Why do you think that is?It is not normal that the youth unemployment rate has almost doubled in 3 years.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Chinese Economics Thread

- Thread starter Norfolk

- Start date

You're not gonna unwind a bubble that took decades to build in just a couple years. I mean, you could, if you want a hard landing, but if you want a soft winding then it's gonna take many years to pop the bubble. My guess is it'll take closer to 10 years than 5.China just can't get over the housing bubble. Once again the government is offering suppport to the housing sector. Its always one step forward two steps back for China when it comes to housing.

Why do you think that is?

There are many obvious reasons as to why this is - but my point is that it is not normal as @PopularScience suggested.

Yes, I can think of several, but you're an SME so I'd like to hear your thoughts on this phenomenon. Whether or not it's "normal" is a normative judgement.There are many obvious reasons as to why this is - but my point is that it is not normal as @PopularScience suggested.

I believe it's a (negative) consequence of the rapidly increasing productivity and technological sophistication of the Chinese economy, which no longer needs as many people to function. Unfortunately, since I see the factors that lead to high youth unemployment accelerating, it's going to be a persistent problem in the future.

It is not normal that the youth unemployment rate has almost doubled in 3 years.

Maybe due to covid.

Ofcourse economy is bad. Teenagers need to lower their expectations.

Yes, I can think of several, but you're an SME so I'd like to hear your thoughts on this phenomenon. Whether or not it's "normal" is a normative judgement.

I believe it's a (negative) consequence of the rapidly increasing productivity and technological sophistication of the Chinese economy, which no longer needs as many people to function. Unfortunately, since I see the factors that lead to high youth unemployment accelerating, it's going to be a persistent problem in the future.

One key thing to remember is that the manufacturing sector over the past 3 years has not been impacted nearly as badly as the services sector. An example of this is how at Shanghai Auto Show 2023 that the Europeans were left with their jaws on the ground as they saw how fast Chinese EVs improved. 3 years ago there was no reason for anyone to buy a Chinese EV over Tesla, and 3 years later there are multiple reasons why you'd want to own a Nio/Li Auto/BYD over Tesla.

However, the manufacturing sector is no longer as labour intensive. I've recently been to a dozen factories in China and by and large automation is quite impressive. However, the manufacturing sector is less than 100mln workers in China - so shrinkage there won't cause a 1000bp increase in youth unemployment rate.

At the same time - COVID has disproportionately impacted the services sector (restaurants, tour guides, shopping malls, etc) - and that is a sector where you cannot automate. You may have also seen the headline that Guangzhou stopped hiring for delivery drivers on Meituan - that used to be the ultimate backup - gives you a sense of the problem.

On top of that you have the real estate sector and the associated impacts there - this is just too big to not have an impact. I'm not even mentioning the regulatory actions in internet/afterschool tutoring.

So things are recovering - but as you can tell - they aren't even - so there is a massive pool of 'excess labour' that need to be worked down as people get back to normal. This takes time.

Maybe due to covid.

Ofcourse economy is bad. Teenagers need to lower their expectations.

Yeah - remember the people earlier this year who were calling for 6.5% GDP growth?

Of course not, but there already is a steady increase in youth unemployment over the years as more youngsters graduate from college but find out that there is a mismatch of supply and demand of many occupations. Covid and crackdown of tutoring and gaming are just made things worse.It is not normal that the youth unemployment rate has almost doubled in 3 years.

Youth unemployment would peak on July and would steady decrease over the months which should tell us how persistent of youth unemployment really is. It is normal to have youth unemployment between 9% to 15%. If youth unemployment could fall back to that percentage then the economic recovery should be sustainable. If not, China needs to promote more vocational schools instead of colleges for many youngsters as many jobs have left unfulfilled especially highly skills technicians.

I still think that's very plausible given last year's growth was 3%, even with all the problems. The services sector should recover fully now that COVID is no longer a thing. The biggest issue, as you pointed out, is real estate. That has to get bled, there's no two ways about it.Yeah - remember the people earlier this year who were calling for 6.5% GDP growth?

I'm hoping to see big spending in next-gen infrastructure: renewable energy and energy storage, 5G rollouts, etc. Less so roads and bridges but still some of that. We shall see.

Most economists were predicting 5% just a few months ago. Members here predicted from 6% to 6.5%. However, I think getting 6.5% isn't impossible. I never did any forecast but a low base last year for Q2 and Q4 would cause a distortion of Quarterly GDP number this year.Yeah - remember the people earlier this year who were calling for 6.5% GDP growth?

In addition, Headline GDP is irrelevant as the sustainability of the recovery that is more relevant. China should stabilize the real estate sector but the real task is a full recovery of the service sector especially tourism and catering industry which employed most people.

Ofcourse economy is bad

who is saying ? economy is bad.Yeah - remember the people earlier this year who were calling for 6.5% GDP growth?

2023 is going to be very good year for Chinese economy.

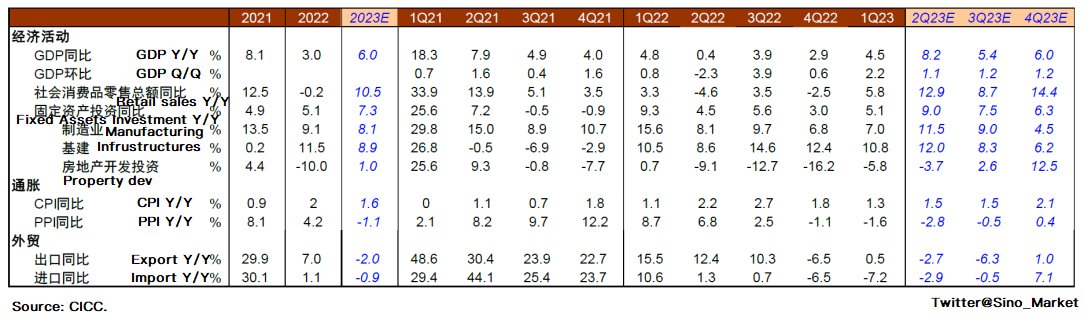

2023 GDP growth forecast:

Citi: 5.7% → 6.1%;

J.P. Morgan: 6.0% → 6.4%;

Goldman Sachs: 6.0% → 6.0%.

IMF - 5.2%

CICC expects to experience an "atypical" recovery in 2023, raising base case GDP growth from 5.5% to 6%, much closer to the 6.7% in Scenario B, if the impact of the pandemic fades.

World economy growth contribution in next 5 years. (IMF)