|

China Will Be Fine, And So Will China Tech Stocks

Jun. 18, 2019 11:00 AM ET

|

|

About:

,

,

, Includes:

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

Foreign companies, eCommerce, internet, software

(1,541 followers)

Summary

It seems unavoidable for investors to ignore the macro challenges in accessing the investment potential in China-based stocks, including those in the internet sector.

In this week's article, I justify why China will not only survive the drag on the economy from the trade woes but also thrive in the longer term.

Alibaba Group's secondary listing in Hong Kong would send a strong signal to the investor community that Alibaba has options when it comes to financing its growth.

By ALT Perspective

In nearly every Seeking Alpha article that I have come across touching on China-based companies, there has been at least one commentator remarking that investments in such stocks are a no-go until after a resolution on the trade war or, perhaps, never ever. The

that the returns won't be good or could even be negative as China "is going down".

Hence, even as Chinese internet businesses are deemed to be

and shown themselves to be

, it seems unavoidable for investors to ignore the macro challenges in accessing the investment potential in the sector. Nevertheless, it bears noting that before China got embroiled into an apparent war on trade with the U.S. and specifically, the Trump administration, Beijing has already been on a path of a self-inflicted economic slowdown. There are a few factors for this which will be my focus in this week's issue of Chinese Internet Weekly (

)(

), and I will elaborate in the subsequent sections.

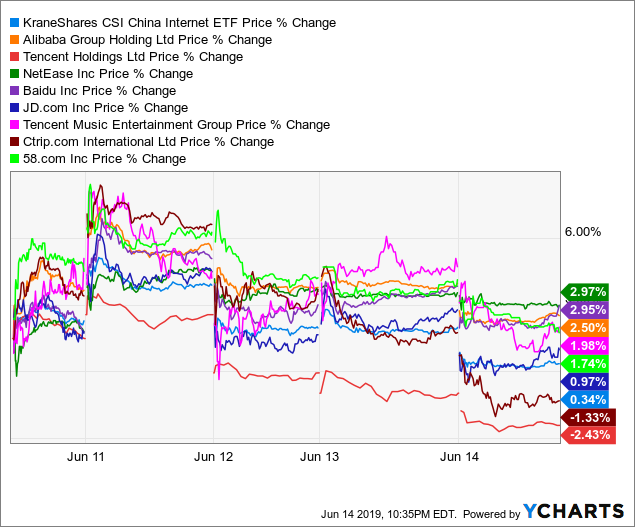

As explained in a

, I find the top constituents of the KraneShares CSI China Internet ETF (

) to be more relevant to the sector. Hence, allow me to provide an overview of the week's share price movements of the top few holdings of KWEB as compared with the ETF itself for convenient references in the subsequent sections.

Data by YCharts

Why China will not just survive but thrive?

Firstly, the anti-corruption campaign that went into full swing as the Chinese President Xi Jinping started his first term,

among the thousands of officials and even businessmen who got their riches from unlawful means. While some observers deemed the campaign as a guise for President Xi to consolidate his power, it is undeniable that regardless of the true intention of the exercise, luxury goods and services saw a huge decline in consumption.

Secondly, the

took out a lot of liquidity from the economy. Incidentally, China’s top banking regulator said Thursday in Shanghai that

by a net RMB13.74 trillion ($1.98 trillion) following more than two years of intervention. Speculative activities in real estate and risky ventures were severely curtailed.

While the intention was good, unfortunately, legitimate private firms also found themselves starved of capital as the large banks, typically state-owned, tended to entertain loans from fellow state-owned enterprises and ignore the smaller non-public ones. This, coupled with the deleveraging exercise to reduce the debt level in the country, inevitably caused a drag on the economic activity.

Thirdly, those who are frequent travelers to China should notice that 'blue skies' days are getting more prevalent, instead of just near and during major events. The positive outcome is a result of years of

where the authorities took serious actions on violators and enforced a 'comply or close' regime on offending factories. When businesses have to stop their operations to perform upgrading or forced to shut, the economy is bound to suffer the consequence.

Fourthly, besides the environment that concerned the government, a series of

heightened awareness among the authorities that the lax supervision in the past cannot be tolerated any longer. Such incidents were getting blown up (no pun intended) due to the wide usage of social media in recent years.

Again, business owners have to decide whether to invest in capital expenditures to upgrade their safety equipment or shut down altogether. Given that there must be numerous facilities that are small scale or aging, it wouldn't make sense to pour more money into compliance, they have to be closed. Consider the cumulative effect from such closures and no doubt the nation's economy is negatively impacted.

Lastly, the authorities are not oblivion to the oft-mentioned 'ghost cities' that the western media delight in featuring every now and then. It can be argued that the provincial governments are apparently still liberal in leasing out land to developers to augment their coffers. Nevertheless, it is undeniable that the policymakers in Beijing are intent on restricting speculations on property, and things could have been worse if they had not even attempted to rein in the undesirable practices at all. The third year of the

, particularly in larger cities like Shanghai.

There are probably more factors that better-informed readers are aware of (please let us know in the comments section). The point is that China can always relax on one or more of these self-imposed measures to counter the deleterious effect from the tariffs and punitive actions from the U.S. such as the 'Huawei ban'. With Chinese stocks at depressed levels and key names like Alibaba Group (

)

, a change in sentiment to the positive could provide the springboard for a strong rebound in valuation.