I'm new here. But I think that everyone should take a wait and see approach. Trump has been in the office for a year and a half now and it is clear that his negotiation tactics are to start off by demanding to the til, and threatening the end of the world, then going back to a more reasonable position where he gained something more than he would've if he had asked politely. It's probably a lot more important to just wait and see the outcome rather than jumping to conclusions. Take North Korea for example, Trump acted like he was ready to nuke Pyongyang, but in the end, he became buddies with Kim Jong Un which is unthinkable with any other recent US president.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Trade War with China

- Thread starter Ultra

- Start date

- Status

- Not open for further replies.

Jura The idiot

General

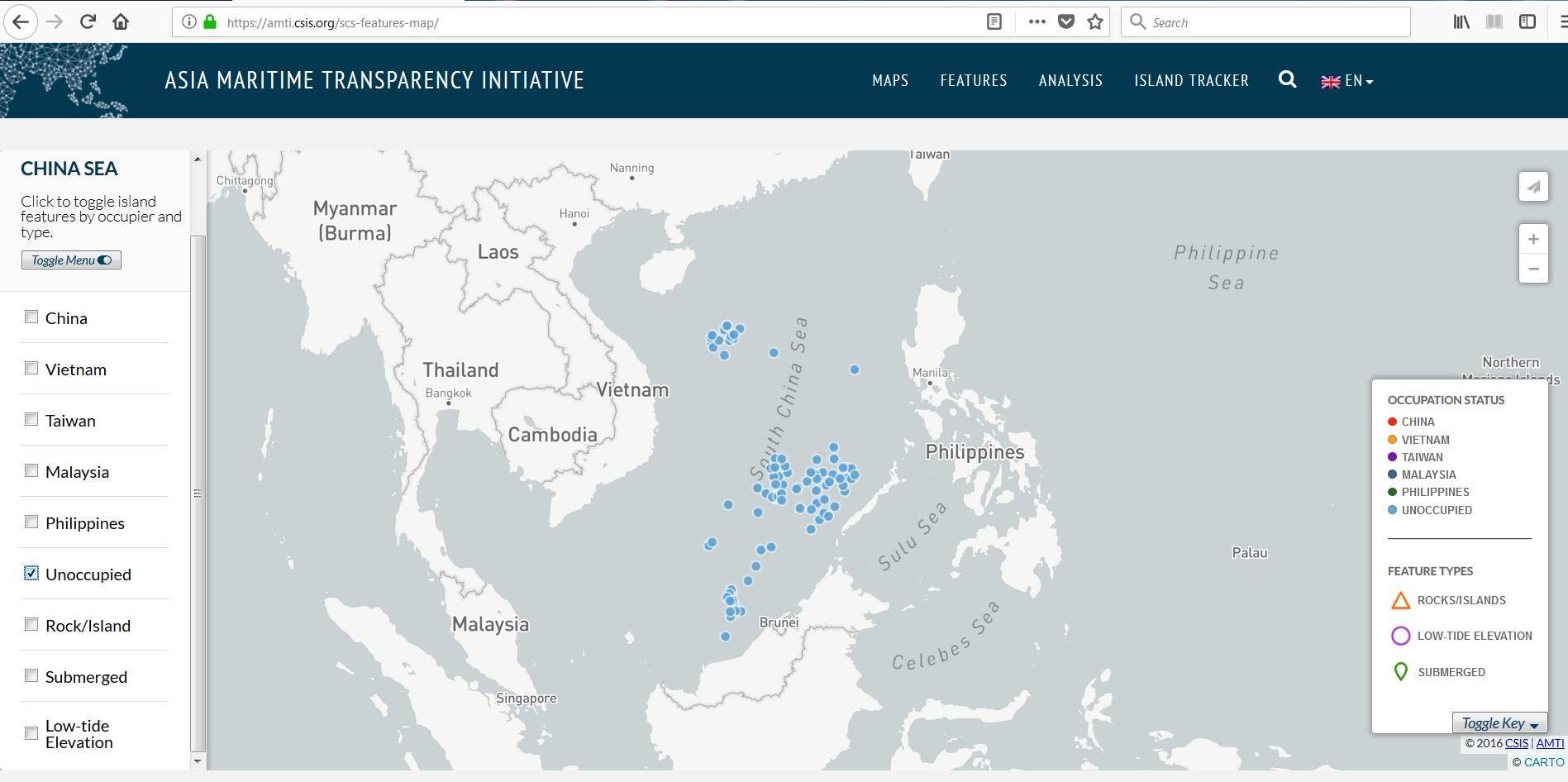

Yeah Vietnam seized 22 island and phillipine at least 10 island

thanks, led me togoogle image search for "south china sea country control islands"

where one may count

LOL then realized I had been to that site

Oct 29, 2017

now I noticed in Twitter an interesting link for those who like maps:

you can select what claim(s) specifically you want to see for example this 'dense' area:

Jura The idiot

General

now I read

MOFCOM: US unpredictability means China needs to respond in a strong manner

2018-06-21 13:23 GMT+8

MOFCOM: US unpredictability means China needs to respond in a strong manner

2018-06-21 13:23 GMT+8

China has had to respond in a strong manner as the United States is being unpredictable and challenging, and initiated the trade war, spokesman for the Chinese Ministry of Commerce Gao Feng said on Thursday.

The previous trade negotiations with the US were positive and constructive, they served the interests of the peoples from both sides, accorded with the established rhythm of China's reform and opening up, as well as the rules of WTO, Gao said, however, the US constantly changes its attitude and waged the trade war, US unilateralism will ultimately damage the interests of its own workers and farmers.

The US is used to negotiating with a stick in hands, but that's not going to work with China, this irrational act is not beneficial to fixing problems, Gao said.

plawolf

Lieutenant General

Just to illustrate the interconnected nature of the modern market, German carmaker Daimler (owns Mercedes-Benz) has just issued a profit warning based on the expected impact of Chinese tarrifs on imported US cars (Daimler makes most of its SUVs in the US).

Expect more warnings like this to follow as companies start to forecast the costs of this trade war for them.

Expect more warnings like this to follow as companies start to forecast the costs of this trade war for them.

Just to illustrate the interconnected nature of the modern market, German carmaker Daimler (owns Mercedes-Benz) has just issued a profit warning based on the expected impact of Chinese tarrifs on imported US cars (Daimler makes most of its SUVs in the US).

Expect more warnings like this to follow as companies start to forecast the costs of this trade war for them.

Or status-craving Chinese will find Mercedes and other brands hit by tariffs even more attractive! I hope they have moved on beyond that mentality and perhaps patriotism will override that given this wouldn't be the result of normal trade but a trade war.

Hendrik_2000

Lieutenant General

Good op/ed by China daily in line what I have said Let face all those assembly line job like making toaster, small engine and AC are not going to come back to US . The wage is just too high for those jobs making it too costly product. But other investment might replace it but with the new restriction on investment who want to built plant in US. And they rightly diagnose the cause of the problem in US economy

The travails of the US economy have been the result of the costly wars the US has pursued and the damage done by the greed and dubious practices exposed by the subprime crisis.

Protectionism symptom of paranoid delusions: China Daily editorial

chinadaily.com.cn | Updated: 2018-06-21 21:02

Luo Jie/China Daily

Having fallen prey to the manipulative maneuvers of the Donald Trump administration in its bid to present the United States as a victim of unfair trade practices, Chinese investment in the US declined significantly in the first five months of this year compared with the same period last year.

According to a report released on Tuesday by Rhodium Group, a research company that tracks Chinese foreign investment, it dropped by 92 percent to only $1.8 billion, its lowest level in seven years.

While Beijing tightened its oversight over outbound investment last year, it is the Trump administration's blitzkrieg on China’s trade and enterprises that is to blame for the decline in Chinese investment, since, overall, China's outbound investment in the first five months increased by 38.5 percent year-on-year, to reach $47.89 billion.

In the same way that it is prone to evoking "fair trade" as a justification for its protectionist tariffs, allegations of "national security risks" have become the go-to excuse for the Trump administration to scuttle acquisitions in the US by Chinese companies. Alibaba's Ant Financial’s $1.2 billion bid to take over MoneyGram and HNA Group's bid for Skybridge Capital, a hedge fund, were both derailed earlier this year due to regulatory vetoes by the Committee on Foreign Investment in the United States. And new legislation is in the works that will raise the regulatory hurdles still higher by expanding the scope of CFIUS scrutiny.

The approach that the US is taking is self-defeating. The woes the administration is inflicting on Chinese companies do not simply translate into boons for US enterprises and the US economy. The trade relationship between China and the US supports millions of jobs in the US, including those that Chinese companies have created directly through their US investments.

The fast-shrinking Chinese investment in the US reflects the damage being done to China-US trade relations — long considered the cornerstone of bilateral ties — by the trade crusade of Trump and his trade hawks.

Their desire to acquire is perhaps understandable, having promised so much, and giving the evangelical zeal they have for US ascendancy. However, times have changed, and what they are doing now is folly given the global value chains that were primarily forged by the US for its advantage.

The travails of the US economy have been the result of the costly wars the US has pursued and the damage done by the greed and dubious practices exposed by the subprime crisis.

The Rhodium report said that the new tariffs might incentivize Chinese manufacturers to localize production in the US to ‘"hop the tariff wall". But if Trump and his hawkish advisers were to look beyond the walls of their ideological fortress, they would realize the tariffs are not necessary as the US is not being besieged.

The travails of the US economy have been the result of the costly wars the US has pursued and the damage done by the greed and dubious practices exposed by the subprime crisis.

Protectionism symptom of paranoid delusions: China Daily editorial

chinadaily.com.cn | Updated: 2018-06-21 21:02

Luo Jie/China Daily

Having fallen prey to the manipulative maneuvers of the Donald Trump administration in its bid to present the United States as a victim of unfair trade practices, Chinese investment in the US declined significantly in the first five months of this year compared with the same period last year.

According to a report released on Tuesday by Rhodium Group, a research company that tracks Chinese foreign investment, it dropped by 92 percent to only $1.8 billion, its lowest level in seven years.

While Beijing tightened its oversight over outbound investment last year, it is the Trump administration's blitzkrieg on China’s trade and enterprises that is to blame for the decline in Chinese investment, since, overall, China's outbound investment in the first five months increased by 38.5 percent year-on-year, to reach $47.89 billion.

In the same way that it is prone to evoking "fair trade" as a justification for its protectionist tariffs, allegations of "national security risks" have become the go-to excuse for the Trump administration to scuttle acquisitions in the US by Chinese companies. Alibaba's Ant Financial’s $1.2 billion bid to take over MoneyGram and HNA Group's bid for Skybridge Capital, a hedge fund, were both derailed earlier this year due to regulatory vetoes by the Committee on Foreign Investment in the United States. And new legislation is in the works that will raise the regulatory hurdles still higher by expanding the scope of CFIUS scrutiny.

The approach that the US is taking is self-defeating. The woes the administration is inflicting on Chinese companies do not simply translate into boons for US enterprises and the US economy. The trade relationship between China and the US supports millions of jobs in the US, including those that Chinese companies have created directly through their US investments.

The fast-shrinking Chinese investment in the US reflects the damage being done to China-US trade relations — long considered the cornerstone of bilateral ties — by the trade crusade of Trump and his trade hawks.

Their desire to acquire is perhaps understandable, having promised so much, and giving the evangelical zeal they have for US ascendancy. However, times have changed, and what they are doing now is folly given the global value chains that were primarily forged by the US for its advantage.

The travails of the US economy have been the result of the costly wars the US has pursued and the damage done by the greed and dubious practices exposed by the subprime crisis.

The Rhodium report said that the new tariffs might incentivize Chinese manufacturers to localize production in the US to ‘"hop the tariff wall". But if Trump and his hawkish advisers were to look beyond the walls of their ideological fortress, they would realize the tariffs are not necessary as the US is not being besieged.

Hendrik_2000

Lieutenant General

Another Chinese investment plan in US bite the dust

China Energy Executives Cancel West Virginia Trip Amid Trade Dispute

June 20, 2018, at 7:34 p.m.

China Energy Executives Cancel West Virginia Trip Amid Trade Dispute

More

BY DIANE BARTZ AND Valerie Volcovici

WASHINGTON (Reuters) - A scheduled trip to West Virginia by executives from China Energy Investment Corp to discuss a planned $83.7 billion investment in the state has been canceled, the latest victim of a growing trade war between the United States and China.

The investment by China Energy, which ranks among the world's largest power companies by asset value, was the biggest among a slew of deals signed during U.S. President Donald Trump's state visit to Beijing in November. The total value of the deals could be as much as $250 billion.

Brian Anderson, director of the West Virginia University Energy Institute, told Reuters on Wednesday the executives were due to arrive in West Virginia last weekend to discuss where to invest in shale gas, power and petrochemical projects.

"The original plan was for the CEO of China Energy and a delegation to arrive over this past weekend and be here in West Virginia with our state officials and others," said Anderson.

"But that visit was canceled because it would be inappropriate in the midst of this trade dispute for China to come," he said.

China Energy could not immediately be reached for comment.

Among planned stopovers by the delegation was an appearance at the Northeast U.S. Petrochemical Construction Conference in Pittsburgh on Tuesday.

The gas and power agreement signed as part of Trump's Beijing visit marked the first overseas investment for newly founded China Energy, which formed from a merger of China Shenhua Group [SHGRP.UL], the country's largest coal producer and China Guodian Corp [CNGUO.UL], one of its top five utilities.

The Trump administration announced $50 million in tariffs on Chinese goods last week. In return, China retaliated with tariffs on U.S. exports and threatened to impose more duties on U.S. energy exports.

China's investment would be a game changer for West Virginia, which had an annual Gross State Product of less than $83 billion last year.

West Virginia Governor Jim Justice, a Trump ally, has said the investment deal would boost his economically ailing state's natural gas and petrochemical industries and create jobs.

Trump made West Virginia and its coal miners a centerpiece of his presidential campaign, promising to create jobs for laid-off miners, revive the coal industry and boost its sagging economy.

Justice declined to comment on whether he was concerned that trade frictions jeopardized the China Energy investment, but Anderson said the governor had been in regular contact with Trump.

Among the investments under consideration is an Appalachian Storage and Trading Hub for hydrocarbons, such as ethane and butane, as well as two power plants in the state.

West Virginia's Chamber of Commerce and coal association are watching Washington-Beijing developments with concern.

Mark Drennan, a Republican senator in the West Virginia state legislature, said the promised investment was likely being used by China to gain leverage in the trade dispute.

"They’ve spent a lot of time and effort in West Virginia," he said of China Energy. "I would hope it (the trip) would be rescheduled."

Anderson, who has been coordinating visits from Chinese delegations, said he was optimistic that the trade row would eventually be seen as little more than one of many "speed bumps" along the way of an investment deal that would extend over a 20-year period.

(Reporting by Diane Bartz and Valerie Volcovici; Editing by Chris Sanders and Tom Brown)

China Energy Executives Cancel West Virginia Trip Amid Trade Dispute

June 20, 2018, at 7:34 p.m.

China Energy Executives Cancel West Virginia Trip Amid Trade Dispute

More

BY DIANE BARTZ AND Valerie Volcovici

WASHINGTON (Reuters) - A scheduled trip to West Virginia by executives from China Energy Investment Corp to discuss a planned $83.7 billion investment in the state has been canceled, the latest victim of a growing trade war between the United States and China.

The investment by China Energy, which ranks among the world's largest power companies by asset value, was the biggest among a slew of deals signed during U.S. President Donald Trump's state visit to Beijing in November. The total value of the deals could be as much as $250 billion.

Brian Anderson, director of the West Virginia University Energy Institute, told Reuters on Wednesday the executives were due to arrive in West Virginia last weekend to discuss where to invest in shale gas, power and petrochemical projects.

"The original plan was for the CEO of China Energy and a delegation to arrive over this past weekend and be here in West Virginia with our state officials and others," said Anderson.

"But that visit was canceled because it would be inappropriate in the midst of this trade dispute for China to come," he said.

China Energy could not immediately be reached for comment.

Among planned stopovers by the delegation was an appearance at the Northeast U.S. Petrochemical Construction Conference in Pittsburgh on Tuesday.

The gas and power agreement signed as part of Trump's Beijing visit marked the first overseas investment for newly founded China Energy, which formed from a merger of China Shenhua Group [SHGRP.UL], the country's largest coal producer and China Guodian Corp [CNGUO.UL], one of its top five utilities.

The Trump administration announced $50 million in tariffs on Chinese goods last week. In return, China retaliated with tariffs on U.S. exports and threatened to impose more duties on U.S. energy exports.

China's investment would be a game changer for West Virginia, which had an annual Gross State Product of less than $83 billion last year.

West Virginia Governor Jim Justice, a Trump ally, has said the investment deal would boost his economically ailing state's natural gas and petrochemical industries and create jobs.

Trump made West Virginia and its coal miners a centerpiece of his presidential campaign, promising to create jobs for laid-off miners, revive the coal industry and boost its sagging economy.

Justice declined to comment on whether he was concerned that trade frictions jeopardized the China Energy investment, but Anderson said the governor had been in regular contact with Trump.

Among the investments under consideration is an Appalachian Storage and Trading Hub for hydrocarbons, such as ethane and butane, as well as two power plants in the state.

West Virginia's Chamber of Commerce and coal association are watching Washington-Beijing developments with concern.

Mark Drennan, a Republican senator in the West Virginia state legislature, said the promised investment was likely being used by China to gain leverage in the trade dispute.

"They’ve spent a lot of time and effort in West Virginia," he said of China Energy. "I would hope it (the trip) would be rescheduled."

Anderson, who has been coordinating visits from Chinese delegations, said he was optimistic that the trade row would eventually be seen as little more than one of many "speed bumps" along the way of an investment deal that would extend over a 20-year period.

(Reporting by Diane Bartz and Valerie Volcovici; Editing by Chris Sanders and Tom Brown)

Good op/ed by China daily in line what I have said Let face all those assembly line job like making toaster, small engine and AC are not going to come back to US . The wage is just too high for those jobs making it too costly product. But other investment might replace it but with the new restriction on investment who want to built plant in US. And they rightly diagnose the cause of the problem in US economy

The travails of the US economy have been the result of the costly wars the US has pursued and the damage done by the greed and dubious practices exposed by the subprime crisis.

Protectionism symptom of paranoid delusions: China Daily editorial

chinadaily.com.cn | Updated: 2018-06-21 21:02

Luo Jie/China Daily

Having fallen prey to the manipulative maneuvers of the Donald Trump administration in its bid to present the United States as a victim of unfair trade practices, Chinese investment in the US declined significantly in the first five months of this year compared with the same period last year.

According to a report released on Tuesday by Rhodium Group, a research company that tracks Chinese foreign investment, it dropped by 92 percent to only $1.8 billion, its lowest level in seven years.

While Beijing tightened its oversight over outbound investment last year, it is the Trump administration's blitzkrieg on China’s trade and enterprises that is to blame for the decline in Chinese investment, since, overall, China's outbound investment in the first five months increased by 38.5 percent year-on-year, to reach $47.89 billion.

In the same way that it is prone to evoking "fair trade" as a justification for its protectionist tariffs, allegations of "national security risks" have become the go-to excuse for the Trump administration to scuttle acquisitions in the US by Chinese companies. Alibaba's Ant Financial’s $1.2 billion bid to take over MoneyGram and HNA Group's bid for Skybridge Capital, a hedge fund, were both derailed earlier this year due to regulatory vetoes by the Committee on Foreign Investment in the United States. And new legislation is in the works that will raise the regulatory hurdles still higher by expanding the scope of CFIUS scrutiny.

The approach that the US is taking is self-defeating. The woes the administration is inflicting on Chinese companies do not simply translate into boons for US enterprises and the US economy. The trade relationship between China and the US supports millions of jobs in the US, including those that Chinese companies have created directly through their US investments.

The fast-shrinking Chinese investment in the US reflects the damage being done to China-US trade relations — long considered the cornerstone of bilateral ties — by the trade crusade of Trump and his trade hawks.

Their desire to acquire is perhaps understandable, having promised so much, and giving the evangelical zeal they have for US ascendancy. However, times have changed, and what they are doing now is folly given the global value chains that were primarily forged by the US for its advantage.

The travails of the US economy have been the result of the costly wars the US has pursued and the damage done by the greed and dubious practices exposed by the subprime crisis.

The Rhodium report said that the new tariffs might incentivize Chinese manufacturers to localize production in the US to ‘"hop the tariff wall". But if Trump and his hawkish advisers were to look beyond the walls of their ideological fortress, they would realize the tariffs are not necessary as the US is not being besieged.

In addition to the problems mentioned above the US (same as a lot of other countries) has been both unwilling and unable to address the inequalities and the culture of greed within the country as side effects of globalization so some such as the Trump administration are pointing fingers at external factors, throwing the baby out with the bathwater based on superficial symptoms, and still leaving the real problems unattended (if not actually being a manifestation of the problem themselves).

Jura The idiot

General

now I read

Analysis: Trump’s blackmail and China’s precision counterattack

2018-06-21 22:05 GMT+8

Analysis: Trump’s blackmail and China’s precision counterattack

2018-06-21 22:05 GMT+8

The gathering storm over the Pacific Ocean has become an increasingly severe concern for all participants of the global economy.

The Trump Administration, moving to ramp up pressure on China to make trade concessions, threatened to impose tariffs on an additional 200 billion US dollars' worth of Chinese imports and to double that amount if Beijing retaliates with countermeasures.

The announcement came after the White House detailed plans to slap a 25-percent tariff on 50 billion US dollars in goods imported from China, most of which will take effect on July 6.

The world's two largest economies are heading inexorably toward a trade war, which sparked widespread fears worldwide of the possibly damaging ripple effects. Stocks plunged overnight on both sides of the Pacific. People are now speculating on what Beijing’s response might be-and the possible result of this epic contest.

China’s Precision Counterattack: Quantitative and Qualitative

China reacted swiftly and clearly. Gao Feng, spokesman for the Ministry of Commerce, said that preparing additional tariffs worth 200 billion US dollars on the country’s exports to the US was tantamount to “extreme pressure and blackmail.”

In particular, at the ministry’s regular press conference on June 21, Gao further pointed out that if the US introduces a so-called “taxation list” to distort and undermine the fair order of international trade, China is well prepared to take necessary measures to make a strong response, including both “quantitative” and “qualitative” approaches. After all, China is always firm in upholding the interests of the nation and its people.

In this regard, the “quantitative” approach refers to homomorphic counterattacks against Trump's America with tariffs and other tools. The “quantitative” approach, as a common practice, often responds to (threats of) a trade war waged by other states proportionately and synchronously.

However, when faced with the reality of the China-US trade balance (China exported goods of 506 billion dollars while it imported 130 billion dollars from the US in 2017), it is impractical for China to impose tariffs on an additional 200 billion US dollars in American imports proportionately.

As a result, targeting large and politically influential American industries and companies with huge investments in China is a feasible scheme. This is the principle behind the “qualitative” approach, or namely, the “Precision Strike” in international trade conflicts.

The dynamics undergirding China’s aforementioned practice is the “pressure conductivity,” which starts from US companies in China, to their headquarters in America, then their active lobbies and affiliated associations, and finally to Capitol Hill and the White House.

As such, China may force the Trump Administration to withdraw and reach an accommodation through practicing the art of “asymmetric warfare” on trade.

Trump cannot save the 'American Patient' by compelling the world to take pills

Reviewing the Sino-US economic and trade disputes during the past months, China has always made every effort in maintaining the overall situation of the bilateral ties and especially trade relations, and promoted the consultation in an active, positive and pragmatic manner.

Thus, the two parties once achieved agreements and formulated a clear consultation roadmap and timetable. For example, based on the consensus reached in Washington on May 19, the two sides conducted specific consultations in Beijing in the fields of agriculture and energy in early June, which were generally welcomed by both sides.

They also agreed to conduct specific consultations on the manufacturing and service industries in the near future. China sincerely believes that the previous consultations between them are positive, constructive, and in the interests of the people of both sides.

However, now it is deeply regrettable that the US has been exceptionally capricious and has intensified its efforts to provoke a trade war. Under the circumstances, China has to make a strong response. The US is accustomed to holding big sticks to negotiate, but this does not apply to China. This irrational behavior is not conducive to solving any problems.

After all, the substantial problem of the US economy is rooted in its own domestic political, economic and social institutions, rather than the current system of international trade.

In fact, as the largest economy in the world with vested interests, America has drawn resources from every corner of the world since the end of WWII and the establishment of the contemporary political-economic order, through various approaches either legal or illegal, reasonable or unreasonable, “civilized” or seemingly legitimately predatory.

- Status

- Not open for further replies.