National Key Laboratory of Materials for Integrated Circuits, Shanghai Institute of Microsystem and Information Technology, Chinese Academy of Sciences ...

Lithium tantalate photonic integrated circuits for volume manufacturing

Abstract

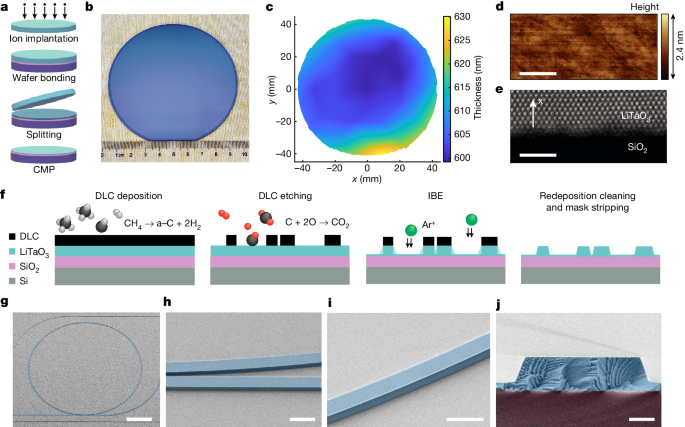

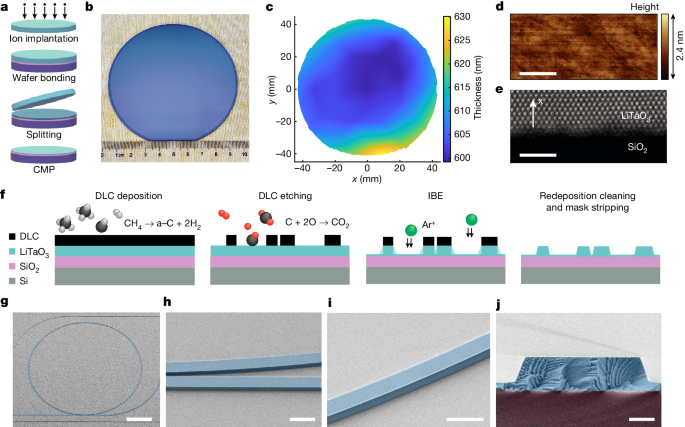

Electro-optical photonic integrated circuits (PICs) based on lithium niobate (LiNbO3) have demonstrated the vast capabilities of materials with a high Pockels coefficient,. They enable linear and high-speed modulators operating at complementary metal–oxide–semiconductor voltage levels to be used in applications including data-centre communications, high-performance computing and photonic accelerators for AI. However, industrial use of this technology is hindered by the high cost per wafer and the limited wafer size. The high cost results from the lack of existing high-volume applications in other domains of the sort that accelerated the adoption of silicon-on-insulator (SOI) photonics, which was driven by vast investment in microelectronics. Here we report low-loss PICs made of lithium tantalate (LiTaO3), a material that has already been adopted commercially for 5G radiofrequency filters and therefore enables scalable manufacturing at low cost, and it has equal, and in some cases superior, properties to LiNbO3. We show that LiTaO3 can be etched to create low-loss (5.6 dB m−1) PICs using a deep ultraviolet (DUV) stepper-based manufacturing process. We demonstrate a LiTaO3 Mach–Zehnder modulator (MZM) with a half-wave voltage–length product of 1.9 V cm and an electro-optic bandwidth of up to 40 GHz. In comparison with LiNbO3, LiTaO3 exhibits a much lower birefringence, enabling high-density circuits and broadband operation over all telecommunication bands. Moreover, the platform supports the generation of soliton microcombs. Our work paves the way for the scalable manufacture of low-cost and large-volume next-generation electro-optical PICs..