Trump's 60% Tariff Would Take China Imports Close to Zero

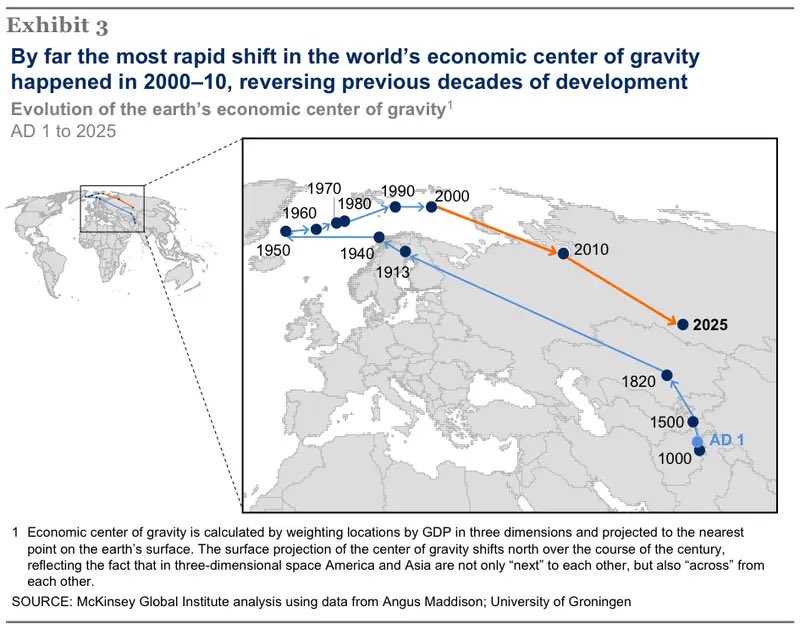

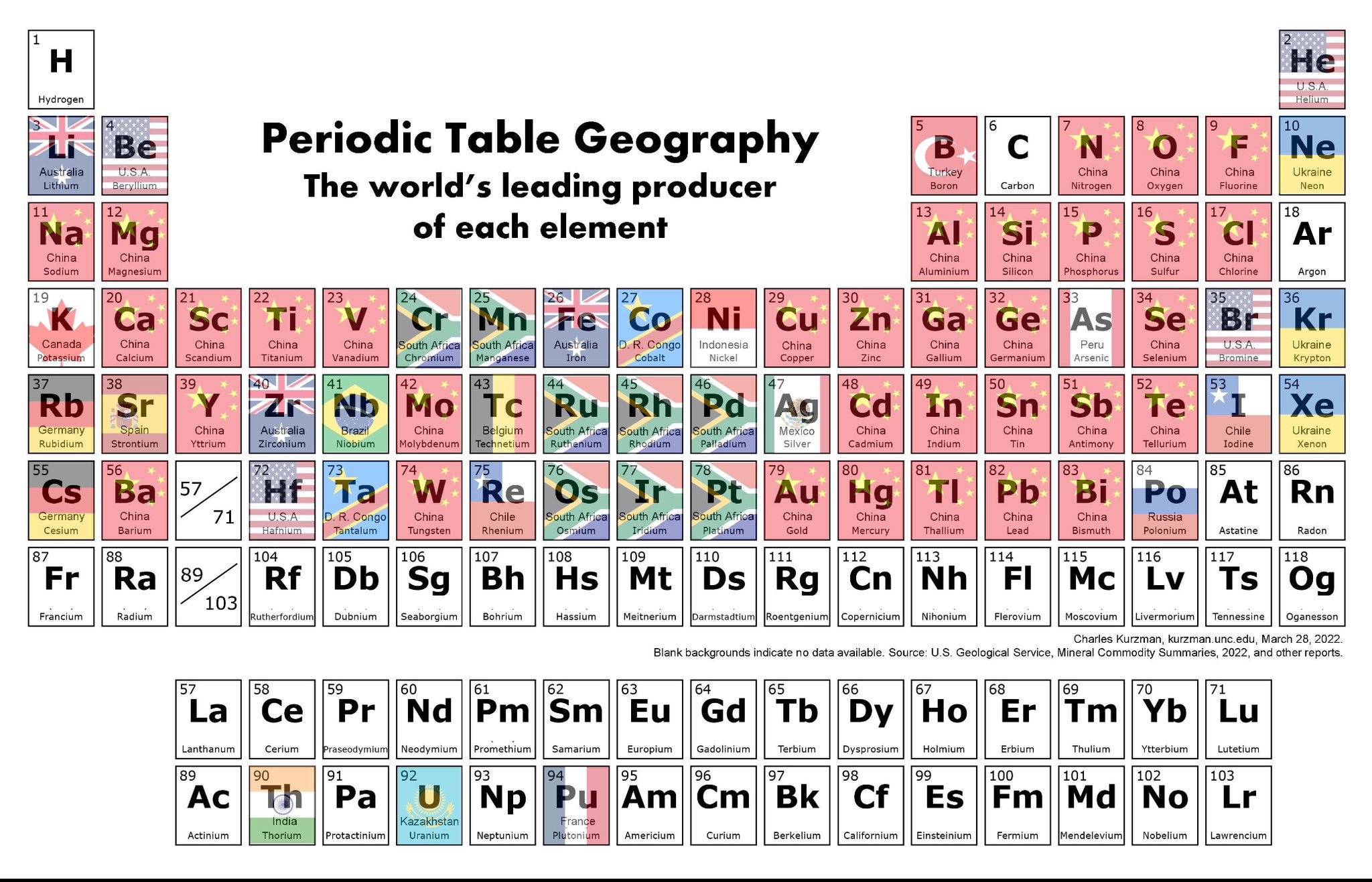

Knowing that the US is 3 times more reliant on Chinese production inputs for their outputs than vice versa and how they are more reliant on China for capgoods (and their economic model in general), it would certainly hurt the US more. And it will only move more in that direction.

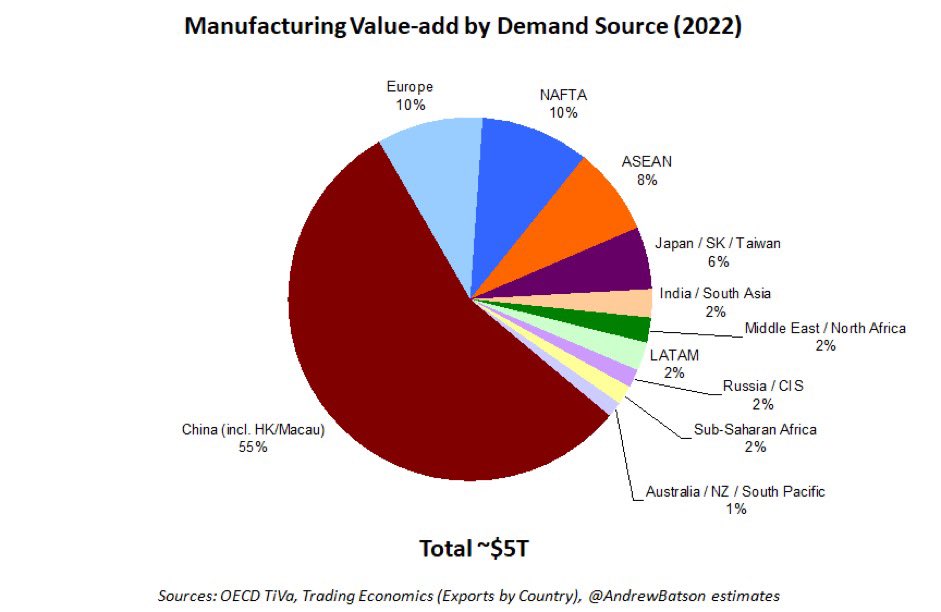

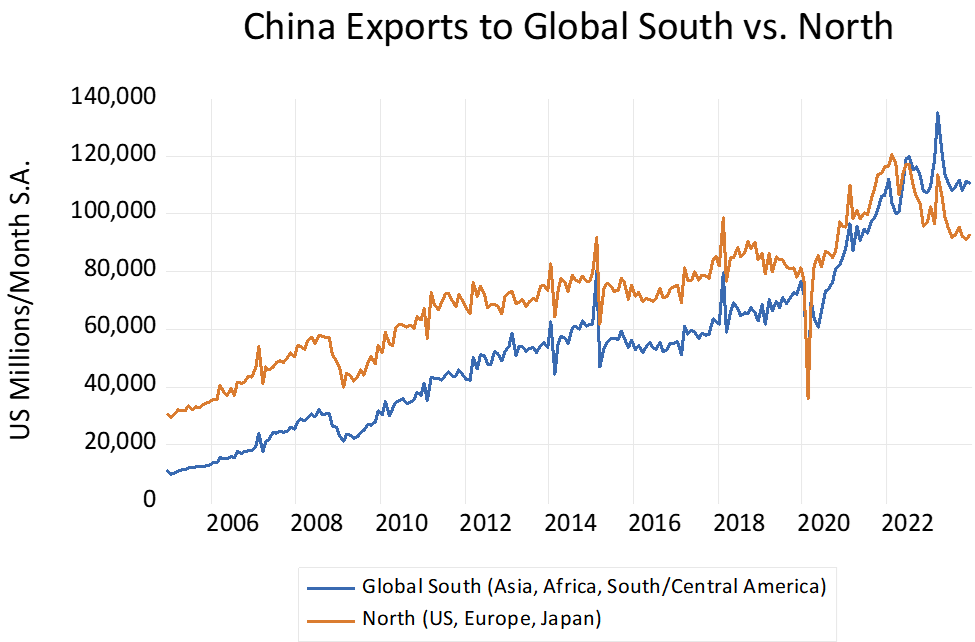

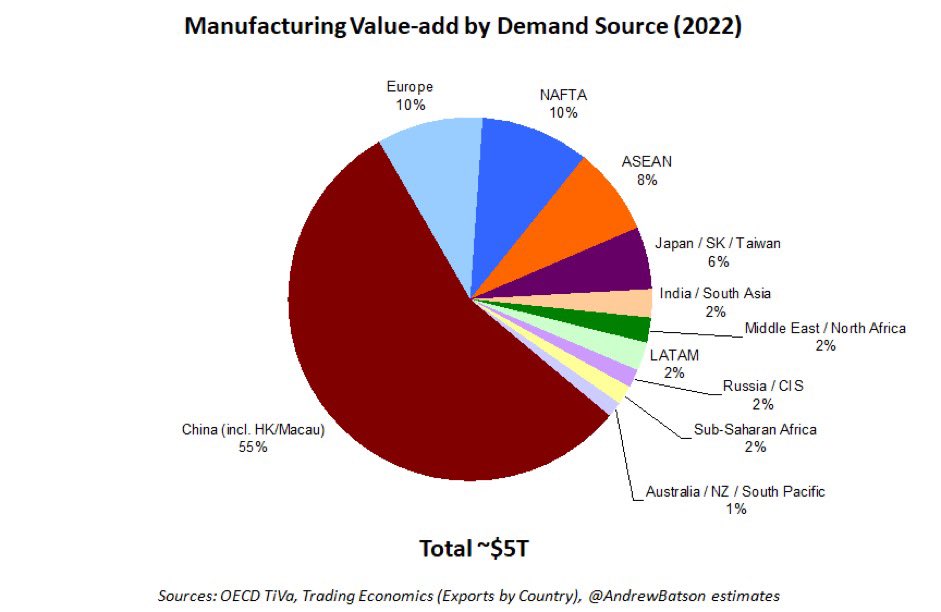

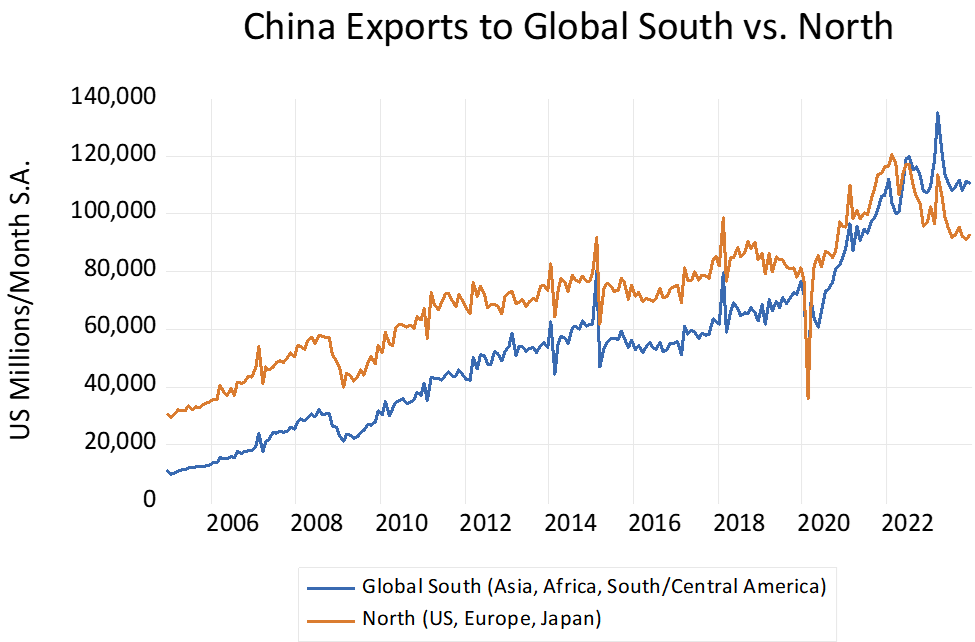

Meanwhile, Chinese exports have long switched to the developing world (for example ASEAN), meaning Chinese can now compete with Western manufacturers in third markets as opposed to creating some low-value-added products for the Western markets themselves (textile, plastic...)

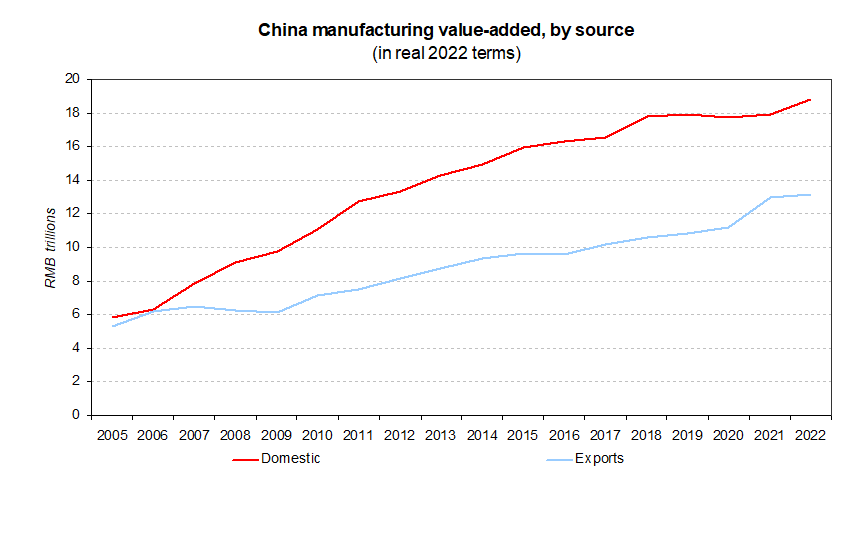

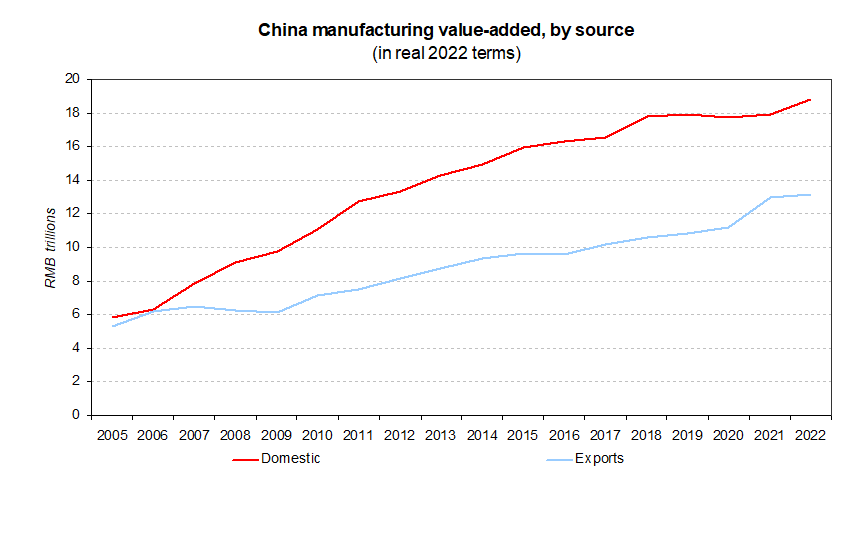

And Chinese manufacturing, in general, switched to domestic demand due to various reasons like technological breakthroughs lowering costs, innovation, and the general rise in the standards of living of the domestic population. All leading to increased domestic market penetration.

Today's products are designed + targeted first and foremost at Chinese consumers and use cases, by Chinese companies. Foreign consumers are a secondary consideration, a nice-to-have. Unlike 2 decades ago today Chinese domestic demand is the main driver of manufacturing growth.

In terms of markets targeted in product design. - 90s/2000s: Fully developed, rich world markets particularly the United States and the EU.

Today: The Chinese domestic market first, then developing economies like ASEAN, and then as a third priority, the fully developed markets.

This has been the case in 5G equipment, smartphones, and now the new three technologies, like NEVs, electric batteries, and solar & wind.

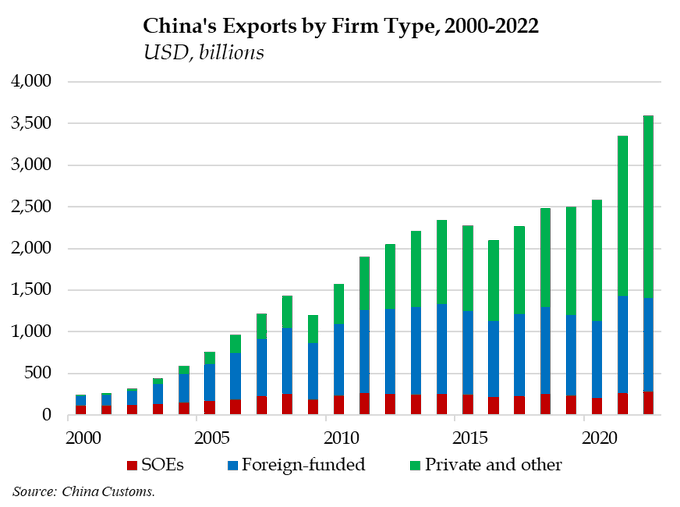

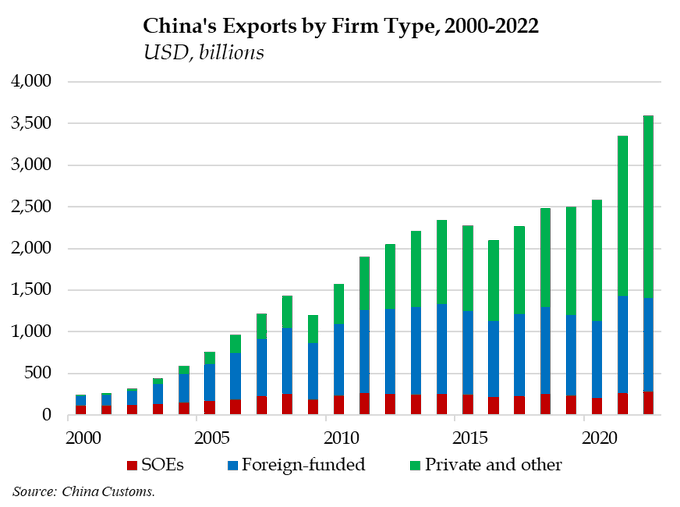

These are products that are increasingly first designed for Chinese consumers and then spilling out into export markets - particularly for developing economies where price points are lower. Also seen in the domestic vs foreign-owned chart. Foreign = low-value added mostly.

The former era of exported products was largely designed and made for developed markets (US/EU/Japan) and rarely crossed over into the domestic market (too expensive for local consumers, wrong product fit/positioning). But since the GFC it all kept reversing the other way.

Therefore I think that Trump might've missed a few decades. This can't hurt China much, it can only make the US even less competitive in manufacturing and drive their inflation through the roof. Like with Russia too, it seems that those Western elites are behind by 20 years...

Also, what's important is that China's focusing on dual circulation more can help bring up the landlocked regions now also (as opposed to coastal ones that rose in the past) because those factories do not require geographical proximity to the sea to export abroad. It is even beneficial for those factories to be somewhere in the center. We've seen it with many companies like BYD and others opening facilities in such areas. There is now also infrastructure (for transport of goods and labor) in place and an educated population, which can help move more investment there and reduce geographically-induced inequality in China, improving their Gini index even more. Due to its sheer size, it is impossible for China to fully develop without strong domestic demand. So the US (and others) will become more and more irrelevant for it.

This is not mentioning BRI rerouting trade to Global South. From the lower end of value-added chain exports to developed countries like the US, owned by their companies, now Chinese brands design & produce for domestic markets and export the rest of those higher value-added affordable, domestic IP products to the developing world and getting dominant market shares and influence, like with industrial machines. Those developing countries will have wider trade deficits with China, but it will help them assemble more exports and create more total economic activity for themselves, thereby offsetting all they lost on that deficit with China and even creating more value, all while increasing China's influence around the world. China will also try to move the remaining low-value-added industries to friendly neighboring countries, increasing their outflows of FDI, and getting even more economic-based influence in that way too, rising in global power now more than ever.