You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

News on China's scientific and technological development.

- Thread starter Quickie

- Start date

Hehe, just another piece of "democratic 1+1 =/= communist 1+1", good kitchen knife vs. bad kitchen knife.

The breakdown list of components. There are totally 35 chips in 17 types.

- More than half are made in China.

- 3 types of totally 5 chips from US companies

- 2 audio chips from Cirrus Logic

- 2 switch chips from Texas Instruments. NOT the type of Ethernet switch, but just simple switch, albeit high speed.

- 1 from Qualcomm QDM2305 RF front-end chip

- The rests are from all other countries

Now, considering the ultra fast speed of replacement, I suspect that Huawei has been preparing for this well before Trump's trade war, and Huawei was going to have alternatives to American components with or without Trump. Note, the alternatives are meant to be multiple suppliers to reduce production risk, not meant to exclude American suppliers, this is common practice of big companies. It is Trump who made these alternatives to be exclusions of American business. Well done "comrade" Trump!

supercat

Colonel

China recruits a lot of Taiwanese talents of semiconductors. Policies such as "31 measures" and "26 measures" are excellent tools for recruiting Taiwanese talents.

Taiwan loses 3,000 chip engineers to 'Made in China 2025'

Beijing rolls out red carpet with triple the pay and benefits

TAIPEI -- China is ramping up recruitment of Taiwanese talent in semiconductors, attracting top executives and engineers alike to bolster an industry that the U.S. trade war has shown to be a Chinese Achilles' heel.

The aggressive campaign has sparked concerns about a brain drain within Taiwan's chip industry, which is struggling to compete with generous offers by cash-rich mainland companies.

A man in his 50s left a longtime job at a leading Taiwanese semiconductor maker a year ago for a position on the mainland.

"It's only natural to want to launch a big project and increase my value as an engineer," he told Nikkei during a trip back to Taipei.

The man's salary more than doubled with the move, and his new employer pays for his child's private education. The decision was easy, the man said.

More than 3,000 semiconductor engineers have departed Taiwan for positions at mainland companies, the island's Business Weekly reports. Analysts at the Taiwan Institute of Economic Research say this figure appears to be accurate. That amounts to nearly one-tenth of Taiwan's roughly 40,000 engineers involved in semiconductor research and development.

The trend is . Richard Chang moved to the mainland in 2000 after his Taiwanese business was acquired by , the world's leading contract chipmaker. Chang brought several hundred employees and launched Semiconductor Manufacturing International Corp. in Shanghai.

SMIC is now the world's fifth-largest contract chipmaker and has become a key rival for TSMC with backing from Beijing.

TSMC's former chief operating officer, Chiang Shang-yi, and research and development executive, Liang Mong-song, have taken high-ranking roles at state-affiliated players in China. Charles Kao, known as the "godfather" of Taiwan's DRAM industry, also joined Tsinghua Unigroup in 2015. Unigroup competes with Taiwanese players like in dynamic random access memory.

But such career moves have accelerated under Beijing's "Made in China 2025" plan to foster self-sufficiency in high-tech industries.

Semiconductor manufacturing is both capital- and talent-intensive: Even with the best equipment on the market, a company cannot mass-produce chips without technicians to work on them.

"Chinese players are now trying to overcome the barrier by recruiting not only top executives, but entire production teams on the ground," a Taiwanese industry insider said. "They are paying two to three times as much as Taiwanese companies."

Taiwanese companies are finding themselves outmatched.

"We are improving our compensation, but it is difficult to compete with mainland companies," Nanya Technology President Lee Pei-ing said.

Taiwan updated its trade secrets act in 2013, imposing prison sentences of up to 10 years for leaking corporate secrets outside the island. But this has not deterred career moves to the mainland in the semiconductor industry.

The effect of these transplants is noticeable. China's Changxin Memory Technologies and Yangtze Memory Technologies next year are slated to start mass-producing memory chips, one of Taiwan's strengths.

As a market for semiconductor manufacturing equipment, mainland China is expected to surpass Taiwan as the world's largest next year.

In addition to bolstering the mainland's chip industry, Beijing also may be rolling out the red carpet for Taiwanese engineers as a step toward its longtime goal of reunification. Beijing announced 26 measures in November aimed at treating Taiwanese equally to mainland Chinese, advocating for more Taiwanese to work and study on the mainland.

"The goal is to bring Taiwanese talent to the mainland and hollow out Taiwan," said Meng Chih-cheng, an associate professor at Taiwan's National Cheng Kung University.

Jura The idiot

General

let me link here... "31 measures" and "26 measures" ...

and

Taiwan Rebukes Beijing’s New 26 Measures for Cross-Strait Exchanges

Jura The idiot

General

some time ago, Nov 29, 2018

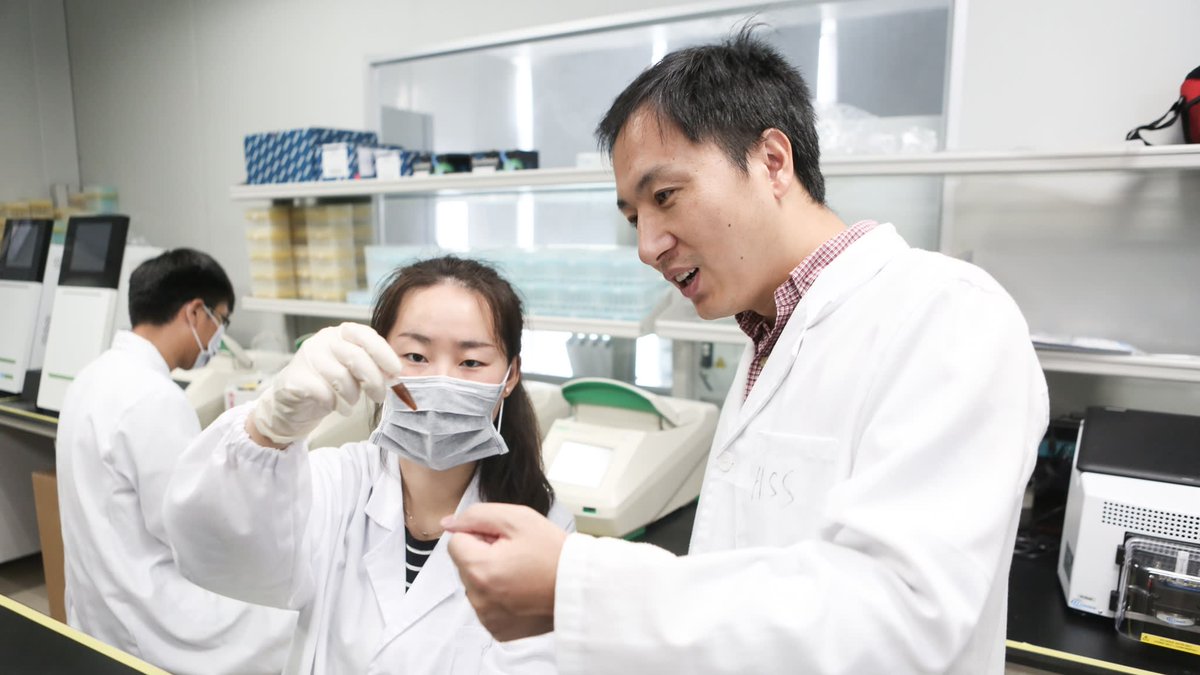

Gene-edited babies: Chinese scientist He Jiankui ‘may have created unintended mutations’

so follow the link if interested

nowthought I had seen the story here ... it's Monday at 5:43 AM; now

Chinese authorities on Thursday ordered suspending research activities of persons involved in the gene-edited babies incident, denouncing the matter as "extremely abominable in nature" and in violation of Chinese laws and science ethics

Gene-edited babies: Chinese scientist He Jiankui ‘may have created unintended mutations’

- Despite biophysicist’s claims, team failed to reproduce changes to make twin girls HIV immune, excerpts from manuscript show

- Birth of gene-edited babies Lula and Nana sent shock waves through scientific world in 2018

so follow the link if interested

antiterror13

Brigadier

Why don't they test the nerds at Shenzhen? These people might even beat Beijing and Shanghai there.

the results may be off the chart ... so not a good look

Wondering where India is ? a lot of super smart people there