"It's a hard-won achievement. But it is still not time to relax and let our guard down," commented Shen Jianguang, Managing Director and Chief Economist of Mizuho Securities Asia Limited, on the joint statement issued by China and the US vowing not to launch a trade war, during his speech at the Tsinghua PBCSF Global Finance Forum on Sunday morning.

Looking back at the trade talks between China and the US over the past two weeks, he thinks that both parties have made compromises to avert a trade war and in this case, it is without doubt a success.

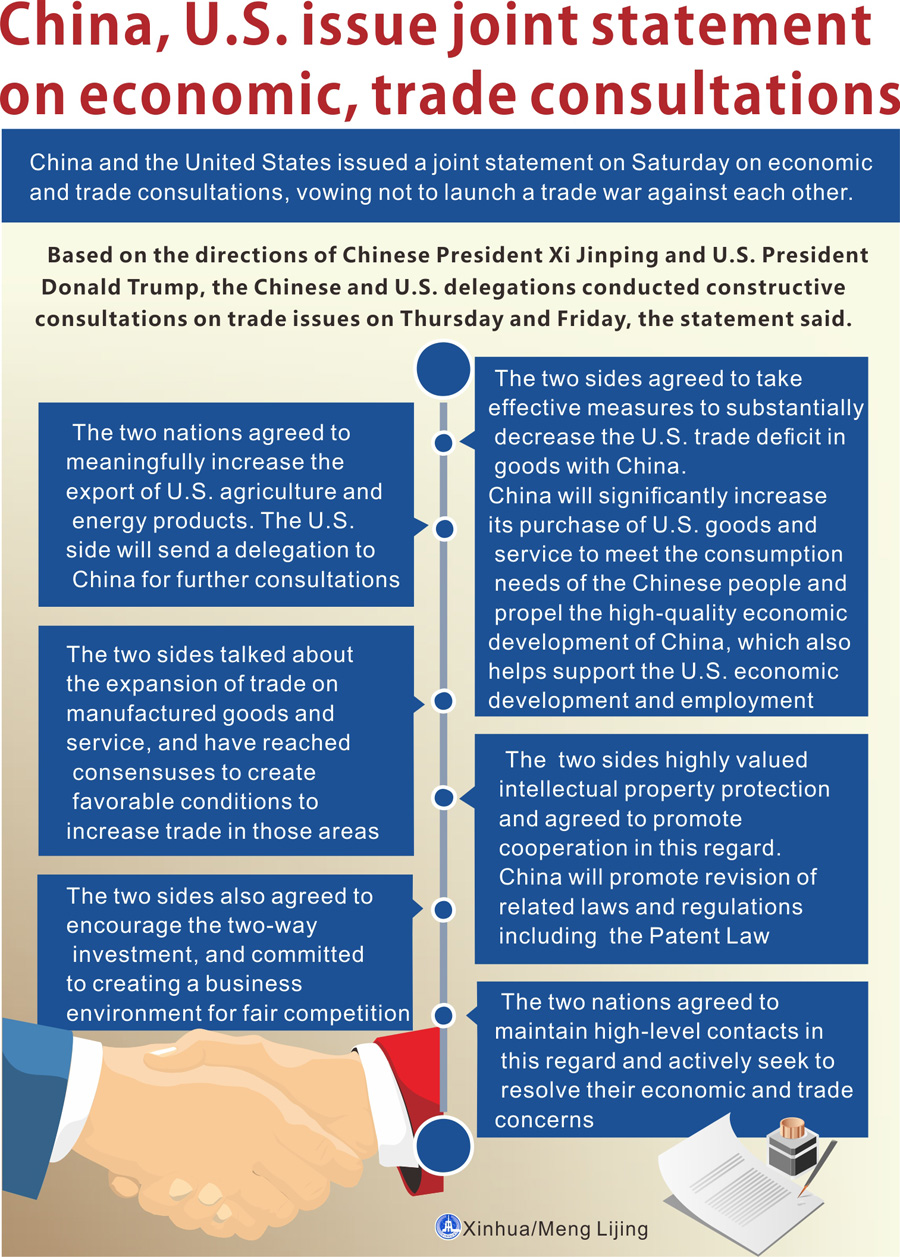

The joint statement says that China would "increase the export of US agriculture and energy products."

"We will be increasing agricultural products anyway. This only means we will get more of them from the US," says Shen, "It's definitely not a loss for China."

Regarding Trump's great concern, the trade deficit, China will "significantly increase its purchases of US goods and services." says Yao Yudong, chief economist at Da Cheng Fund Management, who also considers this a win-win result.

In his opinion, China will for sure become the world's largest economy in the world, no later than 2035. Right now China is a consumption-driven economy. When income increases and consumption upgrades, Chinese people will start purchasing goods from the global community.

Against this background, it is possible that China could have a trade deficit in the future. This could mean a huge bonus for not only the US, but also the global economy's development and employment.

However, Shen also noticed that the joint statement does not touch on some specific but crucial issues in the Sino-US trade disputes, such as China's industrial policy and US's ban on ZTE. A trade war has been averted, but the trade competition still and will exist for a long time in the future.

"We have avoided an imminent trade war in the most urgent time. But the structural issues like technology competition, subsidies, and state-owned enterprise are more profound matters of question in the Sino-US trade relations," Shen explains, "In the mid-long term, we still need to be prepared for possible conflicts with the US - keep deepening opening-up and supply-side reform."

Chen Weidong, general director of the Institute of International Finance, Bank of China Group., also points out that the differences in understanding key issues could also jeopardize Sino-US trade relations. Trump and some media have accused China of technology theft since day one of the trade disputes. "I have done some research and talked to people from joint-ventures. This is simply not the truth," says Chen. This kind of noise will lead to no positive direction.

Qi Bin, vice general manager at China Investment Corp, also sees that China's economy will surpass America. But still China's labor productivity is only one tenth of America's; the US takes up 39 percent of world intellectual property revenues while China takes up less than 1%.

"This determines that competition and cooperation will co-exist in the Sino-US relations for a long time," Qi explains, "We are not afraid of competition even welcome it. We need excellent competitors to improve ourselves. But to create more opportunities and platforms for cooperation will be more constrictive."

The gap between the labor productivity of two countries just mentioned could well be such an opportunity. "But the US would not want to sell its technology to China," says Qi. He points outs that the US has simplified the complex trade issues to the public and made an impossible distinction between "us" and "them" in the increasingly globalized world.

Instead, Qi argues for a new kind of globalization: "If free trade marks globalization 1.0. Then the two-way and cross-border investment is globalization 2.0."

As more consultations and negotiations are on the way, we will see how the new era of globalization unfolds.