Yup, that'd be them, poor fools conditioned to keep spending even though financially, they shouldn't be. Living paycheck-to-paycheck means living paycheck-to-paycheck. Traveling doesn't mean living or not living paycheck-to-paycheck. Warning; I'm about to post an article with a couple of tables and graphs. I know that's your weakness. (By the way, did you ever manage to figure out from our last convo whether your claimed 3% savings is the lowest on record according to the graph that you provided??? hmmmm?)

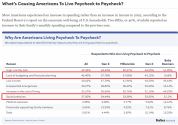

"A 2023 survey conducted by Payroll.org highlighted that 78% of Americans live paycheck to paycheck, a 6% increase from the previous year. In other words, more than three-quarters of Americans struggle to save or invest after paying for their monthly expenses.

Similarly, a 2023 Forbes Advisor survey revealed that nearly 70% of respondents either identified as living paycheck to paycheck (40%) or—even more concerning—reported that their income doesn’t even cover their standard expenses (29%)."

Aaand cue the snake biting its own tail arguments again.

You: Americans keep spending and not saving because that shows strong confidence in the US economy! People want to turn all money into instant fun! Saving is when you think you'll be in trouble!

Also you: No, saving shows a really strong financial situation and that's reflected by how few Americans are living paycheck-to-paycheck because they have strong savings so they can afford to travel!

Circus is in town again!