You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Chinese Economics Thread

- Thread starter Norfolk

- Start date

Or impose special landing fees for planes made in the US.DO the same to ships that are built in other countries.

Thanks.I found this one. South Korea surpassed China in March

SK got more orders in terms of tonnage for March 2025, but CN still got more for Jan to March 2025 in market share.

That's an overstatement and a half. Yes it wouldn't be good for most people just as it isn't good in US either.If China had a stock market like that of the US where 80% of the people are invested then the Chinese economy would have been fucked to high heavens over the past few days/months/years.

If China had decided to use stock market rather than sovereign fund/public funding for "welfare", China would still have a larger economy than US to draw from. They'd just be more vulnerable in the same ways US are.

China has about as much in common with the "developing" world as it has with US. Having a booming economy does not make you a part of the developing world, by that logic, US of 1950 would be developing world.There is a reason why developing economies do not have great capital markets -- they do not control the levers of liquidity built over the centuries by the West. One day, a great capital market will happen in China but not yet. Not now.

It takes just a bit of hot money from the outside to pump up and draw in all the resources from the unsophisticated residents of your developing country and then when they reverse the lever and cash out you'll be left with nothing.

You need a mature economy and population to make this work and to be honest, it had only really worked if you are Western or allied with the West.

There is no great capital market in the developing world except for China and India and neither does much for their economies.

You can't get a more mature economy or population than the literal no1 economy and no1 science publisher/funder. Hot money is far from an issue as China is the biggest trading nation and domestic market.

Countries like India, Congo or Ukraine can be said to be unsophisticated because they have contributed nothing but raw resources to modern life. I don't know what the fuck you're smoking, if China isn't peak sophisticated nation, neither is US per definition (let alone Japan, Russia whatever), since these nations can't pass China in tech.

China ultimately wants stability and to put its own people first. Putting all the eggs into the stock market opposes that goal, hence it will never be done, at least not in the same way as in US.

That's an overstatement and a half. Yes it wouldn't be good for most people just as it isn't good in US either.

If China had decided to use stock market rather than sovereign fund/public funding for "welfare", China would still have a larger economy than US to draw from. They'd just be more vulnerable in the same ways US are.

China has about as much in common with the "developing" world as it has with US. Having a booming economy does not make you a part of the developing world, by that logic, US of 1950 would be developing world.

You can't get a more mature economy or population than the literal no1 economy and no1 science publisher/funder. Hot money is far from an issue as China is the biggest trading nation and domestic market.

Countries like India, Congo or Ukraine can be said to be unsophisticated because they have contributed nothing but raw resources to modern life. I don't know what the fuck you're smoking, if China isn't peak sophisticated nation, neither is US per definition (let alone Japan, Russia whatever), since these nations can't pass China in tech.

China ultimately wants stability and to put its own people first. Putting all the eggs into the stock market opposes that goal, hence it will never be done, at least not in the same way as in US.

China sees itself as a developing nation. And it is one. It is just that this developing nation has the world's largest market and top flight infrastructure.

But it is a developing nation nonetheless with all the potential growth that comes with a developing nation.

Its financial sector is, to be absolutely honest, is absolutely developing nation and is by far the least developed one compared to China's industrial, agriculture and power sectors. And it is absolutely a good thing that it is not as tied in with the real economy as the stock markets of developed nations.

China sees itself as a developing nation. And it is one. It is just that this developing nation has the world's largest market and top flight infrastructure.

But it is a developing nation nonetheless with all the potential growth that comes with a developing nation.

Its financial sector is, to be absolutely honest, is absolutely developing nation and is by far the least developed one compared to China's industrial, agriculture and power sectors. And it is absolutely a good thing that it is not as tied in with the real economy as the stock markets of developed nations.

The US financial markets are now crumbling.

Rereading the "China shock" papers to properly contextualize what was lost in the political sensationalism of blaming those evil commies.

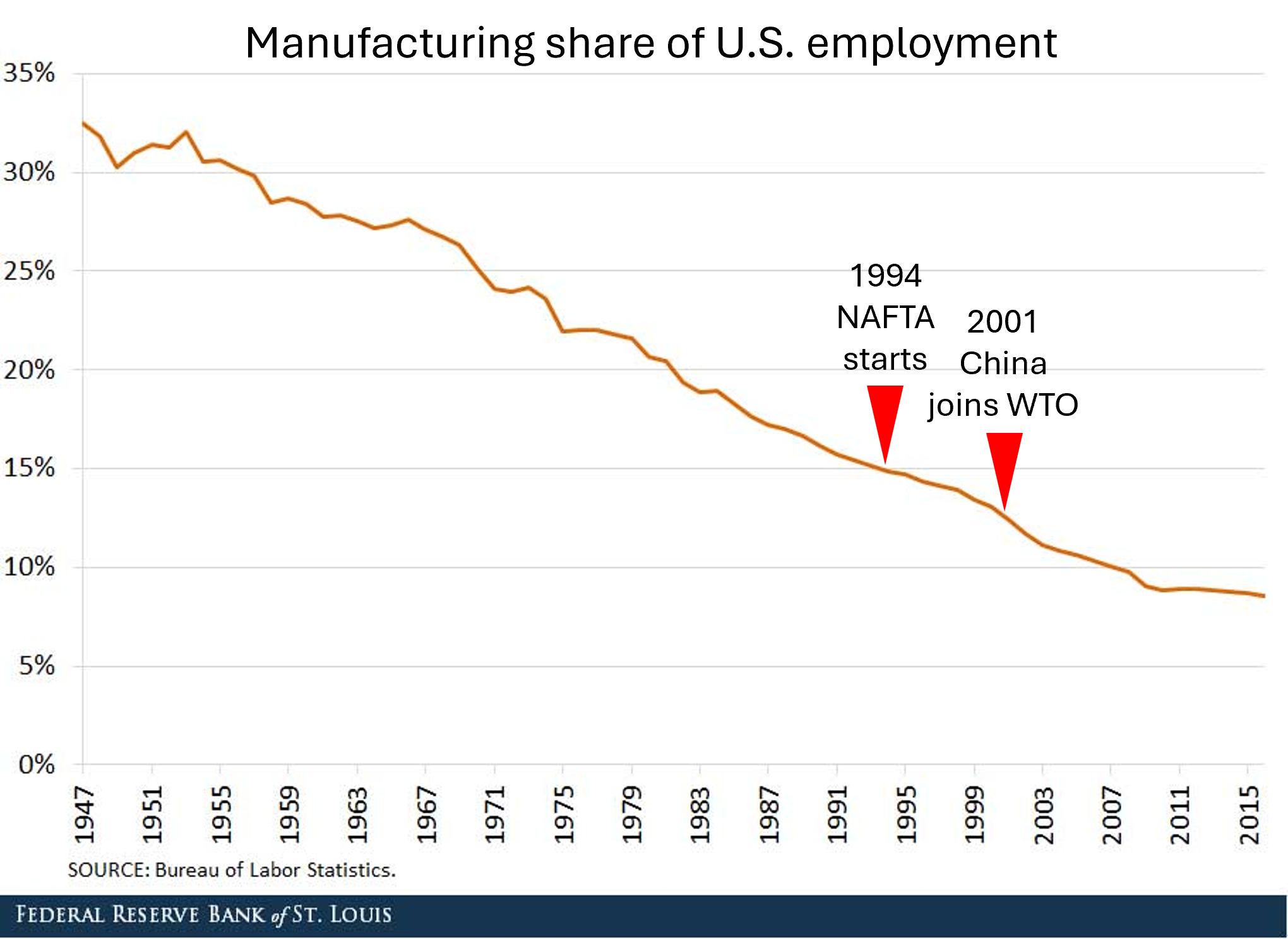

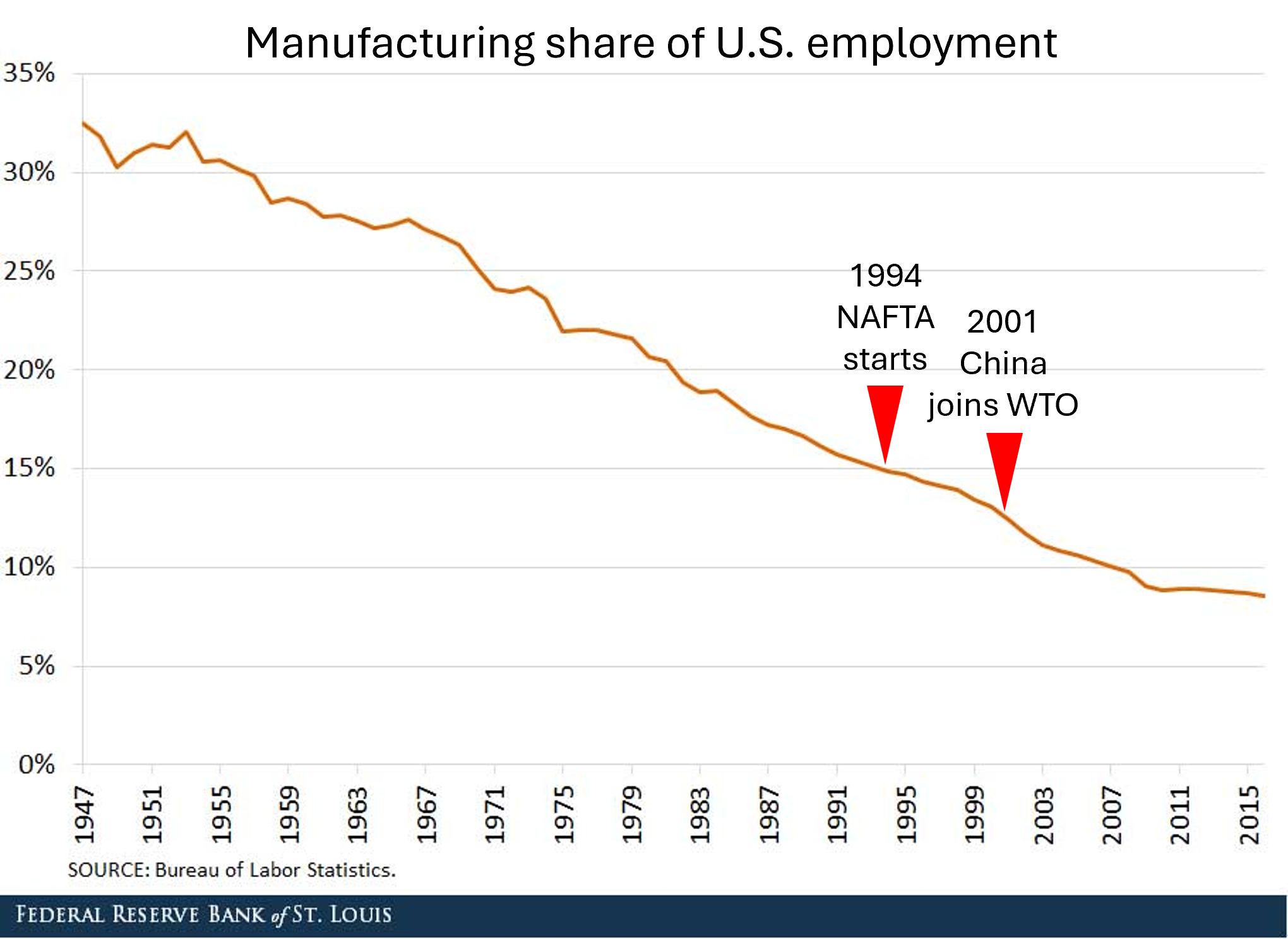

Even if you accept the paper’s estimate of nearly 1 million US manufacturing jobs lost to Chinese imports, this needs to be seen in the context of a much bigger structural shift in the US economy that has been taking place since the end of World War II. For decades, the US has been moving away from manufacturing jobs and toward service sector jobs. While rising Chinese imports did contribute to the loss of some US manufacturing jobs, it was far from the main cause.

While 1 million still sounds like a big number, it’s not quite as massive when you put it into context. We’re talking about 1 million jobs lost over more than a decade. From year to year, the number of US manufacturing jobs can fluctuate by as much as 1 or 2 million. Also, during this period, the total size of the US workforce was around 140 million, so we’re talking about a less than 1% impact on overall jobs at a time when overall employment is growing by millions. Even if you include the additional 1 million service jobs that the paper found were indirectly lost to China, this is still less than 1.5% of total jobs during this period.

I mean, US sees itself as an example of freedom.China sees itself as a developing nation.

Because it says so in some propaganda meant to sell in developing markets?And it is one.

It is just that this developing nation has the world's largest market and top flight infrastructure.

Developing doesn't denote that a country has a great economy that's booming. Is Stalin's Soviet Union developing nation? Is 1950s America? Or peak British empire?But it is a developing nation nonetheless with all the potential growth that comes with a developing nation.

Having a stock market many people are forced to rely on is not a "development". Proponents will argue it is one of many valid ways to build your nation, opponents will say that it is a drawback.Its financial sector is, to be absolutely honest, is absolutely developing nation and is by far the least developed one compared to China's industrial, agriculture and power sectors. And it is absolutely a good thing that it is not as tied in with the real economy as the stock markets of developed nations.

A Venn diagram between China and any developing country in consumption/economy size level, industry, tech, hell, even people culture would be two separate circles. Just like how a Venn diagram of Americans and freedom loving peoples would be two separate circles. So even if some in the country call themselves that, I don't take it seriously.

Because it says so in some propaganda meant to sell in developing markets?

China doesn't see it as propaganda and neither do I. China is not yet fully developed as an economy or country. The financial sector is still immature and one part of the economy that needs more growing. China has a lot of years of growth left to become developed. That's the exciting part.

It is not a Japan or an UK who are basically matured and are about as good as it gets.