true in the market.

All of these factors combined means that the Chinese stock market is traded by a vast number of little guys, who either don't trust the published stats to base their investment decisions on them, and/or don't have the technical training and expertise to make much sense of those stats even if they trusted them.

Unlike western professional firms, who would use all the data available and their models and software to calculation a baseline expected valuable for a company, and so can afford to play the long game and ride out small volatility in share prices by looking at how the market price compares to their baseline, these Chinese little guys don't have a baseline to compare against, and since it's their own money they are trading, and not clients', it all combines to mean the Chinese traders are far more proven to panic compared to western traders.

This means there is no common rule book in play to create any convergence of belief in the market. Instead, convergence of belief in the Chinese stock market is created by rumours and gossip. Which is why it's so volatile and unpredictable.

That volatility and unpredictability also makes it a poor indicator for how the Chinese economy is performing.

3) The tiny size of the Chinese stock market compared to the economy as a whole also means its impact is far smaller.

A stock market crisis in China is still a crisis. Just nowhere as big as it would be for a western economy.