If you uncritically accept the ITIF’s report - you should accept all of its study conclusions.

Not necessarily. That's like saying if you agree with me on one thing you need to agree on everything. Stupid, right? But despite how stupid your rule is, you've still violated it saying that you agree with the one point saying that the US and China are likely at par on one thing, then saying that China is NOT 15 years ahead, which is against the conclusion of the article.

There - it is unambiguous - the U.S. and China are similar in technological levels,

Can you even read? Every point gives China the heavy advantage and one time, it says that analysts say that China and the US are "likely at par." It's unsupported and then even if it's true, the rest of it means that although both guys are big dreamers, China's the bigger doer.

the U.S. has more nuclear energy deployed, and China has a more permissive structure to marketize nuclear energy. So even there, your favored sources do not support an unambiguous “15 years ahead” conclusion - especially not for capital formation and technological development

“However, this does not necessarily mean that China’s largest nuclear power companies—notably the state-owned enterprises (SOEs) China General Nuclear Power Corporation (CGN) and the China National Nuclear Power (CNNP)—are exceptionally innovative technologically.” -

.

No, you can't read at all. The US has more nuclear power deployed because of what it had done in the decades before. China's tech is superior. The US has no 4th gen reactors or plans to build one while China's is operations. You're getting really stupid on a really basic level. You can't even distinguish the difference between numeric superiority and technological superiority.

All of this is distracting from the original point that Congress is able to substantial changes (which you haven’t rebutted as much as you’ve downplayed).

No changes have been seen. They've talked about it. What's the result? Where's the tech that came out of it? Nothing, no changes, just talking about changes.

Not just semiconductors lol. How many of the world’s larger electronic gas manufacturers are from China? Software publishers? Aircraft manufacturers (even with Boeing’s recent kerfuffle)? Pharmaceutical corporates? Life insurers? Medical device manufacturers? Oilfield equipment companies? Package couriers? Commercial avionics manufacturers?

The pattern is all the same; American/Western companies totally dominant a decade or 2 ago, now, some of those fields, they have Chinese challengers and others, they have already been beaten like telecom, electric vehicles. Like I said, old lion's tools getting ground down by young lion's growth.

The point was you don’t need to know anything about the state of where China is to know US firms will maintain their market leading positions for decades.

The point is that you actually know nothing about the state of China but hope that you can close your eyes and imagine that the future will resemble the past. The hallmark of a waning empire.

This is indeed the point. By the time China scales effectively, it will be 203X at the earliest. Decades, indeed.

Your point is that it'll take 20 years or less from the time China challenges the US to when it overtakes in each field?

Generally, when people hear "decades," we think at least 40 years, probably 50-60. You meant decades as in 203X? That's... probably fine. I don't expect the US to go down

that fast.

There were ~1.9M STEM bachelor degree recipients in China in 2022. There were ~18 million people born in China in 2000. ~11% of the cohort earned a STEM bachelor degree.

There were ~420K STEM bachelor recipients in the U.S. in 2022. There ~4 million people born in the U.S. in 2000 and once again, ~11% of the cohort earned a ST

This is jumbled garbage. This mixes all types of majors with no emphasis on STEM. Nobody has any idea which lines you decided to add.

STEM graduates per capita direct data:

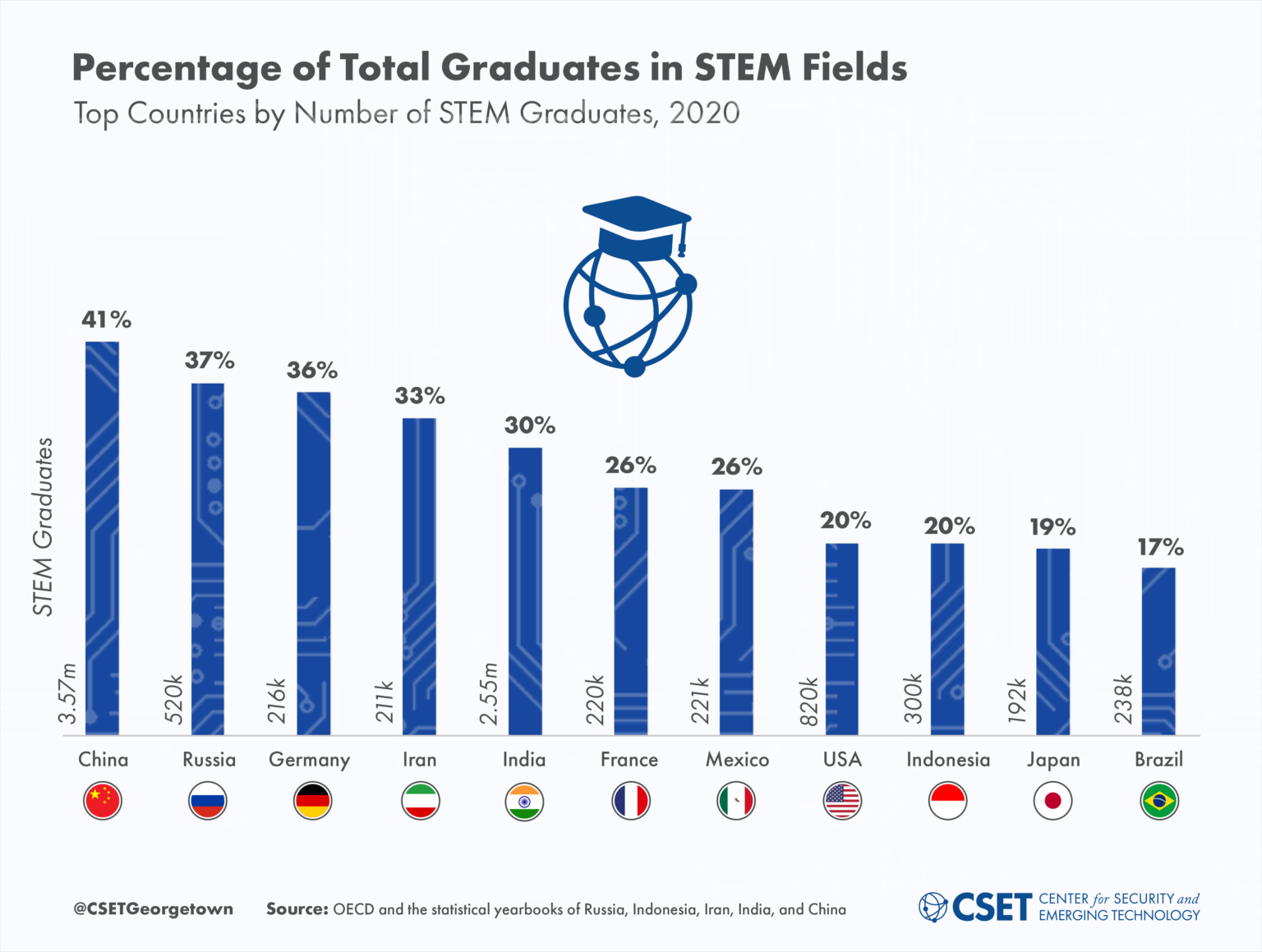

Figure 3 shows that 41% of Chinese students choose STEM while ony 20% of American students choose STEM. Furthermore, while America has basically nowhere left to go as a developed nation (actually seeing declines in college attedance since 2011), China's rapidly increasing college attendance rate compounds with the double in proportion of students selecting STEM.

You can toggle with the numerators with international students and U.S. citizen/lpr Asians. It doesn’t change the analysis.

Which I'm showing above, not your made up shit.