This is significant..

Chinese companies are dominating the global market for initial public offerings, as listings in the West continue to drag in 2023. So far this year, new Chinese flotations have raised almost five times as much money as those in the United States.

For China’s policymakers, that’s good news. Beijing has sought to encourage private companies — particularly those in strategic sectors — to pursue IPOs at home, while at the same time making it harder for them to list abroad. Data on listings since the start of 2022 suggest that that plan may be working.

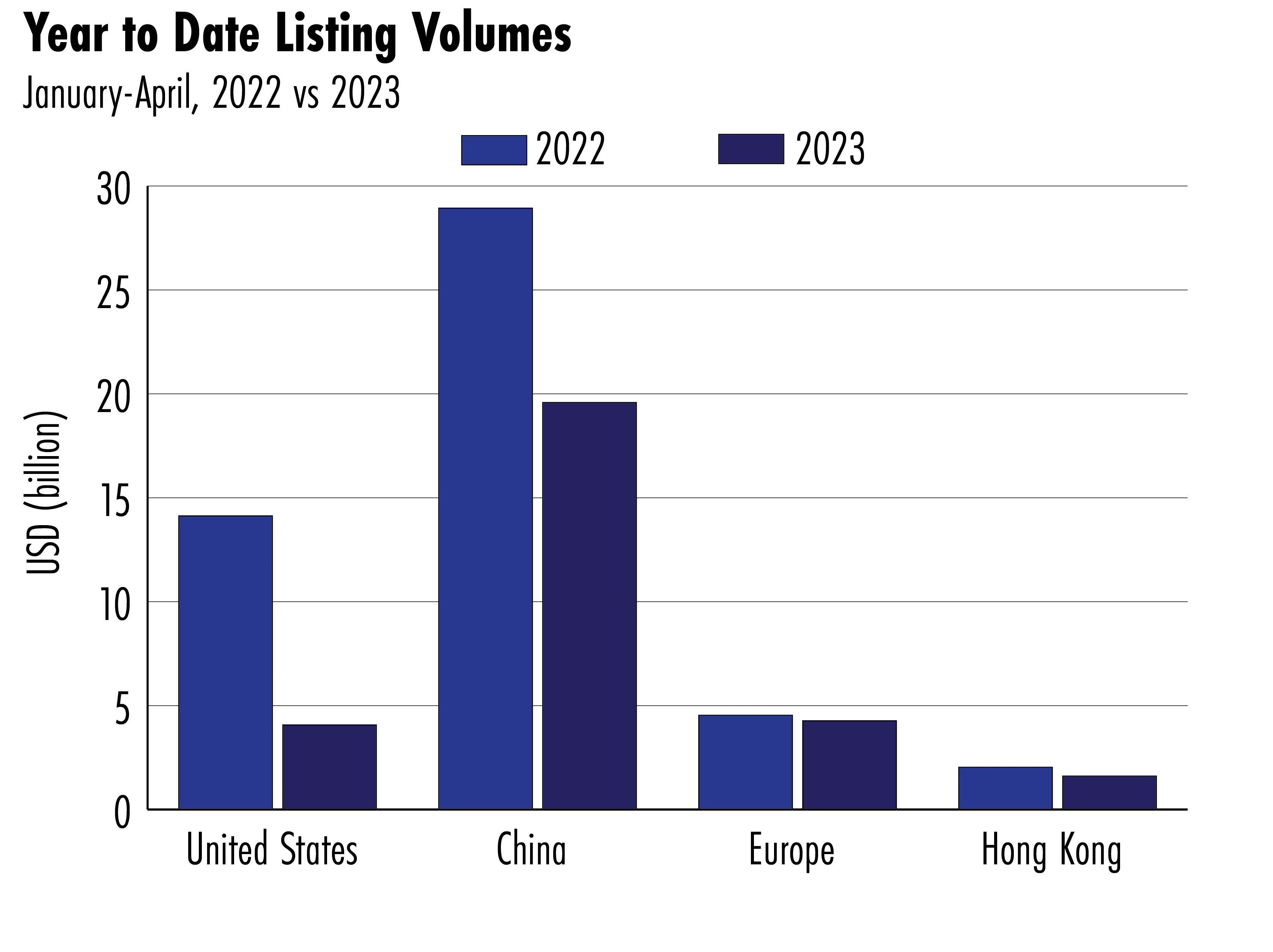

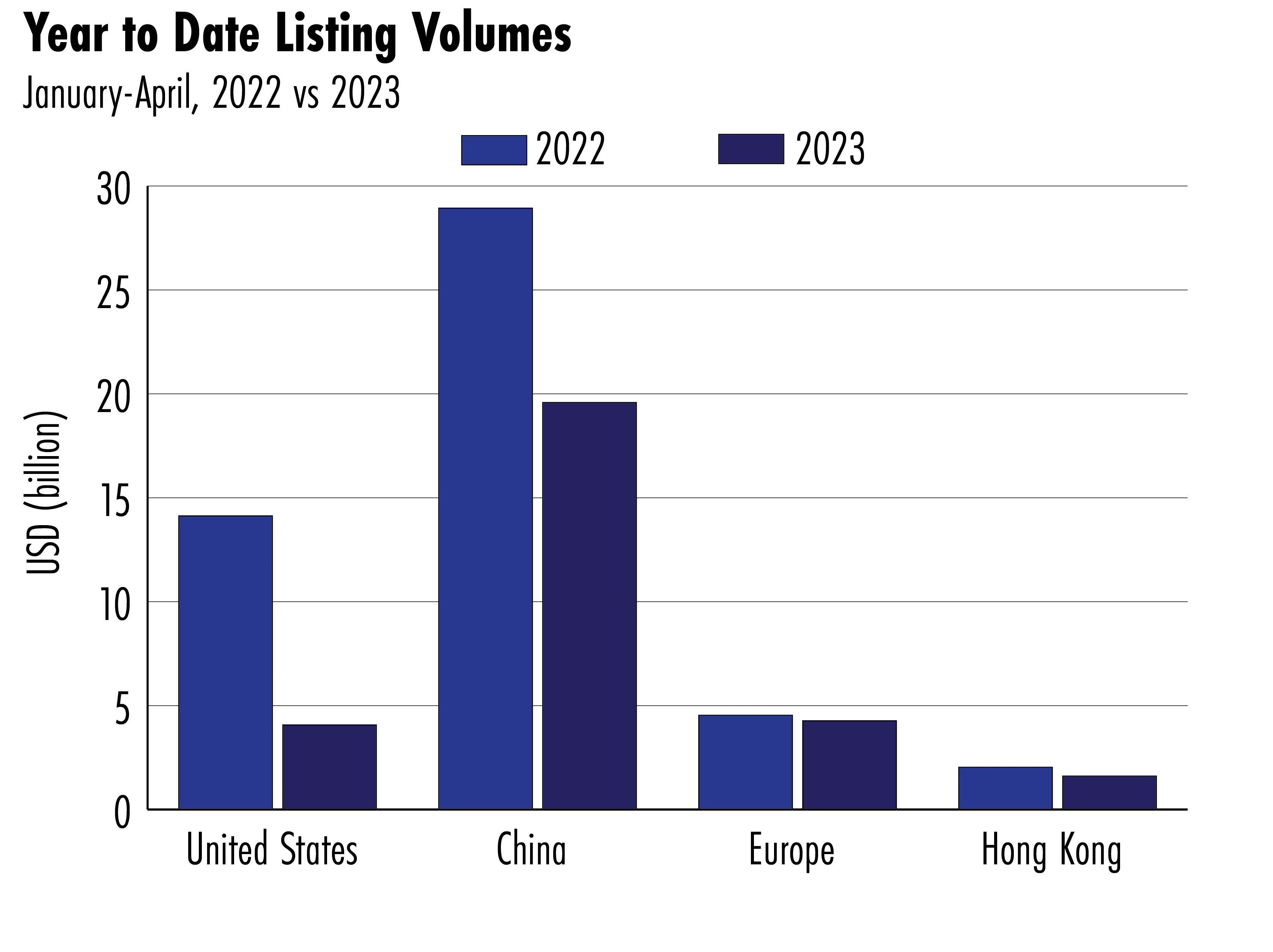

Both the number and total volume of Chinese public listings in the first four months of the year has outpaced those in the U.S. So far this year, Chinese companies have raised close to $20 billion on mainland bourses, including a $1.1 billion IPO by Shaanxi Energy Investment, a state owned utility firm, and $663 million IPO by Yuneng New Energy Battery Material Co., a battery cathode manufacturer. By comparison, firms in the U.S. raised just $4 billion in the first four months of the year, according to data from Dealogic, a financial data provider.

High inflation and rising interest rates led to a plunge in U.S. and European IPO activity in 2022. This year, additional uncertainty stemming from the crisis in the banking sector has stymied any recovery.

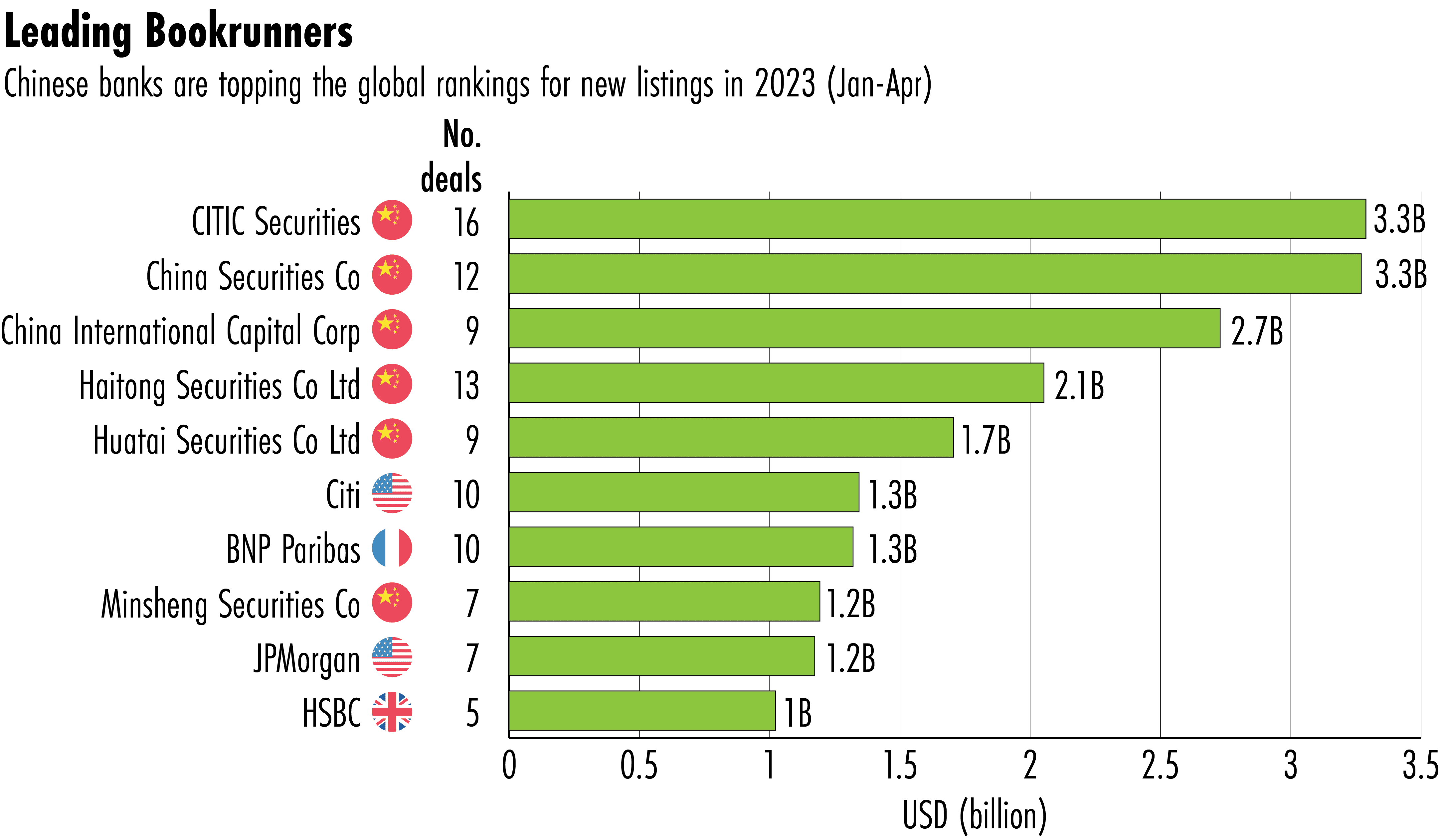

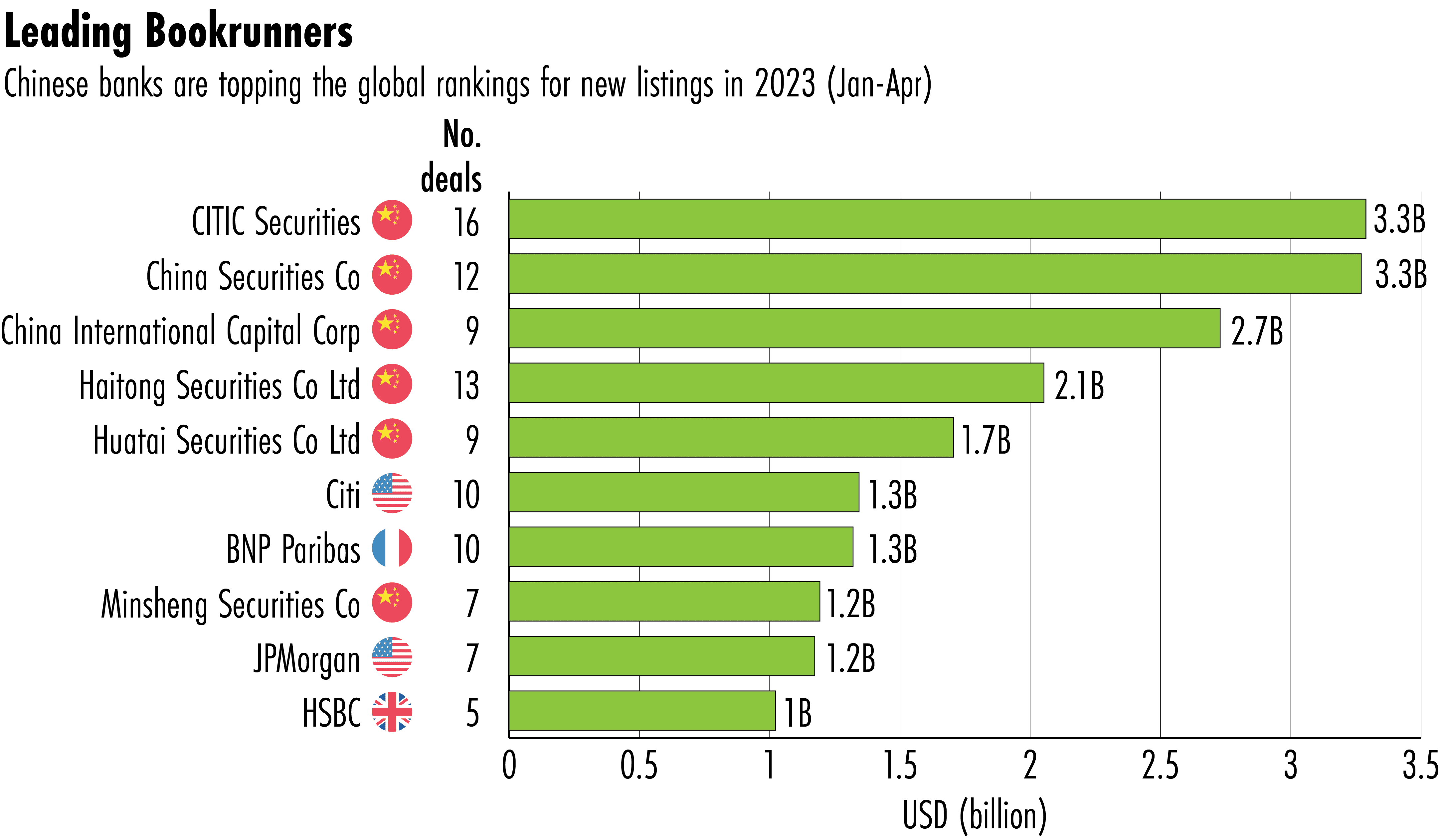

As a result, Chinese investment banks leapfrogged their American counterparts to dominate the rankings of top IPO banks in 2022, with that trend continuing in the first four months of this year. State-owned was the top IPO underwriter of 2022, and continues to lead the rankings this year, followed by 1 and (CICC). Six of the top 10 underwriters so far this year are Chinese.

“China has closed its markets to foreign competition when its own companies were weak,” says Fraser Howie, co-author of . “Now they’ve opened up 100 percent [foreign] ownership of brokerages, but the domestic brokers are much stronger, and the playing field is so tilted that it frankly doesn’t matter what the foreigners do, it’s all become such a domestic insiders game.”

China Floats to the Top

The surge in IPOs on domestic markets is a win for Chinese policy makers and local investment banks.

Chinese companies are dominating the global market for initial public offerings, as listings in the West continue to drag in 2023. So far this year, new Chinese flotations have raised almost five times as much money as those in the United States.

For China’s policymakers, that’s good news. Beijing has sought to encourage private companies — particularly those in strategic sectors — to pursue IPOs at home, while at the same time making it harder for them to list abroad. Data on listings since the start of 2022 suggest that that plan may be working.

Both the number and total volume of Chinese public listings in the first four months of the year has outpaced those in the U.S. So far this year, Chinese companies have raised close to $20 billion on mainland bourses, including a $1.1 billion IPO by Shaanxi Energy Investment, a state owned utility firm, and $663 million IPO by Yuneng New Energy Battery Material Co., a battery cathode manufacturer. By comparison, firms in the U.S. raised just $4 billion in the first four months of the year, according to data from Dealogic, a financial data provider.

High inflation and rising interest rates led to a plunge in U.S. and European IPO activity in 2022. This year, additional uncertainty stemming from the crisis in the banking sector has stymied any recovery.

As a result, Chinese investment banks leapfrogged their American counterparts to dominate the rankings of top IPO banks in 2022, with that trend continuing in the first four months of this year. State-owned was the top IPO underwriter of 2022, and continues to lead the rankings this year, followed by 1 and (CICC). Six of the top 10 underwriters so far this year are Chinese.

“China has closed its markets to foreign competition when its own companies were weak,” says Fraser Howie, co-author of . “Now they’ve opened up 100 percent [foreign] ownership of brokerages, but the domestic brokers are much stronger, and the playing field is so tilted that it frankly doesn’t matter what the foreigners do, it’s all become such a domestic insiders game.”