The world isn't ready for the next financial crisis

Illustration: Sarah Grillo/Axios

Ten years ago, hubristic Wall Street geniuses came

this close to destroying the global economy, saved largely by the Fed feeding trillions of dollars into banks in the U.S. and around the world.

Why it matters: This time, unlike in 2008 and 2009, it may be that no one comes to the rescue, given new U.S.-China tensions, frayed trans-Atlantic relations, and Trump Administration hostility to multi-lateral actions.

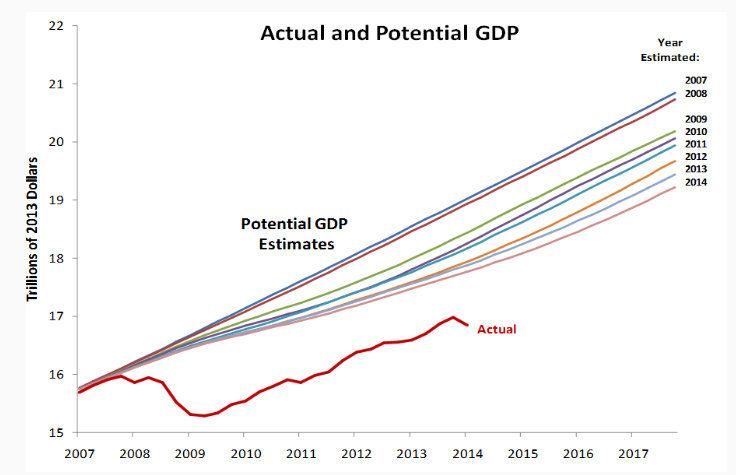

The 2008 financial crisis is not really over: Even as

made history today, the crash continues to reverberate in the form of still-recovering economies and massive global distrust in institutions.

- The memory and residue of the crash are primary reasons why economists and policymakers are on the lookout for the next big financial crisis.

- If a new crisis is brewing, it's in emerging markets, says Adam Tooze, a Columbia university professor and author of , a history of the 2008 financial crisis. Emerging economy stock markets are already down about 10% this year in aggregate.

The background: The financial crisis was triggered by U.S. mortgage defaults, which exposed the folly of trillions of dollars in exotic financial instruments packaged, sold and resold to investors and banks around the world. But even banks with no mortgage exposure ended up in trouble when global interbank lending dried up.

- What makes the story chilling and gives it continued relevance is the degree to which global banking was and continues to be hugely intermeshed — and how it relies to even a greater degree on the U.S. and the dollar.

I caught up with Tooze by phone on his U.K. book tour. The new problem is China, which just by 2015 had borrowed $1.7 trillion in foreign currency, mostly in dollars, to finance its investments.

Tooze called China "the hub of a complex of emerging market economies," with connected manufacturing and other supply lines, commodity and product sales, and countless other businesses relying on the yuan.

- A big danger is movements in the yuan, he said. "One of the nightmares is that China would allow its currency to move dramatically and bring down all of the emerging markets," he said.

- Emerging market economies, he said, do not have the same cash reserves as China to tide them through a devaluation crisis, he said.

- Already, the yuan has devalued by about 10% against the dollar this year. "We are probably testing the limits and the world is watching anxiously," he said.