You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Japan economics thread.

- Thread starter gadgetcool5

- Start date

It is, just not as fast as the Yen right now.How come Indian currency is not devaluing?

The BOJ showed up today, let's see if they can defend 160.

Well, currently a lot of global (and US) capital is basically betting on short selling Japan.Maybe the US wants to sacrifice Japan to force China to devaluate (to retain its industrial export market share) and thus abandon plans for internationalisation of yuan

Which with how things are going, likely to happen (I see 200+ USD to YEN this year bring very likely).

And well, that would likely trigger an 1997 Asian financial crisis version 2, which they hope will also hit China (unlikely to be that damaging in the greater scheme, just like the 1997 didn't really hit China back then).

But it's likely to also hit SK hard (and Philippines as well)

IMHO Japan should just accept the devaluation. It will make their export industries more competitive.

It still won't solve the many problems they have, like how their whole export industries have been falling behind, but at least it will help.

(This above is for EU manufacturing, not Japan, but it illustrates it well enough).

Accepting the devaluation would only make it worse as they are 100% energy-dependent, and buy that energy in USD.

That would only increase production costs to their manufacturing, making them less competitive.

That would only mount on top of the other 5-10 cost advantages China already has over them for example.

Keep in mind that prices of energy and raw materials were already going higher globally recently on their own.

They need to de-dollarize their energy and some commodity imports, only then can they afford this kind of weak yen.

And truly get bigger current account surpluses from domestic tourism and more exports it brings.

However, they probably won't have the guts to do this move until shit really hits the fan later.

They can't increase interest rates to revalue the yen as they have a 263% public debt-to-GDP ratio,

They can only send their tremendous UST reserves, sell that to USD, and then to yen, to prop it up.

But the best move is just to de-dollarize energy imports and keep those advantages of the weaker yen.

Then they print yen and pay with that I don't have doubts that many energy-producing countries would accept it.

There are many things that you could actually buy from Japan in return for that yen and safeguard its value in gold or JGBs.

That's why this is more interesting from the US perspective, they are in a lose-lose situation here.

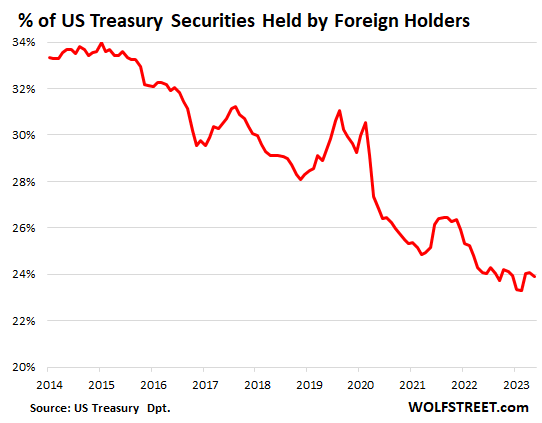

Either allow Japan to start dumping their USTs, in such a moment when the US needs to sell them the most,

Or allow further de-dollarization globally. Both moves from Japan could have ripple effects globally.

Something out of those 2 would need to happen, but I predict much later when Japan is under more serious fire.

Imagine if allies/vassals like these need to start dumping US dollars and their denominated assets, what do other neutral countries think/do?

The US can always disallow Japan to do anything and let them collapse, as they are under their occupation, but it needs it as a launchpad against China.

If Japan starts collapsing like this now, then China would just take their industries, which is maybe an even bigger loss.

And I don't think will fundamentally change until the US starts massively cutting interest rates, which is unlikely ever again.

Also, there are other complications from the depreciated yen, also in the labor sector. Imagine now when it reaches 200-220.

The recent depreciation of the yen has also created a new phenomenon. An increasing number of young Japanese are taking advantage of the “working holiday” program, which allows students to study in countries such as Australia and Canada while working in restaurants and other businesses.

This is because wages are low when they work part-time in Japan, and they can earn more in yen after returning to Japan if they work in foreign countries and receive their wages in foreign currencies.

In addition to the restaurant industry, many industries in Japan, including tourism and construction, are suffering from labor shortages. Many industries rely on foreign workers, but the weak yen reduces the amount of wages after conversion into the home countries’ currency.

Some say the appeal of working in Japan has diminished, making it more difficult to lure foreign workers to Japan. The yen’s depreciation may accelerate the labor shortage.

Eh, it is not something that is gonna help them in the short term, and that is what is really needed.Japan could restart more nuclear power plants. They have been steadily doing it. This will cut on coal and natural gas imports.

if US doesn't start cutting interest rates, how are they able to serve their massive debt pile?

(This above is for EU manufacturing, not Japan, but it illustrates it well enough).

Accepting the devaluation would only make it worse as they are 100% energy-dependent, and buy that energy in USD.

That would only increase production costs to their manufacturing, making them less competitive.

That would only mount on top of the other 5-10 cost advantages China already has over them for example.

Keep in mind that prices of energy and raw materials were already going higher globally recently on their own.

They need to de-dollarize their energy and some commodity imports, only then can they afford this kind of weak yen.

And truly get bigger current account surpluses from domestic tourism and more exports it brings.

However, they probably won't have the guts to do this move until shit really hits the fan later.

They can't increase interest rates to revalue the yen as they have a 263% public debt-to-GDP ratio,

They can only send their tremendous UST reserves, sell that to USD, and then to yen, to prop it up.

But the best move is just to de-dollarize energy imports and keep those advantages of the weaker yen.

Then they print yen and pay with that I don't have doubts that many energy-producing countries would accept it.

There are many things that you could actually buy from Japan in return for that yen and safeguard its value in gold or JGBs.

That's why this is more interesting from the US perspective, they are in a lose-lose situation here.

Either allow Japan to start dumping their USTs, in such a moment when the US needs to sell them the most,

Or allow further de-dollarization globally. Both moves from Japan could have ripple effects globally.

Something out of those 2 would need to happen, but I predict much later when Japan is under more serious fire.

Imagine if allies/vassals like these need to start dumping US dollars and their denominated assets, what do other neutral countries think/do?

The US can always disallow Japan to do anything and let them collapse, as they are under their occupation, but it needs it as a launchpad against China.

If Japan starts collapsing like this now, then China would just take their industries, which is maybe an even bigger loss.

And I don't think will fundamentally change until the US starts massively cutting interest rates, which is unlikely ever again.

Also, there are other complications from the depreciated yen, also in the labor sector. Imagine now when it reaches 200-220.

if US doesn't start cutting interest rates, how are they able to serve their massive debt pile?

The US is different than Japan because actually, they don't even theoretically need any 'real' buyers of their bonds, as the FED is the biggest end-game buyer (gov. extension).

Before that, they would likely force their commercial banks to buy more bonds, and in the last step, the FED just prints money and finances their bulging fiscal deficits entirely.

They will continue to serve it until they can't anymore and then will just collapse.

That point is when the FEDs print enough dollars into circulation to cause hyperinflation.

(Way above the external 'demand' for them, so the RoW can't 'absorb' their inflation anymore entirely).

That would just pour gasoline over already the pretty fiery internal socio-political situation, and then the US would disintegrate.

Where is the guarantee that the US has to exist forever? Nothing exists forever.

Yeah, they can likely do a few symbolic 0.25 or 0.50 rate cuts, but they fundamentally can't defeat inflation anymore, judging by the data and common sense.

So, that means that their interest rates will always need to stay relatively high. They need to balance economic slowdown in activity and inflation concerns (stagflation).

Last edited: