You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Pakistan Military News, Reports, Data, etc.

- Thread starter A.Man

- Start date

Equation

Lieutenant General

Do you know how many warheads can be packed inside Pakistan MIRV missile?

timepass

Brigadier

Karachi Shipyards to Spend $30 Million On a Syncrolift System

Pakistan’s Karachi Shipyards & Engineering Works (KSEW) has signed an agreement with Norwegian ship design and building firm, TTS Group. The US $29.8 million deal is for the implementation of infrastructure modernization in the form of a 9,000 ton Syncrolift, ship lift and transfer system.

In an official press release, TTS Group has confirmed that the design and development work will be carried out in Norway while the manufacturing will take place in China and Europe. KSEW is set to receive the system during the first half of 2019.

The Ship Lift & Transfer System

Syncrolift is a system which enables shipbuilders to lift ships from sea level to land level. TTS Group’s “advanced hydraulic transfer trollies” will move ships onto and from repair and production sites on land.

Compared to dry docks, the Syncrolift enabled sites can handle as many as 10 ships, in turn increasing efficiency and volume compared to shipyards using standard drydocks. The Syncrolift for KSEW will be able to lift ships weighing up to 9,000 tons.

Pakistan’s Ministry of Defence (MoD) set up the acquisition of a lift and transfer system as a priority for KSEW in 2017.

The Syncrolift system will be used to lift ships from sea to land, but unlike a drydock system which is fixed, a connected to a rail-linked network would place ships onto one of the 13 in-land workstations using 30 winches (motorized trollies). Pakistan will also get a transfer-of-technology agreement which will enable after-sale maintenance to be managed locally.

The rail transfer system will then move ships from the workstations to the ship-lift system and lay them at sea.

Syncrolift is registered trademark of TTL Group and is a complete system which comprises of a ship elevator, trollies and the rail-transfer system. The company already holds 70 percent of the market share. TTL Group claims its ship lifting system is faster than competitors and will improve further with its new FastDocking products.

Impact on Pakistan

MoD states that “[the acquisition will] increase business capacity and efficiency of ship turnover by three times.” The system will enable KSEW to improve with regards to its commercial aspects, especially in the ship repair market. The upgrade for KSEW will also allow full support to “all present and future national maritime and defence objectives.”

It is also expected that the system will enable domestic construction and launching of submarines “for the first time”.

KSEW was previously tasked to assembled maritime vessels, like the MILGEM corvette. Modernization to its infrastructure, like the Syncrolift acquisition, will enable it to complete its current projects and undertake future projects. This will, in turn, be helpful for Pakistan Navy which will be able to modernize its fleet at reduced costs through local manufacturing facilities and raw material.

Pak Navy’s next generation submarine program – the Hangor class submarines – is considered to be the trigger behind this venture. KSEW will be managing 4 out of the total 8 submarines. The steel-cutting (inauguration) of the first Hangor-class submarine, built by the KSEW, is scheduled for October 2020 while the remaining are to be in the hands of Pakistan Navy by 2028.

Future Propositions for KSEW & Pak Navy

While the construction work will be carried out locally, the KSEW will still import steel, mechanical and other critical components from other countries. However, it is sure to push Maritime Technologies Complex (MTC) to start on in-house ship design and development programs. In the long run, this could enable MTC to take on the role of a contractor like STM or CSOC by developing original designs and then acquire components from manufacturers.

On the other hand, KSEW’s modernization could enable foreign designers to pitch custom solutions to Pakistan Navy. In short, it could help reduce overall costs for the naval forces.

Pakistan’s Karachi Shipyards & Engineering Works (KSEW) has signed an agreement with Norwegian ship design and building firm, TTS Group. The US $29.8 million deal is for the implementation of infrastructure modernization in the form of a 9,000 ton Syncrolift, ship lift and transfer system.

In an official press release, TTS Group has confirmed that the design and development work will be carried out in Norway while the manufacturing will take place in China and Europe. KSEW is set to receive the system during the first half of 2019.

The Ship Lift & Transfer System

Syncrolift is a system which enables shipbuilders to lift ships from sea level to land level. TTS Group’s “advanced hydraulic transfer trollies” will move ships onto and from repair and production sites on land.

Compared to dry docks, the Syncrolift enabled sites can handle as many as 10 ships, in turn increasing efficiency and volume compared to shipyards using standard drydocks. The Syncrolift for KSEW will be able to lift ships weighing up to 9,000 tons.

Pakistan’s Ministry of Defence (MoD) set up the acquisition of a lift and transfer system as a priority for KSEW in 2017.

The Syncrolift system will be used to lift ships from sea to land, but unlike a drydock system which is fixed, a connected to a rail-linked network would place ships onto one of the 13 in-land workstations using 30 winches (motorized trollies). Pakistan will also get a transfer-of-technology agreement which will enable after-sale maintenance to be managed locally.

The rail transfer system will then move ships from the workstations to the ship-lift system and lay them at sea.

Syncrolift is registered trademark of TTL Group and is a complete system which comprises of a ship elevator, trollies and the rail-transfer system. The company already holds 70 percent of the market share. TTL Group claims its ship lifting system is faster than competitors and will improve further with its new FastDocking products.

Impact on Pakistan

MoD states that “[the acquisition will] increase business capacity and efficiency of ship turnover by three times.” The system will enable KSEW to improve with regards to its commercial aspects, especially in the ship repair market. The upgrade for KSEW will also allow full support to “all present and future national maritime and defence objectives.”

It is also expected that the system will enable domestic construction and launching of submarines “for the first time”.

KSEW was previously tasked to assembled maritime vessels, like the MILGEM corvette. Modernization to its infrastructure, like the Syncrolift acquisition, will enable it to complete its current projects and undertake future projects. This will, in turn, be helpful for Pakistan Navy which will be able to modernize its fleet at reduced costs through local manufacturing facilities and raw material.

Pak Navy’s next generation submarine program – the Hangor class submarines – is considered to be the trigger behind this venture. KSEW will be managing 4 out of the total 8 submarines. The steel-cutting (inauguration) of the first Hangor-class submarine, built by the KSEW, is scheduled for October 2020 while the remaining are to be in the hands of Pakistan Navy by 2028.

Future Propositions for KSEW & Pak Navy

While the construction work will be carried out locally, the KSEW will still import steel, mechanical and other critical components from other countries. However, it is sure to push Maritime Technologies Complex (MTC) to start on in-house ship design and development programs. In the long run, this could enable MTC to take on the role of a contractor like STM or CSOC by developing original designs and then acquire components from manufacturers.

On the other hand, KSEW’s modernization could enable foreign designers to pitch custom solutions to Pakistan Navy. In short, it could help reduce overall costs for the naval forces.

timepass

Brigadier

HENSOLDT: EUROPE’S NEW BUT ALSO EXPERIENCED DEFENCE ELECTRONICS VENDOR

The newly formed German defence electronics vendor Hensoldt is on the verge of acquiring British radar company Kelvin Hughes from ECI Partners, Kelvin Hughes’ parent firm. Subject to London’s anti-trust and regulatory approval, Hensoldt aims to close the acquisition by Q3 2017.

Known for supplying maritime radars to the Royal Navy and overseas customers, Kelvin Hughes comprises of 200 employees and maintains annual revenues of $34 million U.S.

If successful, this would be Hensoldt’s second corporate acquisition since its emergence in March. In May, Hensoldt acquired Euroavionics GmbH, a supplier of avionics for civilian aircraft applications.

Hensoldt is the result of private equity group KKR buying spun-off two Airbus Defence and Space (DS) divisions: Electronics and Border Security GmbH and Airbus DS Optronics GmbH. Consequently, Hensoldt inherited Airbus DS’ strong defence electronics portfolio, which comprised of radars, communications equipment, electronic warfare (EW) systems and electro-optical and infrared tracking (EO/IR) equipment, among other assets.

Organizationally, Hensoldt is two business clusters: Hensoldt Sensors GmbH, which will market Airbus DS’ sensor and EW systems, and Hensoldt Optronics GmbH, which will continue selling Airbus DS’ EO systems, such as optronic masts and EO/IR turrets. Hensoldt has 4,000 employees based in Europe, South Africa and, potentially, the United Kingdom, with annual revenue potential of over $1 billion.

Hensoldt’s acquisition behaviour to-date highlights the company’s drive to become a new major sensor and defence electronics supplier. Today, Thales is the incumbent supplier of radars to both NATO and non-NATO markets, with Saab and Leonardo as strong competitors.

Despite its expansiveness, Airbus DS did not emerge as a markedly notable contender in the electronics space. In fact, its former acquisition from South Africa – i.e. Airbus DS Optronics – did not add to the space of helmet mounted display and sight (HMD/S) systems, an area South Africa had helped pioneer.

In contrast, Hensoldt is a specialist electronics vendor; thus, its growth is contingent on its ability to sell and develop electronics. Hensoldt Optronics South Africa (HOSA) will the mainstay of optronics work for the Hensoldt, which includes HMD/S solutions, EO/IR turrets (such as the Argos II and Goshawk II), laser rangefinders and thermal imagers. HOSA is also the source of optronic masts and periscopes for submarines, a key business area for the company.

In radars and EW, Hensoldt will seek to cast a dent to Thales’ near and long-term big-ticket prospects, but it will cast a broad net and address smaller markets. In his regarding the purchase of Kelvin Hughes, Hensoldt CEO Thomas Müller stated: “The Kelvin Hughes product portfolio will allow us to enter more price-sensitive markets and … bring us one step closer towards our strategic objective to develop our Sensor House into a Sensor Solutions provider.”

Granted, “price-sensitive markets” can also include NATO markets, but with many militaries in Asia, the Middle East and North Africa seeking to modernize their naval and land-based air defence environments, Hensoldt has considerable opportunity for near-term big-ticket sales.

How is Hensoldt relevant to Pakistan?

Through its acquisition, Hensoldt is both inheriting and consolidating business with Pakistan. In October, Pakistan, via Turkey’s STM, Airbus DS Optronics to supply a SERO 250 periscope and OMS 200 optronic mast for the lead Khalid-class Agosta 90B submarine (of three) . In February, Pakistan Kelvin Hughes’ SharpEye I-band pulse-Doppler radar for the Agosta 90B. The Pakistan Navy also the Kelvin Hughes’ SharpEye radar for its 17,000-ton Navy Fleet Tanker.

If the Kelvin Hughes acquisition succeeds, Hensoldt would acquire the combined share (in value) of Airbus DS Optronics and Kelvin Hughes’ inputs in the Agosta 90B. The SERO 250, OMS 200 and SharpEye would essentially become a Hensoldt package, which Hensoldt can potentially extend to other programs.

For Hensoldt, the Pakistani naval market would have at least three major business opportunities: the next-generation – i.e. – submarine program, the , and the . While Hensoldt’s main incentive is to expand its business activities in pakistan, the Pakistan Navy could continue pursuing Hensoldt with the aim of standardizing its equipment.

The SharpEye radar platform could be integrated onboard Pakistan’s submarines, warships, patrol ships and auxiliary support ships. The SharpEye is a comparatively low-cost system that has already been cleared for sale to Pakistan, where it is to see use aboard on the Khalid-class submarine and Pakistan Navy Fleet Tanker. It would not be surprising if is extended to the MOPV, MILGEM corvette and other ships.

In terms of submarines, the main draw for Pakistan to extend the Khalid-class’ coming subsystems to the Hangor-class would be commonality, which helps scale its training and maintenance infrastructure. For Hensoldt, this would mean sales for the SERO 250, OMS 200 and SharpEye.

For the MILGEM corvettes, Hensoldt could offer the SharpEye along with the TRS-3D and TRS-4D radars, which provide 200 km and 250 km in range, respectively. However, Pakistan’s radar selection will depend on the extent of the MILGEM’s anti-air warfare (AAW) capabilities. If the corvettes lack space for vertical launch system (VLS) cells for medium-range surface-to-air missile (SAM) systems, then the Navy has little utility for long-range radars. Lower-cost radars, such as the Saab Giraffe AMB, may be sought instead.

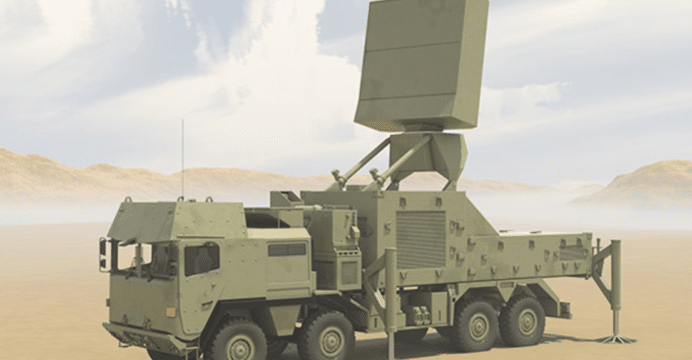

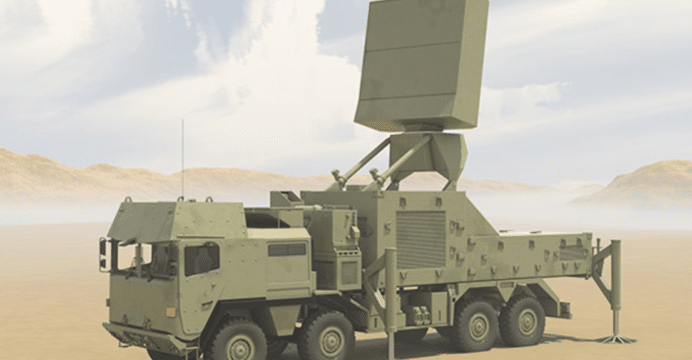

However, Hensoldt’s land-based radars – i.e. TRML-3D/32 and TRML-4D – may interest the Pakistan Air Force (PAF) as potential successors for its Siemens Mobile Pulse-Doppler Radars (MPDR). The MPDRs are the PAF’s mainstay low-level , but in light of modern EW threats such as digital radio frequency memory (DRFM)-based jamming, the MPDRs are diminishing utility. The is a gallium nitride (GaN)-based active electronically-scanned array (AESA) C-Band radar with an instrumented range of 250 km. It can be used as an air surveillance or target acquisition radar. Hensoldt’s competition on the market include the Saab Giraffe 4A, Leonardo Kronos Land and Thales Ground Master 200.

It is not known how Pakistan will supplant the MPDR, but for Hensoldt and the industry, it could be a high-value and long-term avenue. The Saab 2000 Erieye airborne early warning and control (AEW&C) program is an example of the PAF’s executing cornerstone requirements over the long-term (in May it announced that it will to its existing fleet, which it ordered in 2007). Low-level radars are essential for plugging gaps in high-level coverage, which expose vulnerabilities to low-flying aircraft, unmanned aerial vehicles and stand-off range munitions. Readily mobile low-level radars fill these gaps and provide an added dimension of flexibility to the PAF, which can adjust its air defence coverage to the situation by re-deploying its radars.

HOSA’s optronics could also be a factor for the PAF provided HOSA develops a fighter-use HMD/S system for the JF-17 Thunder multi-role fighter. While it had disclosed a general overview of the JF-17 Block-III’s subsystems, the PAF has not provided few details into the specific suppliers it will rely upon to support the Block-III. However, the HMD/S market has few competitors, with Elbit dominating the space on most platforms, leaving Thales and BAE Systems to fulfill the rest. Likewise, HOSA’s EO/IR turrets could interest to the PAF for use on small manned and unmanned aircraft.

Hensoldt’s emergence presents Pakistan with a new potential supplier for its sensor and electronics requirements. The usual fiscal constraints will shape the outcome of deliberations, but there are key, yet untouched, opportunities Hensoldt can pursue within the Pakistani market (e.g. HMD/S). In other realms, such as radars, Hensoldt would broaden the competitive pool, providing Pakistan with additional quality options.

Source: Quwa...

The newly formed German defence electronics vendor Hensoldt is on the verge of acquiring British radar company Kelvin Hughes from ECI Partners, Kelvin Hughes’ parent firm. Subject to London’s anti-trust and regulatory approval, Hensoldt aims to close the acquisition by Q3 2017.

Known for supplying maritime radars to the Royal Navy and overseas customers, Kelvin Hughes comprises of 200 employees and maintains annual revenues of $34 million U.S.

If successful, this would be Hensoldt’s second corporate acquisition since its emergence in March. In May, Hensoldt acquired Euroavionics GmbH, a supplier of avionics for civilian aircraft applications.

Hensoldt is the result of private equity group KKR buying spun-off two Airbus Defence and Space (DS) divisions: Electronics and Border Security GmbH and Airbus DS Optronics GmbH. Consequently, Hensoldt inherited Airbus DS’ strong defence electronics portfolio, which comprised of radars, communications equipment, electronic warfare (EW) systems and electro-optical and infrared tracking (EO/IR) equipment, among other assets.

Organizationally, Hensoldt is two business clusters: Hensoldt Sensors GmbH, which will market Airbus DS’ sensor and EW systems, and Hensoldt Optronics GmbH, which will continue selling Airbus DS’ EO systems, such as optronic masts and EO/IR turrets. Hensoldt has 4,000 employees based in Europe, South Africa and, potentially, the United Kingdom, with annual revenue potential of over $1 billion.

Hensoldt’s acquisition behaviour to-date highlights the company’s drive to become a new major sensor and defence electronics supplier. Today, Thales is the incumbent supplier of radars to both NATO and non-NATO markets, with Saab and Leonardo as strong competitors.

Despite its expansiveness, Airbus DS did not emerge as a markedly notable contender in the electronics space. In fact, its former acquisition from South Africa – i.e. Airbus DS Optronics – did not add to the space of helmet mounted display and sight (HMD/S) systems, an area South Africa had helped pioneer.

In contrast, Hensoldt is a specialist electronics vendor; thus, its growth is contingent on its ability to sell and develop electronics. Hensoldt Optronics South Africa (HOSA) will the mainstay of optronics work for the Hensoldt, which includes HMD/S solutions, EO/IR turrets (such as the Argos II and Goshawk II), laser rangefinders and thermal imagers. HOSA is also the source of optronic masts and periscopes for submarines, a key business area for the company.

In radars and EW, Hensoldt will seek to cast a dent to Thales’ near and long-term big-ticket prospects, but it will cast a broad net and address smaller markets. In his regarding the purchase of Kelvin Hughes, Hensoldt CEO Thomas Müller stated: “The Kelvin Hughes product portfolio will allow us to enter more price-sensitive markets and … bring us one step closer towards our strategic objective to develop our Sensor House into a Sensor Solutions provider.”

Granted, “price-sensitive markets” can also include NATO markets, but with many militaries in Asia, the Middle East and North Africa seeking to modernize their naval and land-based air defence environments, Hensoldt has considerable opportunity for near-term big-ticket sales.

How is Hensoldt relevant to Pakistan?

Through its acquisition, Hensoldt is both inheriting and consolidating business with Pakistan. In October, Pakistan, via Turkey’s STM, Airbus DS Optronics to supply a SERO 250 periscope and OMS 200 optronic mast for the lead Khalid-class Agosta 90B submarine (of three) . In February, Pakistan Kelvin Hughes’ SharpEye I-band pulse-Doppler radar for the Agosta 90B. The Pakistan Navy also the Kelvin Hughes’ SharpEye radar for its 17,000-ton Navy Fleet Tanker.

If the Kelvin Hughes acquisition succeeds, Hensoldt would acquire the combined share (in value) of Airbus DS Optronics and Kelvin Hughes’ inputs in the Agosta 90B. The SERO 250, OMS 200 and SharpEye would essentially become a Hensoldt package, which Hensoldt can potentially extend to other programs.

For Hensoldt, the Pakistani naval market would have at least three major business opportunities: the next-generation – i.e. – submarine program, the , and the . While Hensoldt’s main incentive is to expand its business activities in pakistan, the Pakistan Navy could continue pursuing Hensoldt with the aim of standardizing its equipment.

The SharpEye radar platform could be integrated onboard Pakistan’s submarines, warships, patrol ships and auxiliary support ships. The SharpEye is a comparatively low-cost system that has already been cleared for sale to Pakistan, where it is to see use aboard on the Khalid-class submarine and Pakistan Navy Fleet Tanker. It would not be surprising if is extended to the MOPV, MILGEM corvette and other ships.

In terms of submarines, the main draw for Pakistan to extend the Khalid-class’ coming subsystems to the Hangor-class would be commonality, which helps scale its training and maintenance infrastructure. For Hensoldt, this would mean sales for the SERO 250, OMS 200 and SharpEye.

For the MILGEM corvettes, Hensoldt could offer the SharpEye along with the TRS-3D and TRS-4D radars, which provide 200 km and 250 km in range, respectively. However, Pakistan’s radar selection will depend on the extent of the MILGEM’s anti-air warfare (AAW) capabilities. If the corvettes lack space for vertical launch system (VLS) cells for medium-range surface-to-air missile (SAM) systems, then the Navy has little utility for long-range radars. Lower-cost radars, such as the Saab Giraffe AMB, may be sought instead.

However, Hensoldt’s land-based radars – i.e. TRML-3D/32 and TRML-4D – may interest the Pakistan Air Force (PAF) as potential successors for its Siemens Mobile Pulse-Doppler Radars (MPDR). The MPDRs are the PAF’s mainstay low-level , but in light of modern EW threats such as digital radio frequency memory (DRFM)-based jamming, the MPDRs are diminishing utility. The is a gallium nitride (GaN)-based active electronically-scanned array (AESA) C-Band radar with an instrumented range of 250 km. It can be used as an air surveillance or target acquisition radar. Hensoldt’s competition on the market include the Saab Giraffe 4A, Leonardo Kronos Land and Thales Ground Master 200.

It is not known how Pakistan will supplant the MPDR, but for Hensoldt and the industry, it could be a high-value and long-term avenue. The Saab 2000 Erieye airborne early warning and control (AEW&C) program is an example of the PAF’s executing cornerstone requirements over the long-term (in May it announced that it will to its existing fleet, which it ordered in 2007). Low-level radars are essential for plugging gaps in high-level coverage, which expose vulnerabilities to low-flying aircraft, unmanned aerial vehicles and stand-off range munitions. Readily mobile low-level radars fill these gaps and provide an added dimension of flexibility to the PAF, which can adjust its air defence coverage to the situation by re-deploying its radars.

HOSA’s optronics could also be a factor for the PAF provided HOSA develops a fighter-use HMD/S system for the JF-17 Thunder multi-role fighter. While it had disclosed a general overview of the JF-17 Block-III’s subsystems, the PAF has not provided few details into the specific suppliers it will rely upon to support the Block-III. However, the HMD/S market has few competitors, with Elbit dominating the space on most platforms, leaving Thales and BAE Systems to fulfill the rest. Likewise, HOSA’s EO/IR turrets could interest to the PAF for use on small manned and unmanned aircraft.

Hensoldt’s emergence presents Pakistan with a new potential supplier for its sensor and electronics requirements. The usual fiscal constraints will shape the outcome of deliberations, but there are key, yet untouched, opportunities Hensoldt can pursue within the Pakistani market (e.g. HMD/S). In other realms, such as radars, Hensoldt would broaden the competitive pool, providing Pakistan with additional quality options.

Source: Quwa...

timepass

Brigadier

>> " BLITZKRIEG DEFENSE SOLUTIONS HAMZA 8×8 MCV "

HAMZA first 8x8 MRAP vehicle in the world developed in Pakistan by the Company Blitzkrieg

The Pakistani Company Blitzkrieg Defense Solutions unveils a new 8x8 armoured vehicle in the category of MRAP, the HAMZA 8x8 at IDEAS 2016, the International Defense Exhibition in Karachi, Pakistan. This is the first MRAP vehicle in the world based on a 8x8 chassis offering a large internal volume to carried a total of 14 military personnel.

New 8x8 MRAP vehicle HAMZA developed and designed by the Pakistani Company Blitzkrieg unveiled at IDEAS 2016, International Defense Exhibition in Karachi, Pakistan.

The HAMZA 8x8 is a new vehicle fully designed and developed by the Pakistani Company Blitzkrieg to response to the new needs of Pakistani army. The vehicle showed at IDEAS 2016 is the second prototype and the HAMZA will be tested on the field in the next few months.

The hull of the HAMZA 8x8 provides standard protection Level 4 STANAG 4569, with ballistic protection against firing of small arms 14.5 mm caliber and mine blast of 10 kg of TNT under the wheels. The vehicle can be fitted with an armour package to increase the protection to Level 5 STANAG 4569.

The HAMZA 8x8 has weight of around 30 tons with a payload capacity of 15 tons. The vehicle is motorized with a 600hp engine offering a power to weight ration of over 20Hp/tons combined with fully independent suspension.

At IDEAS 2016, the HAMZA 8x8 is showed with a one-man turret mounted in center part of the roof armed with a 30mm cannon and one coaxial 7.62mm machine gun. According to Syed Muhammad Haroon, Defense Program Director at Blitzkried the HAMZA 8x8 is able to be fitted with a combat turret armed with a cannon up to 105mm.

At IDEAS 2016, the HAMZA 8x8 was presented in armoured personnel carrier variant but the vehicle can also be configured as riot control vehicle, IFV (Infantry Fighting Vehicle), fire support vehicle with 90 or 105 mm cannon, air defense vehicle or self-propelled mortar carrier.

timepass

Brigadier

>> / / -

Pakistan test fires Enhanced version of NASR Tactical Short range Ballistic Missile system.

According to Official Press release , the enhanced version has increased range of 70km from its preivous range of 60km. It is also reported to be possessing better maneuveribility .

The NASR system was developed as a response to India's "Cold Start Doctrine" and the system is equipped with neutron bomb technology which is reported to have no long term radiation in the area of attack and is suitable to attack enemy troops inside/outside the country as well as enemy air defense systems.

Last edited:

timepass

Brigadier

Secretary Defense Lt General (R) Zamir ul Hassan Shah is on an official visit to Ukraine in order to attend the second meeting of joint commission on military and defense production fields.

Secretary Defense has also visited the defense industry of Ukraine. He mentioned that Pakistan values it's relations with Ukraine and believes that the relationship will strengthen with the passage of time. He also expressed that both the countries need to mutually benefit from each other's training facilities .

Secretary Defense has also visited the defense industry of Ukraine. He mentioned that Pakistan values it's relations with Ukraine and believes that the relationship will strengthen with the passage of time. He also expressed that both the countries need to mutually benefit from each other's training facilities .

timepass

Brigadier

Pakistan Air Force (PAF) has established an Aviation City at Aeronautical Complex which was inaugurated today. Air Chief Sohail Aman described the establishment of the aviation city as an important step towards achieving self-reliance in defense production.