Don't conflate labor participation rate with real productivity especially when total aggregate energy resources are now the rate limiting factor as opposed to human workers (which in the age of automation and AI don't really mean anything anymore whence income/wealth is decoupled from human labor)

For example, a gallon of gas contains about 132 million joules of energy, or the equivalent of nearly two weeks (actually six weeks if considering 8 hour workdays) of manual human muscle power and labor. Currently the minimum wage is still $7.25/hr and with gas at $2.8 USD per gallon, this roughly translates to acquiring 2 gallons of gas per hour and obtaining the energy and work/force multiplier of almost a factor of 672 times for the lowest paid member of society. By some estimates every American has somewhere between 200 to 8,000 'energy slaves

Currently you can buy 1 kilowatt hour of power from the grid for about ten cents. But imagine what it would cost you to hire a worker to pull a car of 2,500 lbs., using a pulley with a factor of 1:40, from the ground to the top of the Empire State Building. That’s at least a day’s of hard work or $200 to $300 in money terms. This perfectly illustrates the huge subsidy modern industrial society enjoys while the oil age will last, which is not too long anymore.

Money is just a mere abstract symbolic token representation of the ability of cheap and abundant higher EROEI (Energy Returned on Energy Invested) energy to do 'work' on our behalf. No amount of funny-money fiscal policy can change the fact that the underlying physical system that powers absolutely everything we do has ran out of energy. When the quality and quantity of energy available to us continues to decline and decrease, then proportionately so does the value or purchasing power of the money that we hold... for that money was a mere representation of the 'multiplier-effect' of energy/work and the resulting productivity that cheap energy had amplified and enabled. Butwith the energy depleted so too does our money become worthless.

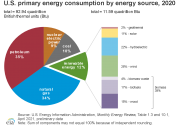

So what is happening to the US from a big picture energy perspective?

""

Total U.S. consumption of petroleum, natural gas, and coal slumped by 9 percent in 2020 reaching the lowest level since 1991 and marking the largest annual decrease in U.S. fossil fuel consumption in both absolute and percentage terms since at least 1949, the EIA said this week.

Lockdowns and economic responses to COVID-19, as well as relatively warmer weather last year, were the key reasons for the plunge in consumption of transportation fuels, heating fuels, and fossil fuels used for industrial purposes.""

Based on the US gov own way of calculating inflation and the CPI stats back from the 1990s, the US inflation rate already surpassed double digits right now... with the way the US keeps revising the way inflation is calculated to continuously fudge the numbers to make it look better than it really is (not unlike the fake 15% imputed rent that adds to America's nominal GDP etc) its only serving to mask the symptoms while inevitably making the coming collapse that much harder and steeper...

US minimum wage was $7.25 back in 2009, had it kept up pace with real inflation and adjusted for true cost of living it would be closer to $34 dollars an hour today... The American government is putting the squeeze on its bottom 90% of its own citizenry to keep afloat domestically and whilsts also squeezing the rest of the world by way of monetary harvesting its allies and vassals alike internationally to keep the lights on for a little while longer, it even had to jettison Afghanistan to refocus on China containment in the Far East, but back in its heyday of unipolar moment it wouldn't even had to have made the compromise or concession at all and would have gladly taken on both at the same time...