It suprise to me that China hasn't banned American cloud service in China,the US banned Chinese cloud service long ago.

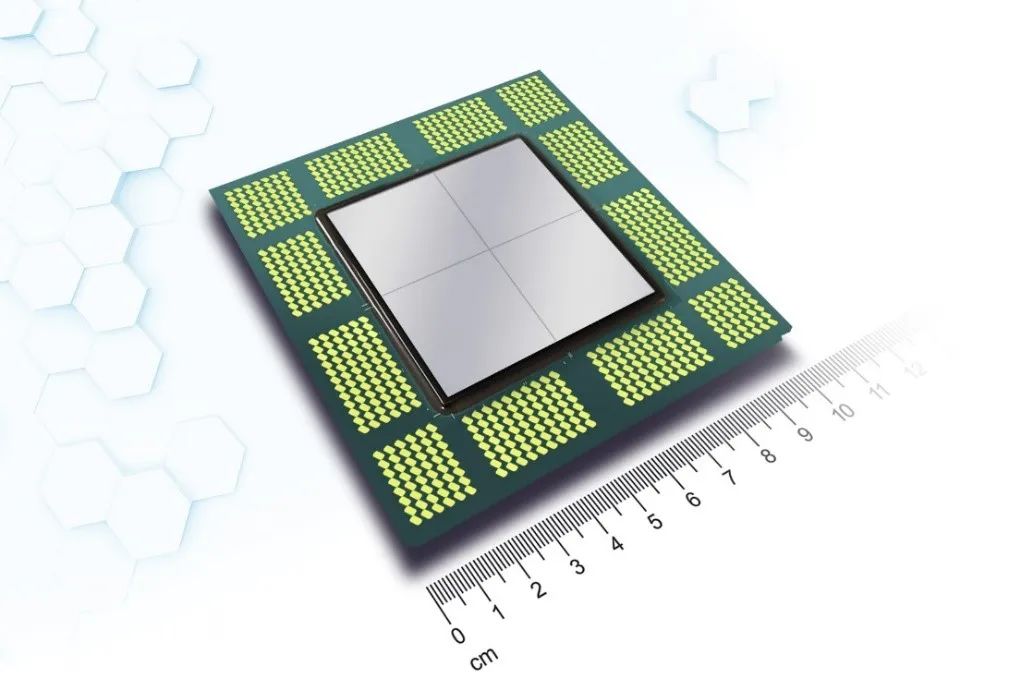

国产GPU尚处萌芽期,与国际厂商差距更大。提供通用算力的全球服务器CPU市场被英特尔、AMD垄断。国产服务器CPU包括阿里的倚天、华为的鲲鹏,以及“中科系”(中科院计算技术研究所持股企业)的海光和龙芯。国产CPU在全球市场份额不足2%,在中国市场份额不足8%。

Domestic GPUs are still in their infancy, and the gap with international manufacturers is even greater. The global server CPU market that provides general-purpose computing power is monopolized by Intel and AMD. Domestic server CPUs include Ali's Yitian, Huawei's Kunpeng, and Haiguang and Loongson of the "Chinese Academy of Sciences" (a holding company of the Institute of Computing Technology, Chinese Academy of Sciences). The domestic CPU has a global market share of less than 2%, and a Chinese market share of less than 8%.

目前中国大陆本土科技公司自主设计的14nm以下先进工艺芯片几乎都由台积电代工。不过,考虑到美国的制裁风险,一些企业正在尝试摆脱台积电。一位半导体公司人士对《财经十一人》透露,百度昆仑芯三代的代工方已更换成三星半导体。

At present, almost all advanced process chips below 14nm independently designed by local technology companies in mainland China are manufactured by TSMC. However, considering the risk of US sanctions, some companies are trying to get rid of TSMC. A person from a semiconductor company revealed to Caijing Eleven that the third-generation foundry of Baidu Kunlun Core has been replaced by Samsung Semiconductor.

国产芯片服务器目前采购和优化成本偏高。国内市场,英特尔x86芯片服务器均价4万-5万元/台,华为鲲鹏920芯片服务器售价8万-10万元/台。一位服务器设备制造厂商人士今年3月对《财经十一人》说,国产服务器芯片另一挑战是软件生态不完善。例如,采购鲲鹏服务器后,通常还要进行长达半个月的软件适配和优化,否则只能发挥理论性能的30%-60%。

Domestic chip servers are currently expensive to purchase and optimize. In the domestic market, the average price of Intel x86 chip servers is 40,000-50,000 yuan/set, and the price of Huawei Kunpeng 920 chip servers is 80,000-100,000 yuan/set. A person from a server equipment manufacturer told Caijing Eleven in March this year that another challenge for domestic server chips is the imperfect software ecosystem. For example, after purchasing a Kunpeng server, it usually takes half a month to adapt and optimize the software, otherwise it can only play 30%-60% of the theoretical performance.

即使如此,规模化采购国产芯片服务器仍然被认为是必须要走的一步。一位金融机构CIO和中国电子技术人士此前同时对《财经十一人》直言,国产芯片服务器目前只做到了能用这一步。从经济指标来看,国产服务器采购成本高,易用性相对较差,被认为占用了原本的IT支出。但从政策指标来看,这是必须走的一步。只有先买起来、用起来,国产芯片服务器才能从能用变得好用。

Even so, large-scale procurement of domestic chip servers is still considered a necessary step. A CIO of a financial institution and a person from China's electronic technology told "Finance and Economics Eleven" at the same time that domestic chip servers have only reached the point where they can be used. From the perspective of economic indicators, domestic servers are expensive to purchase and relatively poor in ease of use, which are considered to occupy the original IT expenditure. But judging from policy indicators, this is a necessary step. Only by buying and using it first, can domestic chip servers change from useful to easy to use.

云计算服务原本是算力产业链利润最丰厚的部分。中国在技术需求、市场发展有自己的节奏,目前的节奏是,云厂商竞争激烈,暂时普遍亏损。美国三朵云(亚马逊AWS、微软智能云、谷歌云)2022年掌握全球66%市场份额,营业利润总和超3700亿元。中国七朵云全球份额低于20%,七朵云均在战略亏损,2022年营业亏损总和超百亿元。

Cloud computing services were originally the most profitable part of the computing power industry chain. China has its own rhythm in technology demand and market development. The current rhythm is that cloud vendors are highly competitive and generally lose money for the time being. The three American clouds (Amazon AWS, Microsoft Smart Cloud, and Google Cloud) will hold 66% of the global market share in 2022, with a total operating profit of over 370 billion yuan. China's Qiduoyun's global share is less than 20%, and Qiduoyun is making strategic losses. The total operating loss in 2022 will exceed 10 billion yuan.

此时中国公司出现了一组矛盾:

· 科技公司技术基础好、研发支出高,原本最有条件发 展智能计算,但资本支出却在下滑。科技公司的资本 支出通常用于采购服务器、建数据中心、购置园区土 地等固定资产。这意味着智算业务投入会受到限制。

· 电信运营商资本支出高,扩大算力投入意愿强。但目 前大部分投入都集中于通用算力。由于研发支出低, 缺少技术积淀,智算资源也不足。电信运营商面对智 能算力浪潮时,反应迟缓。

At this time, a set of contradictions appeared in Chinese companies:

· Technology companies have a good technical foundation and high R&D expenditures. They are originally the most qualified to develop intelligent computing, but capital expenditures are declining. The capital expenditure of technology companies is usually used to purchase servers, build data centers, and purchase fixed assets such as park land. This means that investment in smart computing services will be limited.

· Telecom operators have high capital expenditures and strong willingness to expand computing power investment. But most of the current investment is concentrated on general computing power. Due to low R&D expenditure, lack of technology accumulation, and insufficient intellectual computing resources. Telecom operators were slow to respond to the wave of intelligent computing power.

微软、亚马逊的云业务利润规模可观,大模型有成熟商业路径。此时巨额资本支出、研发支出顺其自然,可以形成良性循环。反观国内,算力资源、技术关键投入期,中国公司尚未走上正循环。云业务普遍亏损,大模型会让亏损加剧,如果没有更好的策略,中国公司在智能算力领域的差距可能会被拉大。

The profit scale of Microsoft and Amazon's cloud business is considerable, and the large model has a mature business path. At this time, huge capital expenditures and R&D expenditures can go with the flow and form a virtuous circle. In contrast, in China, Chinese companies have not yet embarked on a positive cycle during the key investment period of computing power resources and technology. The cloud business generally loses money, and large models will intensify the losses. If there is no better strategy, the gap between Chinese companies in the field of intelligent computing power may be widened.

美国只有三朵公共云,三者在市场竞争中形成了规模效应,最大程度降低了算力成本。中国市场有七朵,电信运营商和科技公司是竞争关系,地方政府还在建大数据产业园、做国资云。中国市场分散且割裂,算力成本高,每家云都在亏损。长此以往,企业资本支出、研发支出无法摊薄,难以形成良性循环。

There are only three public clouds in the United States, and the three have formed a scale effect in the market competition, which minimizes the cost of computing power. There are seven in the Chinese market. Telecom operators and technology companies are in competition. Local governments are still building big data industrial parks and state-owned cloud. The Chinese market is fragmented and fragmented, the cost of computing power is high, and every cloud company is losing money. If things go on like this, corporate capital expenditures and R&D expenditures cannot be diluted, and it is difficult to form a virtuous circle.