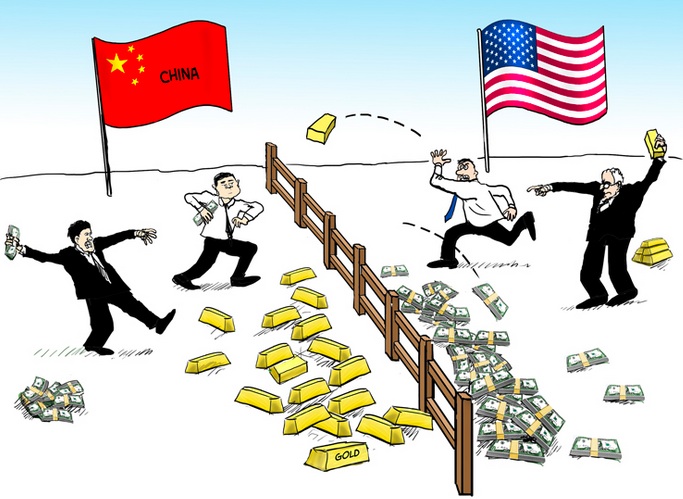

The article explained in one picture:

China will lose for sure. Do you know the arm strength required to chuck a bar of gold that size)

The article explained in one picture:

Seems that the cartoonist needs to label the Chinese flag and gold bars because Americans are too stupid recognize them without it.The article explained in one picture:

27.4 pounds. That is nearly 2 men's open competition shot puts (16 pounds each), or a little over 3 women's open competition shot puts (8.82 pounds each).China will lose for sure. Do you know the arm strength required to chuck a bar of gold that size)

Gotta label the flag China in case Americans too dumb to tell the flag.The article explained in one picture:

American: surely I will win because hospital cost they pay is more than the gold bar landing on their face!China will lose for sure. Do you know the arm strength required to chuck a bar of gold that size)

The weak retail sales data is related to declining property prices. The weak private sector investment data is related to the weak retail sales data. Perhaps the government's plan to purchase unsold homes and convert them into affordable housing will boost consumer spending.

This program could cost up to 280 billion dollars over a 5 year period. If this number is true then this will not be enough to revive the housing market but might be able to put a floor on falling prices. Which is the goal. Still I'm against this as its nothing more than a bailout for the housing industry that needs to shrink. China can use this money much better elsewhere.So that move could be subsidised flats for rent or sale in the end?

I agree, but what do you think that money should be used for instead? Perhaps that money could be used to bolster the pension system so that Chinese people don't have to worry about retirement as much. Perhaps that money could be used to bolster the stock market. At the end of the day, the CPC's job is to ensure that Chinese people feel financially secure.This program could cost up to 280 billion dollars over a 5 year period. If this number is true then this will not be enough to revive the housing market but might be able to put a floor on falling prices. Which is the goal. Still I'm against this as its nothing more than a bailout for the housing industry that needs to shrink. China can use this money much better elsewhere.