More blowback... and more appropriate here than in the semicon thread.

GT Voice: Nightmare for US chip firms just beginning after latest ban

By Global Times Published: Oct 20, 2022 08:35 PM

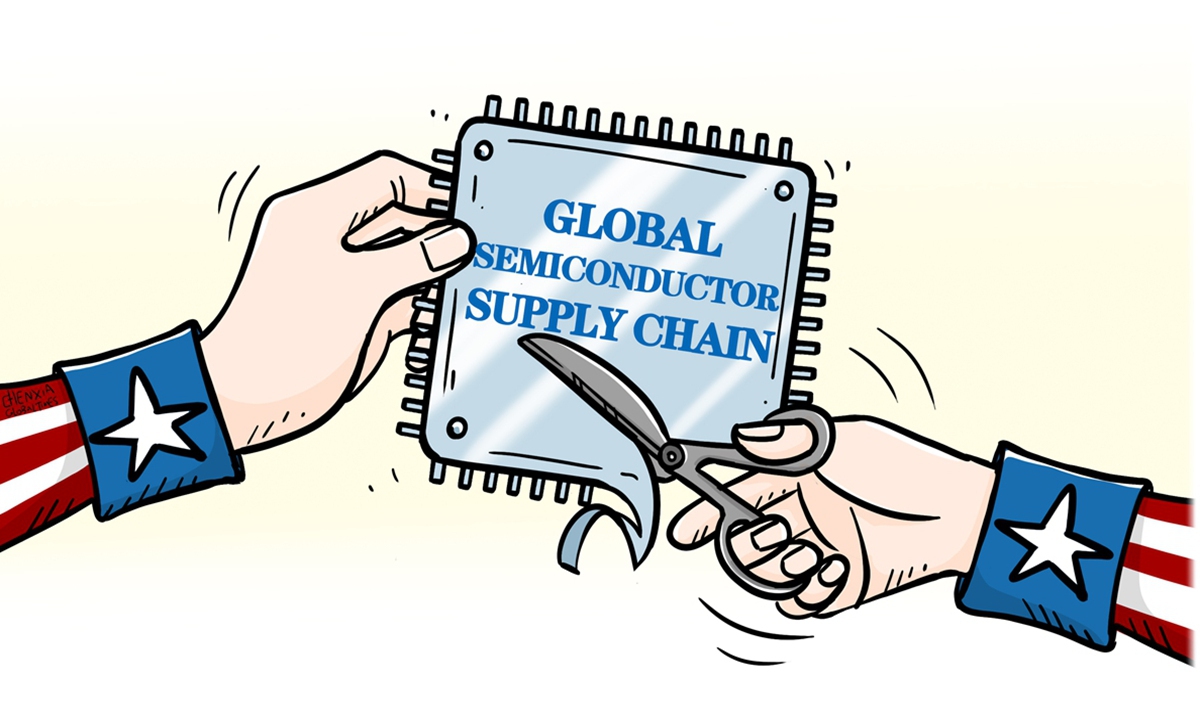

Illustration: Chen Xia/GT

US chipmaking equipment supplier Lam Research on Wednesday warned of a $2 billion to $2.5 billion revenue hit in 2023 from Washington's latest export controls on advanced semiconductors and equipment to China, which covers about 30 percent of the US company's sales, Reuters reported.

Lam Research is just the latest chip firm to forecast a sales loss due to the US' chip ban. Last week, Applied Materials estimated a $250 million to $550 million drop in net sales in the quarter ending October 30, with a further impact expected in the coming months.

While comments from the US business community about the latest round of US tech crackdown on China seem muted, their worrying sales outlook is not an isolated situation, but one that concerns all companies in the global chip supply chain, particularly those in the US. Indeed, the nightmare caused by the US' chip ban for its own firms may have just started.

It is understandable that in an environment dominated by Washington's political pressure and distorted public opinion against China, business leaders may keep their heads down toward unilateral US intervention in the highly globalized semiconductor sector.

But it is more essential than ever for businesses to speak out about the impact of such moves instead of staying quiet. The world needs to hear the numbers to know how much damage the industry is facing because of US geopolitical gambits. As the losses accumulate, the commercial impact on Washington's policy will also increase.

It is no secret that as the US repeatedly tightened curbs on high-tech exports to China, especially in the semiconductor sector, in an apparent attempt to contain China's independent development and breakthroughs in science and technology, the market outlook for US chip companies has significantly darkened.

Even before the latest US crackdown moves, chip firms had already been suffering. Of the 15 largest chip companies reporting for the September quarter, 10 are expected to report decelerations in revenue growth compared with the June quarter, according to a Wall Street Journal report last week.

Their plight worsened after the Biden administration unveiled "the most aggressive" export control rules earlier this month, aiming to curb sales of advanced semiconductors and equipment to China.

China is the world's largest market for chips, and it imported about $400 billion worth of semiconductors in 2021, accounting for nearly 60 percent of the global chip market. US high-tech companies are the biggest beneficiaries of the massive Chinese demand, which is their biggest source of profits. It is unthinkable for any chipmaker to lose such a large market. It would greatly affect their spending plans and in turn cause an indirect loss of sales for semiconductor equipment suppliers like Lam Research and Applied Materials.

With the global semiconductor sector facing a plunge in sales of personal computers and smartphones amid recession worries, Washington's latest chip ban has seriously destabilized the global industrial chain. The policy, which appears to completely ignore the impact on the wider chip industry, seems more like the Biden administration flexing its muscles and playing tough with China in the run-up to the US mid-term elections.

But far from ensuring US dominance in the chip sector, the export controls could hurt US tech companies the most in terms of sales, and curtail their research and development investment.

From China's perspective, it has a huge market, and it is doubtful whether the US can use unilateral executive orders to prevent non-US chip companies from conducting normal cooperation and trade with China. If non-US companies don't join, unilateral US bans will actually undercut US companies' competitiveness by depriving them of the Chinese market.

US restrictions will only accelerate the development of China's chip sector, because the Chinese market won't wait for the US to come to its senses. If the Chinese chip sector catches up quickly and no longer relies on imports, it will not be a $2.5 billion loss for a single US company, but hundreds of billions of dollars of loss for the chip industry.