Healthier, happier people do not necessarily have more money; or are valued more by the global market.Product consumption is a small portion of overall consumption. Big ticket items like rent, medical care and food are locally priced.

The biggest exported item for consumers is a car, and Chinese cars are banned in the US.

Environment is also local. John would on average live fewer years, have higher rates of mental illness and drug use, and be more likely to become a victim of crime. His children are more likely to go to school with misbehaving children testing lower on PISA. Does the exchange rate help him?

Until you are ultra rich and able to insulate yourself from basic problems like crime, health, rent, mental illness, education, transportation, etc all this extra stuff doesn't matter.

The fact of the matter is, if he wanted those benefits, John could always take his life savings and retire in China - or if not China, then Southeast Asia, Eastern Europe, Japan, or any number of countries whose currencies trade poorly against the US dollar (this list can often be determined by looking at the difference between GDP nominal and GDP PPP, funny enough). Indeed, this is an increasingly popular life-style choice among Americans.

They are able to do this because the global market values their labor at a premium, such that they can trade it for so much more than their equivalent in China, Southeast Asia, Eastern Europe, etc. could. They could, if they chose to immigrate to those countries, live much better than locals could, while having achieved much less than locals did. While the reverse is not the case.

Of course, John was just an extreme example, used to illustrate a particular phenomenon through exaggeration. The better, more realistic example is not an impoverished minimum wage worker moving to China, but the much larger industry of companies exploiting the exchange rate for cross-border labor, trading, tourism, and all sorts of other activities. The most important of these being sustaining the lavish and vastly wasteful American empire.

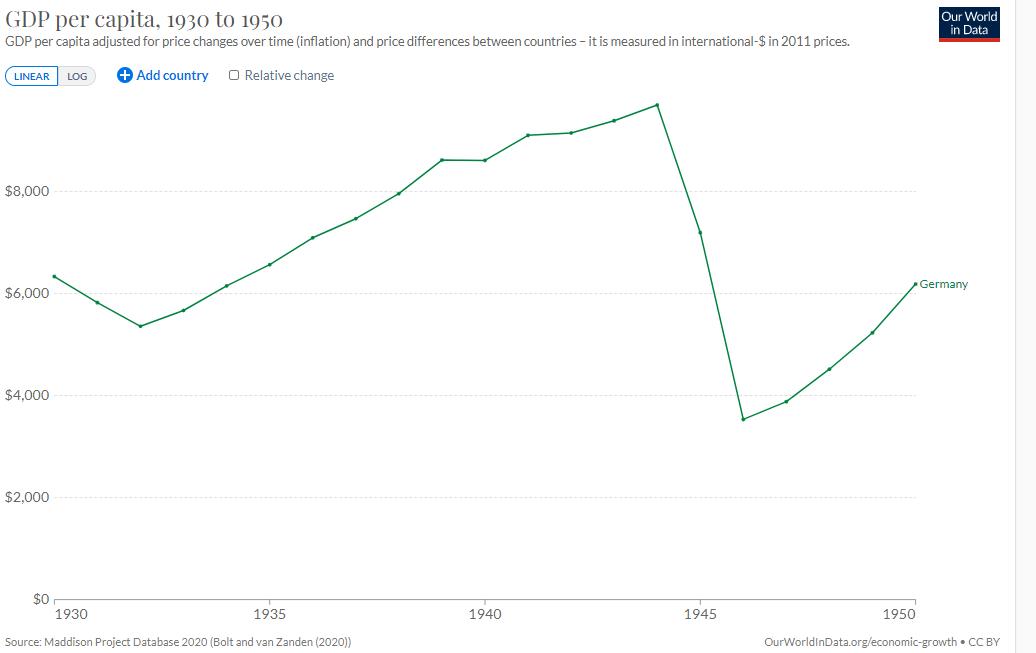

This is the global financial system that was built by the US post-World War 2; the one that puts them at the top and everyone else at a disadvantage. Make no mistake, China has contributed to this empire - through providing Americans with cheap products, while taking the dollar as premium exchange, it has contributed greatly to the dollar's inflated value, and allowed Americans to trade very little of their own efforts, for very much of China's.

Last edited: