You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Turkey Military News, Reports, Data, etc.

- Thread starter Jeff Head

- Start date

TerraN_EmpirE

Tyrant King

Looks like the Single engines model, that means Cobra. Super Cobras are twin engines.

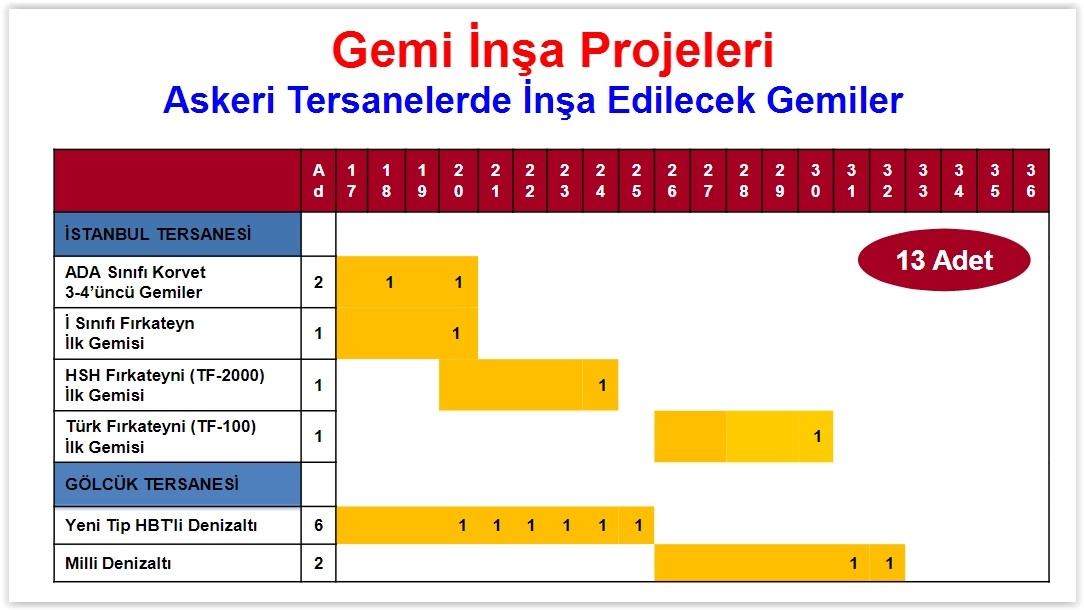

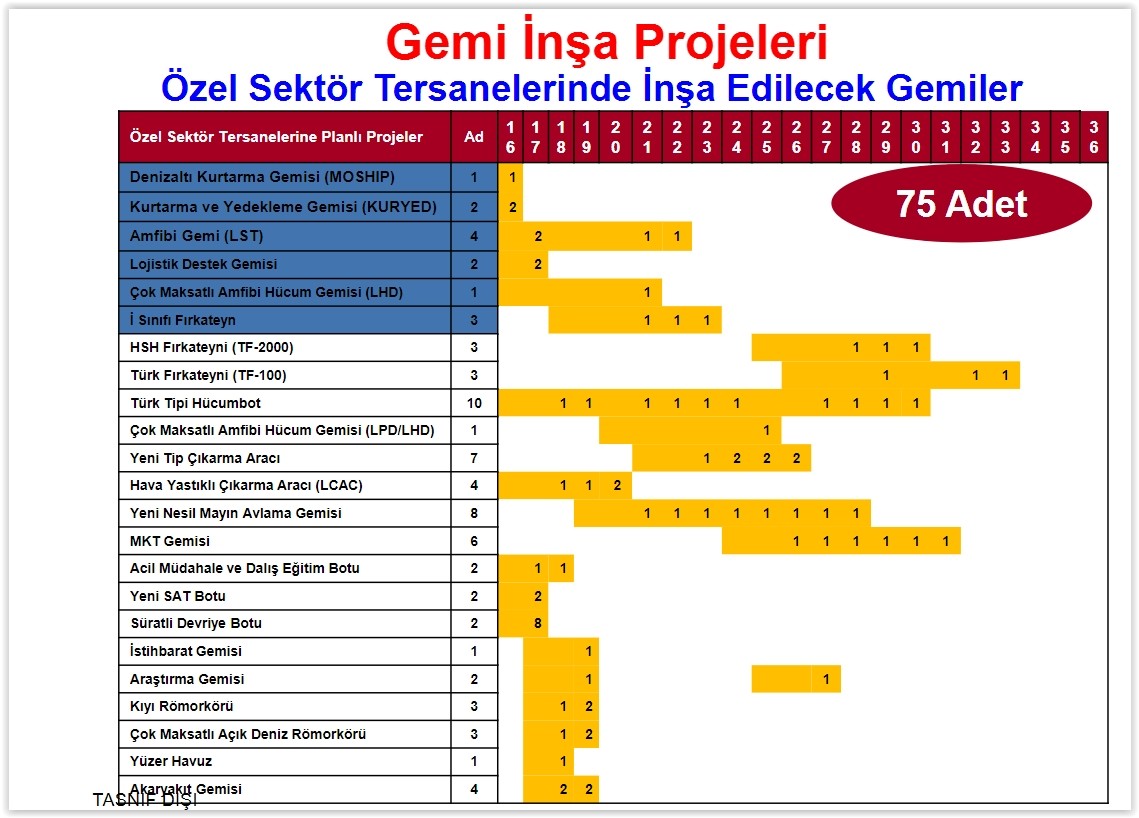

National Submarine Workshop

Turkish Naval Forces organised a national Submarine Workshop on 15. and 16. June at Tuzla Naval Shipyard.

This invitation only workshop was attended by marine engineers both military and civilian, representatives of defense companies and scholars.

The aim was to create a viable road map for the National Submarine, to identify competencies and competences of the national companies and potential short comings, risks in design and production phases.

Turkish Navy wants to commission its first indigenous submarine in 2030. Commander of Turkish Naval Forces Admrail Bostanoğlu stated in his opening speech that Turkish Navy was overhauling its submarines in Gölcük Naval Yard for the last 53 years. He also mentioned that Turkey constructed 11 submarines in 35 years and the building of Type 214 submarines was proceeding.

For me the most interesting part of the speech when Admiral Bostanoğlu mentioned that Turkish Navy developed its own engineering solution to 5 major design faults of Type 214 submarines.

These solutions were verified by TKMS and incorporated into the design of Turkish Type214’s. Therefore the Turkish submarines will have slightly different dimensions compared to the one’s already serving in Greek, Portuguese and South Korean navies.

Admiral Bostanoğlu indicated the following objectives where local work and innovations is needed:

It is not a secret that Turkey aims to develop and built its own submarines and reduce its dependency to foreign suppliers in critical areas. This workshop indicates that the local know-how and production abilities reached a critical mark where a local development is considered feasible.

(A digitally created rendering of Milden shown during the workshop. The end product may have a much different shape. Interesting to note that it has X type rudders a shrouded propeller. The thin line prodding form the aft of the submarine is like to house a towed array sonar or a towed counter measure. There is a provision for flank array sonar. The sail is streamlined and houses the forward diving planes.)

Turkish Naval Forces organised a national Submarine Workshop on 15. and 16. June at Tuzla Naval Shipyard.

This invitation only workshop was attended by marine engineers both military and civilian, representatives of defense companies and scholars.

The aim was to create a viable road map for the National Submarine, to identify competencies and competences of the national companies and potential short comings, risks in design and production phases.

Turkish Navy wants to commission its first indigenous submarine in 2030. Commander of Turkish Naval Forces Admrail Bostanoğlu stated in his opening speech that Turkish Navy was overhauling its submarines in Gölcük Naval Yard for the last 53 years. He also mentioned that Turkey constructed 11 submarines in 35 years and the building of Type 214 submarines was proceeding.

For me the most interesting part of the speech when Admiral Bostanoğlu mentioned that Turkish Navy developed its own engineering solution to 5 major design faults of Type 214 submarines.

These solutions were verified by TKMS and incorporated into the design of Turkish Type214’s. Therefore the Turkish submarines will have slightly different dimensions compared to the one’s already serving in Greek, Portuguese and South Korean navies.

Admiral Bostanoğlu indicated the following objectives where local work and innovations is needed:

- Integrated sonar and fire control system

- High resolution optronics systems

- Periscope

- LPI navigation radar

- ECM system capable of detecting LPI radars

- Enhanced COMING and SIGINT capabilities

- Accurate inertial navigation system

- EHF and SHF satellite communication system

- Link 16/22 ability

- AIP

- High powered batteries

- Long range land attack capable cruise missiles

- Locally developed torpedoes and mines

- Torpedo and mine countermeasures.

It is not a secret that Turkey aims to develop and built its own submarines and reduce its dependency to foreign suppliers in critical areas. This workshop indicates that the local know-how and production abilities reached a critical mark where a local development is considered feasible.

(A digitally created rendering of Milden shown during the workshop. The end product may have a much different shape. Interesting to note that it has X type rudders a shrouded propeller. The thin line prodding form the aft of the submarine is like to house a towed array sonar or a towed counter measure. There is a provision for flank array sonar. The sail is streamlined and houses the forward diving planes.)

asif iqbal

Banned Idiot

Great news !

That will make 4 x Ada class 511,512,513 and 514

Next iteration Istanbul class is under construction already

TF2000 the 7,000 ton monster is under development with CAFRAD live fire from this radar due to take place next year

Good progrsss on warship

That will make 4 x Ada class 511,512,513 and 514

Next iteration Istanbul class is under construction already

TF2000 the 7,000 ton monster is under development with CAFRAD live fire from this radar due to take place next year

Good progrsss on warship

timepass

Brigadier

TURKISH AEROSPACE INDUSTRIES (TAI) TOUTS T625 UTILITY HELICOPTER

Turkish Aerospace Industries (TAI) displayed a mock-up of its at the 2017 Paris Air Show, touting the forthcoming aircraft as an attractive option for civilian and military use.

The T625 is a six-ton twin-engine design meant to compete with the Leonardo AW139 and Airbus H175. It will have the capacity to carry 12 passengers. Aselsan is the principal vendor of avionics for the T625.

With the prototype under production, TAI aims to have the T625’s first flight in September 2018, with civil certification in Turkey by the end of 2020.

The T625 will be powered by two Rolls-Royce-Honeywell Light Helicopter Turbine Engine Co. (LHTEC) T800 turboshaft engines, sharing a common powerplant as the T129 ATAK attack helicopter.

TAI began designing the T625 under the designation of ‘Ozgun’, which was changed to ‘T625’ in January. TAI envisages domestic and overseas sales of 300 and 500 T625 helicopters, respectively, over the next 20 to 25 years ().

TAI’s executive vice-president for helicopters, Metin Sancar, said (via ) the T625 could lead to the development of larger TAI helicopters, potentially up to the range of 12 tons, which would be in the realm of the Leonardo AW101 and Russian Helicopters Mil Mi-171.

Critical to this endeavour is TUSAŞ Engine Industries’ (TEI) turboshaft engine program, which was via a contract from the Turkish Undersecretariat for Defence Industries in February. TEI had been tasked to design and develop a 1,400 shp turboshaft engine for the T625 and . The TEI engine is also pegged to power the TAI Hürkuş trainer and light combat aircraft platform.

TEI’s General Manager Mahmut Aksit told that it would take two years to design the engine, with prototype production complete in “four and a half years.” Aksit expects the engine to come into full fruition in 7-10 years. Until then, TAI will be reliant on the LHTEC platform.

Beside the T625, TAI and TEI are also spearheading the production of Lockheed Martin S-70i Black Hawk helicopters, which are to be produced in Turkey with the T-70 designation.

The Black Hawk was for the Turkish Utility Helicopter Program, which envisaged a domestic requirement of at least 109 helicopters for the Turkish Armed Forces (TSK).

Like the T129, TAI has export licenses for the T-70, which could see it market the Black Hawk platform to a host of Turkish defence industry customers, such as Pakistan, which is reportedly in negotiations with TAI for 30 T129 ATAK attack helicopters.

Source: Quwa

Turkish Aerospace Industries (TAI) displayed a mock-up of its at the 2017 Paris Air Show, touting the forthcoming aircraft as an attractive option for civilian and military use.

The T625 is a six-ton twin-engine design meant to compete with the Leonardo AW139 and Airbus H175. It will have the capacity to carry 12 passengers. Aselsan is the principal vendor of avionics for the T625.

With the prototype under production, TAI aims to have the T625’s first flight in September 2018, with civil certification in Turkey by the end of 2020.

The T625 will be powered by two Rolls-Royce-Honeywell Light Helicopter Turbine Engine Co. (LHTEC) T800 turboshaft engines, sharing a common powerplant as the T129 ATAK attack helicopter.

TAI began designing the T625 under the designation of ‘Ozgun’, which was changed to ‘T625’ in January. TAI envisages domestic and overseas sales of 300 and 500 T625 helicopters, respectively, over the next 20 to 25 years ().

TAI’s executive vice-president for helicopters, Metin Sancar, said (via ) the T625 could lead to the development of larger TAI helicopters, potentially up to the range of 12 tons, which would be in the realm of the Leonardo AW101 and Russian Helicopters Mil Mi-171.

Critical to this endeavour is TUSAŞ Engine Industries’ (TEI) turboshaft engine program, which was via a contract from the Turkish Undersecretariat for Defence Industries in February. TEI had been tasked to design and develop a 1,400 shp turboshaft engine for the T625 and . The TEI engine is also pegged to power the TAI Hürkuş trainer and light combat aircraft platform.

TEI’s General Manager Mahmut Aksit told that it would take two years to design the engine, with prototype production complete in “four and a half years.” Aksit expects the engine to come into full fruition in 7-10 years. Until then, TAI will be reliant on the LHTEC platform.

Beside the T625, TAI and TEI are also spearheading the production of Lockheed Martin S-70i Black Hawk helicopters, which are to be produced in Turkey with the T-70 designation.

The Black Hawk was for the Turkish Utility Helicopter Program, which envisaged a domestic requirement of at least 109 helicopters for the Turkish Armed Forces (TSK).

Like the T129, TAI has export licenses for the T-70, which could see it market the Black Hawk platform to a host of Turkish defence industry customers, such as Pakistan, which is reportedly in negotiations with TAI for 30 T129 ATAK attack helicopters.

Source: Quwa

timepass

Brigadier

PAKISTAN TO BEGIN NEGOTIATIONS FOR T129 ATTACK HELICOPTERS FROM TURKEY

Pakistan will reportedly commence formal negotiations for the attack helicopter from Turkish Aerospace Industries (TAI).

According to aviation journalist Alan Warnes (via ), both sides are aiming to announce a deal, which could involve 30 aircraft, by the end of 2017 or early 2018. Turkish officials told that Pakistan was interested in the T129, but numbers have not yet been agreed upon.

This follows a year of active interest from Pakistan, beginning with trials in June 2016, when the Pakistan Army put the T129 ATAK (i.e. P6) through rigorous hot-and-high performance tests.

The P6 was flown at Pano Aqil when it was 50° Celsius. It was also flown at high-altitude at 14,000 feet in the Hindu Kush in the Himalayas. Endurance tests included a 480 km non-stop from Quetta to Multan.

In February, TAI’s General Manager Dr. Temel Kotil in a speech to the İstanbul Düşünce Vakfı (i.e. Istanbul Though Foundation) that TAI “will sell [T-129s] to Pakistan in the coming months.” Dr. Kotil also confirmed that Turkey acquired licenses to export the T129’s CTS800 turboshaft engine.

At IDEF 2017 in May, TAI and PAC had signed a memorandum-of-understanding (MoU) committing to expanding cooperation. At the end of May, Dr. Temel Kotil, visited PAC and TAI’s commitment to enable PAC to manufacture parts for the T129. PAC may also T129 ATAKs.

Last week, the Pakistan Army’s Chief of Army Staff General Qamar Javed Bajwa to Turkey, where he met with TAI and inspected TAI’s T129 production site.

Pakistan also has 12 AH-1Z Viper and four Mi-35P Hind attack helicopters on order from Bell Helicopter and Russian Helicopters, respectively. The and all four Mi-35P are scheduled to arrive in Pakistan by the end of 2017.

The T129 is an upgraded variant of the AgustaWestland A129 Mangusta, which flew in 1983 and entered production that year for the Italian Army. Derived from the A129CBT, the T129 benefits from an uprated engine (i.e. LHTEC CTS800-4A), airframe modifications as well as new tail rotor and drive train.

Turkey selected the T129 in 2007 with manufacturing and third-party export rights. Aselsan, Roketsan and Havelsan developed weapons and subsystems for the T129.

Notes & Comments:

The Pakistan Army evaluated the T129 and Z-10 as part of a for attack helicopters to compliment the forthcoming Bell AH-1Z. Although a program for the Pakistan Army Aviation Corps (PAA), the program apparently drew interest from the Pakistan Air Force (PAF) and Pakistan Navy as well.

In an interview with during Pakistan’s biennial defence exhibition IDEAS, the Deputy Undersecretary for Defence Industries (SSM) Mustafa Şeker said “The vehicle is required by the Pakistan Army, Navy and Air Force. Thus, all three services are involved in the process [of evaluating the T129].” In effect, the ‘plus-one’ attack helicopter may have been slotted to have a significant impact: from forming an industry link to PAC, expanding the PAA’s Aviation Combat Group to potentially making attack helicopters available to subsets other than the Army’s infantry and armour.

In comparison to either the T129 or Z-10, the Bell AH-1Z is the larger helicopter, especially in terms of payload where it can carry 16 anti-tank guided missiles (ATGM) in comparison to the eight ATGM-load of the T129 and Z-10. Pakistan took delivery of three Z-10s from China in late 2015. It had appeared that the Pakistan Army would procure the Z-10, but it is apparent that the Z-10 batch was in place for assessment. Alan Warnes reported (via Monch) of “strong speculation” of the three Z-10s in Pakistan no longer flying.

If the T129 order is inked, it would result in an acquisition roadmap of 46-49 modern attack helicopters – i.e. 12-15 AH-1Z, 30 T129 and 4 Mi-35P (a new version of the Mi-35M). Although this is similar in size to the Pakistan Army’s current fleet of AH-1F/S Cobra attack helicopters, the new fleet is vastly more capable. This is a result of integrated electro-optical and infrared (EO/IR) turrets, integrated countermeasures and fire-and-forget ATGMs, such as the AGM-114R Hellfire-II and Mizrak (UMTAS).

The potential fleet composition would result in a high (AH-1Z) and low (T129) format. Though the AH-1Z is the more capable machine, the T129 would benefit from greater numbers and a local supply channel, resulting in a broader operational impact. The Mi-35P, while also an attack helicopter, can provide troop and cargo lift, making it an asset for hot-zone insertion and extraction.

This attack helicopter fleet may grow in the long-term. When Pakistan ordered its four Mi-35P, reported that the Pakistan Army could acquire up to 20 aircraft, though Russian diplomat Zamir Kabulov that Pakistan is aiming for 10-12 Mi-35Ps. In terms of the T129, Pakistan’s pursuit for – and potentially – at PAC could point to long-term fleet expansion.

Granted, linking PAC into the T129 could be viewed as TAI’s attempt to make the T129 more affordable for Pakistan, namely by providing PAC with continual exports of T129 parts and allowing Pakistan to invest some of the expense domestically (i.e. offsets). However, with PAC engaged in co-producing the T129, Pakistan would have the incentive to gradually expand its T129 fleet. Small annual batch orders of over a period of 10-15 years would amount to a sizable fleet (mirroring, albeit at a smaller scale, the PAF’s approach to inducting the JF-17 Thunder).

This would scale transfer-of-technology and maintenance infrastructure costs, but also provide the Army with a means to build its native close air support (CAS) coverage. A large attack helicopter fleet will enable the Army to take the lead on providing CAS coverage for itself, freeing the PAF’s fighter assets to focus on air defence and stand-off range strikes. This would be applicable in counterinsurgency (COIN), where PAF assets have been relied upon to provide strikes against fixed installations and time-sensitive targets, as well as in conventional anti-armour and infantry support operations.

Aselsan, Roketsan and Havelsan would have opportunities to expand activities in Pakistan through the T129. Aselsan is the principal supplier of the T129’s EO/IR turret, avionics and countermeasures suite. The is among the T129’s main weapons. Havelsan developed a complete for the T129. Pakistan may have the incentive to tie sales from these companies to commercial offsets, particularly in the form of investments in or partnerships with Pakistani companies.

Source: Quwa

Pakistan will reportedly commence formal negotiations for the attack helicopter from Turkish Aerospace Industries (TAI).

According to aviation journalist Alan Warnes (via ), both sides are aiming to announce a deal, which could involve 30 aircraft, by the end of 2017 or early 2018. Turkish officials told that Pakistan was interested in the T129, but numbers have not yet been agreed upon.

This follows a year of active interest from Pakistan, beginning with trials in June 2016, when the Pakistan Army put the T129 ATAK (i.e. P6) through rigorous hot-and-high performance tests.

The P6 was flown at Pano Aqil when it was 50° Celsius. It was also flown at high-altitude at 14,000 feet in the Hindu Kush in the Himalayas. Endurance tests included a 480 km non-stop from Quetta to Multan.

In February, TAI’s General Manager Dr. Temel Kotil in a speech to the İstanbul Düşünce Vakfı (i.e. Istanbul Though Foundation) that TAI “will sell [T-129s] to Pakistan in the coming months.” Dr. Kotil also confirmed that Turkey acquired licenses to export the T129’s CTS800 turboshaft engine.

At IDEF 2017 in May, TAI and PAC had signed a memorandum-of-understanding (MoU) committing to expanding cooperation. At the end of May, Dr. Temel Kotil, visited PAC and TAI’s commitment to enable PAC to manufacture parts for the T129. PAC may also T129 ATAKs.

Last week, the Pakistan Army’s Chief of Army Staff General Qamar Javed Bajwa to Turkey, where he met with TAI and inspected TAI’s T129 production site.

Pakistan also has 12 AH-1Z Viper and four Mi-35P Hind attack helicopters on order from Bell Helicopter and Russian Helicopters, respectively. The and all four Mi-35P are scheduled to arrive in Pakistan by the end of 2017.

The T129 is an upgraded variant of the AgustaWestland A129 Mangusta, which flew in 1983 and entered production that year for the Italian Army. Derived from the A129CBT, the T129 benefits from an uprated engine (i.e. LHTEC CTS800-4A), airframe modifications as well as new tail rotor and drive train.

Turkey selected the T129 in 2007 with manufacturing and third-party export rights. Aselsan, Roketsan and Havelsan developed weapons and subsystems for the T129.

Notes & Comments:

The Pakistan Army evaluated the T129 and Z-10 as part of a for attack helicopters to compliment the forthcoming Bell AH-1Z. Although a program for the Pakistan Army Aviation Corps (PAA), the program apparently drew interest from the Pakistan Air Force (PAF) and Pakistan Navy as well.

In an interview with during Pakistan’s biennial defence exhibition IDEAS, the Deputy Undersecretary for Defence Industries (SSM) Mustafa Şeker said “The vehicle is required by the Pakistan Army, Navy and Air Force. Thus, all three services are involved in the process [of evaluating the T129].” In effect, the ‘plus-one’ attack helicopter may have been slotted to have a significant impact: from forming an industry link to PAC, expanding the PAA’s Aviation Combat Group to potentially making attack helicopters available to subsets other than the Army’s infantry and armour.

In comparison to either the T129 or Z-10, the Bell AH-1Z is the larger helicopter, especially in terms of payload where it can carry 16 anti-tank guided missiles (ATGM) in comparison to the eight ATGM-load of the T129 and Z-10. Pakistan took delivery of three Z-10s from China in late 2015. It had appeared that the Pakistan Army would procure the Z-10, but it is apparent that the Z-10 batch was in place for assessment. Alan Warnes reported (via Monch) of “strong speculation” of the three Z-10s in Pakistan no longer flying.

If the T129 order is inked, it would result in an acquisition roadmap of 46-49 modern attack helicopters – i.e. 12-15 AH-1Z, 30 T129 and 4 Mi-35P (a new version of the Mi-35M). Although this is similar in size to the Pakistan Army’s current fleet of AH-1F/S Cobra attack helicopters, the new fleet is vastly more capable. This is a result of integrated electro-optical and infrared (EO/IR) turrets, integrated countermeasures and fire-and-forget ATGMs, such as the AGM-114R Hellfire-II and Mizrak (UMTAS).

The potential fleet composition would result in a high (AH-1Z) and low (T129) format. Though the AH-1Z is the more capable machine, the T129 would benefit from greater numbers and a local supply channel, resulting in a broader operational impact. The Mi-35P, while also an attack helicopter, can provide troop and cargo lift, making it an asset for hot-zone insertion and extraction.

This attack helicopter fleet may grow in the long-term. When Pakistan ordered its four Mi-35P, reported that the Pakistan Army could acquire up to 20 aircraft, though Russian diplomat Zamir Kabulov that Pakistan is aiming for 10-12 Mi-35Ps. In terms of the T129, Pakistan’s pursuit for – and potentially – at PAC could point to long-term fleet expansion.

Granted, linking PAC into the T129 could be viewed as TAI’s attempt to make the T129 more affordable for Pakistan, namely by providing PAC with continual exports of T129 parts and allowing Pakistan to invest some of the expense domestically (i.e. offsets). However, with PAC engaged in co-producing the T129, Pakistan would have the incentive to gradually expand its T129 fleet. Small annual batch orders of over a period of 10-15 years would amount to a sizable fleet (mirroring, albeit at a smaller scale, the PAF’s approach to inducting the JF-17 Thunder).

This would scale transfer-of-technology and maintenance infrastructure costs, but also provide the Army with a means to build its native close air support (CAS) coverage. A large attack helicopter fleet will enable the Army to take the lead on providing CAS coverage for itself, freeing the PAF’s fighter assets to focus on air defence and stand-off range strikes. This would be applicable in counterinsurgency (COIN), where PAF assets have been relied upon to provide strikes against fixed installations and time-sensitive targets, as well as in conventional anti-armour and infantry support operations.

Aselsan, Roketsan and Havelsan would have opportunities to expand activities in Pakistan through the T129. Aselsan is the principal supplier of the T129’s EO/IR turret, avionics and countermeasures suite. The is among the T129’s main weapons. Havelsan developed a complete for the T129. Pakistan may have the incentive to tie sales from these companies to commercial offsets, particularly in the form of investments in or partnerships with Pakistani companies.

Source: Quwa