You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Chinese shipbuilding industry

- Thread starter tphuang

- Start date

escobar

Brigadier

Chinese firm Yangzijiang Shipbuilding has secured new orders for another 22 vessels, raising its total order book value to date to a record high of US$10.27 billion (S$14.67 billion) and extending its top-line visibility to mid-2025.

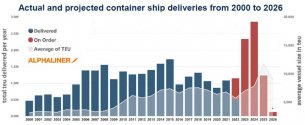

The scale of the upcoming deliveries is unprecedented. Historical delivery data from Clarksons shows that annual fleet growth averaged 970,000 TEUs in 2001-20. Deliveries in 2023-24 will be 2.6 times higher than that average.”

The scale of the upcoming deliveries is unprecedented. Historical delivery data from Clarksons shows that annual fleet growth averaged 970,000 TEUs in 2001-20. Deliveries in 2023-24 will be 2.6 times higher than that average.”

2022-10-14 16:39:25Ecns.cn Editor : Zhang Dongfang

(ECNS) -- Guangzhou Shipyard International Company Limited, a subsidiary of China State Shipbuilding Corporation, has won an additional order of three 8,600 CEU dual-fuel LNG battery hybrid pure car and truck carriers (PCTCs) from H-line, a shipping company from the Republic of Korea.

These PCTCs were developed by Shanghai Merchant Ship Design & Research Institute. The organization has received design orders for 55 ships in 2022 so far, accounting for a 67 percent share of the global market, ranking first in the world. They have incorporated LNG dual-fuel engines with a battery hybrid technology and used an improved hull design for better fuel efficiency.

The new design will cut carbon dioxide emissions by 30 percent compared with their predecessors of the same level, exceeding the requirement of the International Maritime Organization on Energy Efficiency Design Index of ships.

China’s shipbuilders, taking half of world market, are working around the clock to provide much-needed LNG ships, driven by booming demand from energy-starved Europe.

Orders for LNG ships surge as demand rise from energy-starved Europe

China's shipbuilders, accounting for about a 50-percent global market share, are working around the clock to provide much-needed liquefied natural gas (LNG) carriers, driven by booming demand from Europe as it scrambles to increase natural gas storage.

Because of the damaged Nord Stream pipeline and the ongoing Russia-Ukraine conflict, gas supplies in Europe are tight. In response, orders for LNG vessels saw double-digit growth lately, with some major Chinese shipbuilders reporting order backlogs that stretch through 2026, the Global Times learned.

A Shanghai-located shipyard is using 100 percent of its dock capacity and has orders on hand until 2026, even though it's working on 18 large ships around the clock now, according to media reports.

LNG ships have high requirements for the standard of craftsmanship, advanced production line and complete and stable supply chains, experts said. China, as the world's manufacturing hub, owns many self-developed shipbuilding technologies.

Hudong-Zhonghua Shipbuilding (Group) Co, a shipbuilder under CSSC, is working around the clock to build giant LNG ships. An employee said that orders have been surging, and six ships are under production. Employees are working in two shifts and the yard is running at full capacity.

Europe is the world's third-largest consumer for LNG, heavily relying on imports that arrive via pipelines as well as LNG carriers.

As the European energy crisis keeps deepening, European energy traders are looking everywhere for LNG carriers.

An employee with CSSC said that as of October 12, the world-class shipbuilder had received 139 orders for large LNG ships, according to media reports.

Hudong-Zhonghua Shipbuilding (Group) Co has orders for delivering 33 large-capacity LNG ships, of which 26 are new this year, and many other projects are being negotiated.

Jiangnan Shipyard (Group) Co under China State Shipbuilding Co (CSSC) recently delivered a new 30,000-cubic-meter LNG carrier for Dutch ship-owner Anthony Veder.

The vessel uses many new types of technology, equipment and standards, and it's the largest C-type binaural LNG tanker in the world.

"Countries in Europe and Asia are the major markets for Chinese shipbuilders for their high standards, and the Russia-Ukraine conflict has intensified the trend," Chen Daxi, vice chairman of the Zhejiang Shipbuilding Engineering Society, told the Global Times on Sunday.

Chen said that China's shipbuilding sector is leading the world, mainly due to its advanced technology and production capacity.

"An LNG carrier normally takes about two years to build and a stable supply chain is needed for the smooth production, and a complete supply chain and mature production lines make it possible for China to take more orders and complete them on time," the expert said.

In the first eight months, China's shipbuilding completion volume reached 23.94 million tons, accounting for 45.4 percent of the world market, and the number of new orders ranks first in the world, data from the China Association of the National Shipbuilding Industry showed.

New orders in the hands of Chinese shipbuilders account for 50.6 percent of the world's market share, the association said.

Demand for LNG ships has also driven up rates for the vessels that are already operating. The daily rate for a 174,000-cubic-meter LNG ship in the Atlantic region has shot up from $74,000 in early August to $397,000 now, a record high.

Are they planning on building large amphibs there?A model of Hudong shipyard's new home on Changxing island.