This is probably why Intel didn't went to 7nm so quickly. They don't really compete in mobile SoC, so lack of incentive.The smartphone industry has been the strongest pushers for smaller tech nodes

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Chinese semiconductor industry

- Thread starter Hendrik_2000

- Start date

- Status

- Not open for further replies.

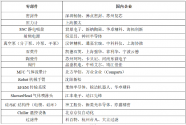

This Table 2-3 was in the article

It is an image file so Google translate won't work. Does anyone have it translated into English or at least a doc file that Google will translate?

Current Status of Semiconductor Parts Industry and Suggestions for my country's Development

It is an image file so Google translate won't work. Does anyone have it translated into English or at least a doc file that Google will translate?

Attachments

The demand for aerospace is already satisfied with existing fabs, you don't need advanced fabs for that. As for automotive - 14/28 nm are probably enough for that plus, again, the market there is not that big, so those chips can be imported, they are not strategic anyway so I doubt they will get blocked.What about Russian automotive, aerospace and heavy industries? They certainly need chips.

Hendrik_2000

Lieutenant General

It is a long article the most pertinent section

2) Scale and structure of my country's semiconductor parts market

At present, my country's semiconductor component industry is still in its infancy and the overall scale is relatively small. According to the data [2] of Xinmou , in 2020, China's local wafer manufacturers (mainly including SMIC, Huahong Group, China Resources Microelectronics, Yangtze River Storage, etc.) purchase 8-inch and 12-inch front-end equipment parts for approximately 4.3 One hundred million U.S. dollars. However, due to the rapid expansion of my country's local wafer manufacturing capacity, it is expected that the demand for semiconductor components will continue to be strong. According to the existing local wafer manufacturing capacity plan, there will be 50% new capacity by 2023. Calculated according to the procurement requirements of equipment and production lines at the same time, it is estimated that the domestic semiconductor parts market will exceed 8 billion yuan in 2023, and it is expected to exceed 12 billion yuan by 2025.

Despite the rapid growth of the domestic semiconductor component market, the current technical capabilities, process level, product accuracy and reliability of my country’s local component companies are far from meeting the needs of domestic equipment and wafer manufacturers, and the overall localization rate is still relatively low. Low standards. Generally speaking, for precision machined parts produced by customized design, the rate of localization in my country is relatively high. Because domestic semiconductor equipment is in its infancy, in order to achieve mass production as soon as possible to catch up with the advanced level, it is often designed by itself and then processed by foreign (mainly Japan, a small amount of South Korea) processors. Because the raw materials, processing methods, surface treatment methods, and cleaning packaging of precision machined parts of semiconductor equipment all have special requirements, domestic processors cannot meet them for a while.

In addition, because Japanese processing technology suppliers have relatively rich experience in processing similar parts, Some design mistakes can be found and adjusted during processing. Later, with the gradual expansion of the domestic market, a small number of domestic semiconductor equipment manufacturers began to gradually cultivate processors in other domestic industries to devote themselves to the processing of semiconductor equipment precision parts in order to reduce costs and ensure the safety of the supply chain. Therefore, in the field of precision machining parts dominated by equipment manufacturers, domestic parts manufacturers have made rapid progress. However, for general-purpose purchased parts that are more standardized and highly dependent on market competition, the localization rate is generally very low. The main reason is that the design and production requirements of these general-purpose outsourcing parts are very high. Even if the samples of domestic products can reach the same level, efforts are still needed to ensure the stability of mass production. At the same time, because domestic equipment companies have just made progress in localization, they are still relatively passive in the procurement of general-purpose parts, mainly domestic mature products, and are reluctant to try domestically manufactured products [1] .

These are the main reasons why my country is still unable to achieve "independent and controllable" in the core products of semiconductor components. According to data from mainstream domestic foundries, the number of parts (including maintenance and replacement parts and replacement parts for failure) used in daily operations throughout the year has reached more than 2,000, but the domestic market share is only about 8%. The United States and Japan share 59.7% and 26.7% respectively. In fact, the high-end parts market is mainly occupied by suppliers from the United States, Japan, and Europe; the mid-to-low-end parts market is mainly occupied by suppliers from South Korea and Taiwan. The electrostatic chuck is a key non-consumable part of the wafer manufacturing plant, and the unit price is as high as tens of thousands or even hundreds of thousands of dollars. At present, no domestic company can make relevant mature products.

Even the aluminum nitride ceramic raw materials used in the electrostatic chuck are also It is far from reaching the required technical indicators, and the external dependence is more than 99%. In addition, although the scale of my country's vacuum pump industry is close to 200 billion yuan, it still needs to import high-end products from Edwards and other companies in terms of dry vacuum pumps for semiconductors. However, in recent years, with the acceleration of new production capacity and expansion of the domestic semiconductor industry, the superposition of the new crown epidemic has caused the logistics and transportation services to be blocked, which has led to the continuous delay of foreign parts delivery, which has brought speed up for some domestic semiconductor parts and components companies with high growth potential in China. Opportunities for domestic substitution. For example, Jiangfeng Electronics' ShowerHead and cavity processing business, Cobetter's filter business, Tongjia Hongrui's dry vacuum pump business, etc. Table 2-3 summarizes some Chinese companies in the field of different semiconductor components.

Table 2-3. Major domestic semiconductor component companies

(Data source: network information collation)

04

The main problems faced by the localization of semiconductor parts

(1) Lack of attention to parts and components, and loss of industrial support policies

The total scale of the semiconductor component industry is in the billions. Compared with the core semiconductor industry chain, the size is small, the product variety and specifications are wide, there are few leading companies, the industry concentration is low, and the existing technical problems are scattered. Therefore, for a long time Not getting enough attention. Since 2014, China has promoted the development of the semiconductor industry to a national strategy, and then at least more than 30 local governments have issued support policies to promote the development of the semiconductor industry [9] , but there are more policies at the national and local levels. Focusing on the design, manufacturing, packaging and testing, equipment materials, etc., it rarely covers the semiconductor parts industry. In terms of capital, parts and components companies seldom get capital attention. The National Integrated Circuit Industry Investment Fund currently has a relatively small proportion of investment in the field of semiconductor components, with an investment amount of less than 100 million yuan. As of the end of 2020, the total market value (less than 30 billion yuan) of listed parts and components companies with semiconductor components as the main business accounted for only 1% (over 3 trillion yuan) of the total market value of all semiconductor industry chain companies.

2) Scale and structure of my country's semiconductor parts market

At present, my country's semiconductor component industry is still in its infancy and the overall scale is relatively small. According to the data [2] of Xinmou , in 2020, China's local wafer manufacturers (mainly including SMIC, Huahong Group, China Resources Microelectronics, Yangtze River Storage, etc.) purchase 8-inch and 12-inch front-end equipment parts for approximately 4.3 One hundred million U.S. dollars. However, due to the rapid expansion of my country's local wafer manufacturing capacity, it is expected that the demand for semiconductor components will continue to be strong. According to the existing local wafer manufacturing capacity plan, there will be 50% new capacity by 2023. Calculated according to the procurement requirements of equipment and production lines at the same time, it is estimated that the domestic semiconductor parts market will exceed 8 billion yuan in 2023, and it is expected to exceed 12 billion yuan by 2025.

Despite the rapid growth of the domestic semiconductor component market, the current technical capabilities, process level, product accuracy and reliability of my country’s local component companies are far from meeting the needs of domestic equipment and wafer manufacturers, and the overall localization rate is still relatively low. Low standards. Generally speaking, for precision machined parts produced by customized design, the rate of localization in my country is relatively high. Because domestic semiconductor equipment is in its infancy, in order to achieve mass production as soon as possible to catch up with the advanced level, it is often designed by itself and then processed by foreign (mainly Japan, a small amount of South Korea) processors. Because the raw materials, processing methods, surface treatment methods, and cleaning packaging of precision machined parts of semiconductor equipment all have special requirements, domestic processors cannot meet them for a while.

In addition, because Japanese processing technology suppliers have relatively rich experience in processing similar parts, Some design mistakes can be found and adjusted during processing. Later, with the gradual expansion of the domestic market, a small number of domestic semiconductor equipment manufacturers began to gradually cultivate processors in other domestic industries to devote themselves to the processing of semiconductor equipment precision parts in order to reduce costs and ensure the safety of the supply chain. Therefore, in the field of precision machining parts dominated by equipment manufacturers, domestic parts manufacturers have made rapid progress. However, for general-purpose purchased parts that are more standardized and highly dependent on market competition, the localization rate is generally very low. The main reason is that the design and production requirements of these general-purpose outsourcing parts are very high. Even if the samples of domestic products can reach the same level, efforts are still needed to ensure the stability of mass production. At the same time, because domestic equipment companies have just made progress in localization, they are still relatively passive in the procurement of general-purpose parts, mainly domestic mature products, and are reluctant to try domestically manufactured products [1] .

These are the main reasons why my country is still unable to achieve "independent and controllable" in the core products of semiconductor components. According to data from mainstream domestic foundries, the number of parts (including maintenance and replacement parts and replacement parts for failure) used in daily operations throughout the year has reached more than 2,000, but the domestic market share is only about 8%. The United States and Japan share 59.7% and 26.7% respectively. In fact, the high-end parts market is mainly occupied by suppliers from the United States, Japan, and Europe; the mid-to-low-end parts market is mainly occupied by suppliers from South Korea and Taiwan. The electrostatic chuck is a key non-consumable part of the wafer manufacturing plant, and the unit price is as high as tens of thousands or even hundreds of thousands of dollars. At present, no domestic company can make relevant mature products.

Even the aluminum nitride ceramic raw materials used in the electrostatic chuck are also It is far from reaching the required technical indicators, and the external dependence is more than 99%. In addition, although the scale of my country's vacuum pump industry is close to 200 billion yuan, it still needs to import high-end products from Edwards and other companies in terms of dry vacuum pumps for semiconductors. However, in recent years, with the acceleration of new production capacity and expansion of the domestic semiconductor industry, the superposition of the new crown epidemic has caused the logistics and transportation services to be blocked, which has led to the continuous delay of foreign parts delivery, which has brought speed up for some domestic semiconductor parts and components companies with high growth potential in China. Opportunities for domestic substitution. For example, Jiangfeng Electronics' ShowerHead and cavity processing business, Cobetter's filter business, Tongjia Hongrui's dry vacuum pump business, etc. Table 2-3 summarizes some Chinese companies in the field of different semiconductor components.

Table 2-3. Major domestic semiconductor component companies

(Data source: network information collation)

04

The main problems faced by the localization of semiconductor parts

(1) Lack of attention to parts and components, and loss of industrial support policies

The total scale of the semiconductor component industry is in the billions. Compared with the core semiconductor industry chain, the size is small, the product variety and specifications are wide, there are few leading companies, the industry concentration is low, and the existing technical problems are scattered. Therefore, for a long time Not getting enough attention. Since 2014, China has promoted the development of the semiconductor industry to a national strategy, and then at least more than 30 local governments have issued support policies to promote the development of the semiconductor industry [9] , but there are more policies at the national and local levels. Focusing on the design, manufacturing, packaging and testing, equipment materials, etc., it rarely covers the semiconductor parts industry. In terms of capital, parts and components companies seldom get capital attention. The National Integrated Circuit Industry Investment Fund currently has a relatively small proportion of investment in the field of semiconductor components, with an investment amount of less than 100 million yuan. As of the end of 2020, the total market value (less than 30 billion yuan) of listed parts and components companies with semiconductor components as the main business accounted for only 1% (over 3 trillion yuan) of the total market value of all semiconductor industry chain companies.

Hendrik_2000

Lieutenant General

(cont)

2) The innovation ability is relatively backward, and the core technology gap is obvious

Since the parts industry has not received attention for a long time and can only grow extensively, most domestic parts companies entering the semiconductor industry mainly provide maintenance and replacement services and cleaning services. The overall R&D investment is insufficient and the innovation ability is relatively backward. It has long stayed at the low-end production standard and the level of copying foreign products, and the core technology gap is obvious. According to the prospectus of a listed semiconductor component company in China, its total number of R&D personnel is only 15. In addition, the lack of innovation capabilities of my country's semiconductor parts industry is also reflected in the incomplete industry standard system, serious insufficient investment in basic process research, poor access to process technology, and inadequate integration of scientific research and production practices, which restrict semiconductor parts products. The innovative development of structural design technology, reliability technology, manufacturing technology and process, and basic material performance research.

Table 2-4. Technical Difficulties of Main Domestic Semiconductor Components

(Data source: SMIC [4] , Jiangfeng Electronics [6] , network information compilation)

(3) Insufficient supply of artisan talents and lack of effective incentive mechanism

At present, the talent gap in China's semiconductor industry has reached hundreds of thousands. Although China has introduced a series of support measures in the training of semiconductor talents in recent years, the training of a large number of semiconductor talents mainly focuses on the links of design, manufacturing, equipment and materials. There is still a lack of attention to the training of talents in basic industries, and there is a lack of overall planning and implementation in the education system reforms, professional settings, on-the-job engineering education, and technical qualification certification of basic disciplines. The professional foundation of parts and components and the arrangement of professional skills courses are seriously inadequate, and at the same time There is also a lack of guidance for the craftsman's spirit of advocating refinement, seeking truth, seeking innovation, being good at design, and good at tackling tough problems [5] .

In addition, the semiconductor component industry is facing a serious problem of inadequate talent incentive mechanisms. Although the current overall salary level of the domestic semiconductor industry personnel has increased significantly compared with the previous ones, for the machining, precision instrumentation, surface treatment and other industries required by parts and components companies, the salary of employees is generally significantly lower than the average level of the semiconductor industry. According to the prospectus of a domestic semiconductor component company, it had only 15 R&D personnel before listing, the annual salary of core technical personnel was only 75,000, and the annual salary of ordinary R&D personnel was only 30,000. Low salary levels have led to serious brain drain in semiconductor parts and components companies, resulting in a lack of successors in the basic parts industry and falling into a vicious circle.

(4) The various links of the industrial chain are out of touch, and the upstream support capacity is insufficient

Semiconductor components need to undergo strict and complex verification procedures before they can be verified through large-scale production lines and achieve large-scale sales. Therefore, component manufacturers need to have full cooperation with downstream equipment and manufacturers. At present, the domestic semiconductor component online verification procedures are complicated and the process is long, and the cooperation between manufacturers, equipment manufacturers and domestic semiconductor component manufacturers is not high, and effective communication and interaction are lacking, resulting in the two parties do not know each other's process parameters and matching compatibility. Insufficient power for domestic alternatives.

In addition, in the long-term product iteration process, existing foreign component manufacturers have formed a large number of Know-How (technical know-how). In the process of follow-up imitation and trial production, domestic manufacturers usually can only achieve similarity, and they are eliminated in the initial verification due to lack of experience and key technologies, and cannot enter large-scale applications [5] . In addition, domestic semiconductor component manufacturers are unable to obtain support from supporting links such as raw materials and production equipment, which also affects the competitiveness of their products. Semiconductor parts and components are generally products with multiple varieties and high processing accuracy requirements.

The raw materials and processing equipment required for the production of these parts are high and expensive. As my country's industry is affected by the long-standing ideology of "emphasizing the main engine and neglecting the matching", the investment in the upstream and downstream supporting areas of parts and components is seriously insufficient, which has led to a gap between my country and foreign countries in raw materials and production equipment for parts and components. For example, the current high-precision machining centers commonly used in semiconductor metal parts, my country lags behind foreign countries in terms of machining accuracy, machining stability, and geometric flexibility. Another example is the high-end metal parts manufacturing raw materials aluminum alloy metal, tungsten and molybdenum metal, and the upstream raw material high-purity quartz sand raw materials for quartz parts, which are basically monopolized by American and Japanese companies.

The monopoly of raw material supply makes downstream material manufacturers/processors/users Limited to passive. The mainstream quartz glass materials (tubes/rods/inhibitions) are basically from the United States, Germany, and Japan. Insufficiency of upstream processing equipment and raw materials has caused most of my country’s semiconductor component companies to operate at a low level of technology for a long time. The level of raw materials and process equipment is not high, and advanced equipment is lacking and not supporting. It cannot guarantee the consistency of product quality. The improvement of product quality.

2) The innovation ability is relatively backward, and the core technology gap is obvious

Since the parts industry has not received attention for a long time and can only grow extensively, most domestic parts companies entering the semiconductor industry mainly provide maintenance and replacement services and cleaning services. The overall R&D investment is insufficient and the innovation ability is relatively backward. It has long stayed at the low-end production standard and the level of copying foreign products, and the core technology gap is obvious. According to the prospectus of a listed semiconductor component company in China, its total number of R&D personnel is only 15. In addition, the lack of innovation capabilities of my country's semiconductor parts industry is also reflected in the incomplete industry standard system, serious insufficient investment in basic process research, poor access to process technology, and inadequate integration of scientific research and production practices, which restrict semiconductor parts products. The innovative development of structural design technology, reliability technology, manufacturing technology and process, and basic material performance research.

Table 2-4. Technical Difficulties of Main Domestic Semiconductor Components

(Data source: SMIC [4] , Jiangfeng Electronics [6] , network information compilation)

(3) Insufficient supply of artisan talents and lack of effective incentive mechanism

At present, the talent gap in China's semiconductor industry has reached hundreds of thousands. Although China has introduced a series of support measures in the training of semiconductor talents in recent years, the training of a large number of semiconductor talents mainly focuses on the links of design, manufacturing, equipment and materials. There is still a lack of attention to the training of talents in basic industries, and there is a lack of overall planning and implementation in the education system reforms, professional settings, on-the-job engineering education, and technical qualification certification of basic disciplines. The professional foundation of parts and components and the arrangement of professional skills courses are seriously inadequate, and at the same time There is also a lack of guidance for the craftsman's spirit of advocating refinement, seeking truth, seeking innovation, being good at design, and good at tackling tough problems [5] .

In addition, the semiconductor component industry is facing a serious problem of inadequate talent incentive mechanisms. Although the current overall salary level of the domestic semiconductor industry personnel has increased significantly compared with the previous ones, for the machining, precision instrumentation, surface treatment and other industries required by parts and components companies, the salary of employees is generally significantly lower than the average level of the semiconductor industry. According to the prospectus of a domestic semiconductor component company, it had only 15 R&D personnel before listing, the annual salary of core technical personnel was only 75,000, and the annual salary of ordinary R&D personnel was only 30,000. Low salary levels have led to serious brain drain in semiconductor parts and components companies, resulting in a lack of successors in the basic parts industry and falling into a vicious circle.

(4) The various links of the industrial chain are out of touch, and the upstream support capacity is insufficient

Semiconductor components need to undergo strict and complex verification procedures before they can be verified through large-scale production lines and achieve large-scale sales. Therefore, component manufacturers need to have full cooperation with downstream equipment and manufacturers. At present, the domestic semiconductor component online verification procedures are complicated and the process is long, and the cooperation between manufacturers, equipment manufacturers and domestic semiconductor component manufacturers is not high, and effective communication and interaction are lacking, resulting in the two parties do not know each other's process parameters and matching compatibility. Insufficient power for domestic alternatives.

In addition, in the long-term product iteration process, existing foreign component manufacturers have formed a large number of Know-How (technical know-how). In the process of follow-up imitation and trial production, domestic manufacturers usually can only achieve similarity, and they are eliminated in the initial verification due to lack of experience and key technologies, and cannot enter large-scale applications [5] . In addition, domestic semiconductor component manufacturers are unable to obtain support from supporting links such as raw materials and production equipment, which also affects the competitiveness of their products. Semiconductor parts and components are generally products with multiple varieties and high processing accuracy requirements.

The raw materials and processing equipment required for the production of these parts are high and expensive. As my country's industry is affected by the long-standing ideology of "emphasizing the main engine and neglecting the matching", the investment in the upstream and downstream supporting areas of parts and components is seriously insufficient, which has led to a gap between my country and foreign countries in raw materials and production equipment for parts and components. For example, the current high-precision machining centers commonly used in semiconductor metal parts, my country lags behind foreign countries in terms of machining accuracy, machining stability, and geometric flexibility. Another example is the high-end metal parts manufacturing raw materials aluminum alloy metal, tungsten and molybdenum metal, and the upstream raw material high-purity quartz sand raw materials for quartz parts, which are basically monopolized by American and Japanese companies.

The monopoly of raw material supply makes downstream material manufacturers/processors/users Limited to passive. The mainstream quartz glass materials (tubes/rods/inhibitions) are basically from the United States, Germany, and Japan. Insufficiency of upstream processing equipment and raw materials has caused most of my country’s semiconductor component companies to operate at a low level of technology for a long time. The level of raw materials and process equipment is not high, and advanced equipment is lacking and not supporting. It cannot guarantee the consistency of product quality. The improvement of product quality.

Hendrik_2000

Lieutenant General

Look to me like academic paper without any insight in the industry So take it with a gob of salt

[1] Zhihu. What is the localization rate of the core components of my country's semiconductor equipment? [EB/OL].(2020-10-13)[2020-10-13]

[2] Xinmo Research. One of the sources of China's semiconductor card neck-equipment parts [EB/OL]. (2021-03-23) [2021-03-25]. /dy/article/G5U1FE2605312NX9.html.

[3] Dakang Mo. Introduction to Subsystems of Semiconductor Equipment [EB/OL]. (2021-04-19) [2021-05-13].

[4] SMIC. Jointly build a new industrial ecology with strategic partners, 2021

[5] Yang Yanming, Zhu Minghao, Shao Zhufeng, et al. Research on the development countermeasures of basic parts and components in my country[J]. Chinese Engineering Science, 2017,19(3):117-124.

[6] Jiangfeng Electronics. Exploration of the localization of core components of integrated circuits, 2021

[7] Wang Guangyu. The core process equipment and vacuum components of the integrated circuit industry [C] The 14th International Conference on Vacuum Science and Engineering Application, 2019

[8] Lei Zhenlin. Pan-semiconductor equipment and parts [C] The 4th Guangdong-Hong Kong-Macao Greater Bay Area Vacuum Technology Innovation and Development Forum and 2020 Guangdong Vacuum Society Academic Annual Conference, 2020

[9] Zhu Jing, Zhuo Hongjun, Zhang Zhihong, et al. Analysis of the integrated circuit industry policy in various provinces and cities in my country and relevant suggestions[J]. China Integrated Circuits, 2019,28(11):16-21,30. DOI:10.3969 /j.issn.1681-5289.2019.11.002.

[1] Zhihu. What is the localization rate of the core components of my country's semiconductor equipment? [EB/OL].(2020-10-13)[2020-10-13]

[2] Xinmo Research. One of the sources of China's semiconductor card neck-equipment parts [EB/OL]. (2021-03-23) [2021-03-25]. /dy/article/G5U1FE2605312NX9.html.

[3] Dakang Mo. Introduction to Subsystems of Semiconductor Equipment [EB/OL]. (2021-04-19) [2021-05-13].

[4] SMIC. Jointly build a new industrial ecology with strategic partners, 2021

[5] Yang Yanming, Zhu Minghao, Shao Zhufeng, et al. Research on the development countermeasures of basic parts and components in my country[J]. Chinese Engineering Science, 2017,19(3):117-124.

[6] Jiangfeng Electronics. Exploration of the localization of core components of integrated circuits, 2021

[7] Wang Guangyu. The core process equipment and vacuum components of the integrated circuit industry [C] The 14th International Conference on Vacuum Science and Engineering Application, 2019

[8] Lei Zhenlin. Pan-semiconductor equipment and parts [C] The 4th Guangdong-Hong Kong-Macao Greater Bay Area Vacuum Technology Innovation and Development Forum and 2020 Guangdong Vacuum Society Academic Annual Conference, 2020

[9] Zhu Jing, Zhuo Hongjun, Zhang Zhihong, et al. Analysis of the integrated circuit industry policy in various provinces and cities in my country and relevant suggestions[J]. China Integrated Circuits, 2019,28(11):16-21,30. DOI:10.3969 /j.issn.1681-5289.2019.11.002.

That Argon Fluoride Immersion machines are being included in the ban is indicative that they their tech is near cutting edge.Conflicting goals:

Nikon:

View attachment 79190

China:

View attachment 79191

United States:

View attachment 79192

Is up to the Japanese government if they want to continue to be Lapdogs of the U.S. to the point of letting their poster child company die in 5-7 years once SMEE immersion lithography machines become dominant on China. At the end of the day Japan will lose their ability to make advance litho machines. Letting just two countries with that ability.

So basically are they saying that china needs to also incentivize and support the semiconductor auxillary industries as well? I feel the govt understands that already but the main thing is that domestics semiconductor manufacturers have not been buying domestic products, leading to underfunding. I think with the tech war, that will change in the future.Look to me like academic paper without any insight in the industry So take it with a gob of salt

[1] Zhihu. What is the localization rate of the core components of my country's semiconductor equipment? [EB/OL].(2020-10-13)[2020-10-13]

[2] Xinmo Research. One of the sources of China's semiconductor card neck-equipment parts [EB/OL]. (2021-03-23) [2021-03-25]. /dy/article/G5U1FE2605312NX9.html.

[3] Dakang Mo. Introduction to Subsystems of Semiconductor Equipment [EB/OL]. (2021-04-19) [2021-05-13].

[4] SMIC. Jointly build a new industrial ecology with strategic partners, 2021

[5] Yang Yanming, Zhu Minghao, Shao Zhufeng, et al. Research on the development countermeasures of basic parts and components in my country[J]. Chinese Engineering Science, 2017,19(3):117-124.

[6] Jiangfeng Electronics. Exploration of the localization of core components of integrated circuits, 2021

[7] Wang Guangyu. The core process equipment and vacuum components of the integrated circuit industry [C] The 14th International Conference on Vacuum Science and Engineering Application, 2019

[8] Lei Zhenlin. Pan-semiconductor equipment and parts [C] The 4th Guangdong-Hong Kong-Macao Greater Bay Area Vacuum Technology Innovation and Development Forum and 2020 Guangdong Vacuum Society Academic Annual Conference, 2020

[9] Zhu Jing, Zhuo Hongjun, Zhang Zhihong, et al. Analysis of the integrated circuit industry policy in various provinces and cities in my country and relevant suggestions[J]. China Integrated Circuits, 2019,28(11):16-21,30. DOI:10.3969 /j.issn.1681-5289.2019.11.002.

I wonder how long it would take for china to be competitive in those industries? Is it harder than making a lithography machine?

Just curious, what is preventing Russia from developing its own smartphone and PC industry? I remember Russia has its own Yota phone when I there as an exchange student in 2013-2014. However, the Yotaphone has never become as popular as Huawei, Apple, and Samsung. I bought one when I was in St. Petersburg simply because somehow none of the local SIM cards worked on my old Iphone.We don't have a large electronics industry or a large internal market, so I doubt SSA800 is even needed because setting up an advanced fab would be a waste of money anyway. Russia is probably going to aim to get domestic 28 nm and stop at that, mostly for military applications. The only way I see us ever needing advanced fabs is if Elbrus and Baikal platforms become successful outside of government procurement and military which is not likely.

Just curious, what is preventing Russia from developing its own smartphone and PC industry? I remember Russia has its own Yota phone when I there as an exchange student in 2013-2014. However, the Yotaphone has never become as popular as Huawei, Apple, and Samsung. I bought one when I was in St. Petersburg simply because somehow none of the local SIM cards worked on my old Iphone.

Scale. Their market simply isn't large enough.

- Status

- Not open for further replies.