There is little question but that the Chinese economy, after its spectacular performance over the past two decades, is currently in the process of slowing down. From growth rates in terms of real Gross Domestic Product reaching 9% per annum, it is now declining toward the 8% level or even less in the near future. Some say that this represents the start of a bubble bursting following the path taken by Japan in about 1990 and the US in 2008/9. Others believe, however, that this shift is merely a small correction towards a more sustainable growth path.

The pessimists point to recent declines in housing prices in major Chinese cities, and also the substantial increase in vacant properties that may have been built for speculative purposes. From that vantage point, there appear to be striking similarities to real estate markets in Japan and the US when those bubbles burst.

On the other hand, optimists believe that the recent decline in economic growth is the direct result of government policies whose intended purpose is specifically to restrain real estate speculation and ease inflationary pressures. The goal is to engineer a "soft landing" at a growth rate that can be maintained for a substantial period of time; and that the recent slowdown is entirely consistent with achieving that objective.

China observers are conflicted, and include knowledgeable people on both sides of the divide. The question asked is which side is right; which side more accurately describes what is actually going on in China? This debate is really over near-term forecasts. While the pessimists foresee a decline in Chinese growth rates, the optimists see only bright lights ahead, although perhaps with slightly slower growth rates. Interestingly, such polarizing views regarding China are not uncommon. One explanation is that both alternatives are found within the vast confines of that country.

Rather than adopt either position, we seek a more integrated approach, emphasizing government policy decisions, which will link Chinese development to that which occurred in Japan only a few decades earlier. We believe that policy mistakes in Japan were largely responsible for its economic breakdown. There are striking similarities between their economic paths from which to draw certain conclusions. However, we do not suggest that China will necessarily encounter the same period of stagnation that Japan did following 1990; it is fundamentally up to its government policies.

In various respects, the Chinese economy in the past decade appears much like its Japanese counterpart in the 1960s. During that decade, which was sometimes characterized as the Japanese Miracle, its economy registered double-digit real growth rates that incorporated both a domestic investment boom and an aggressive export drive. Even more relevant, the Japanese economy at the time was going through a fundamental change from a labor surplus phase to a labor shortage phase; it passed the so-called Lewis turning point sometime in the mid-60s, just as China is doing today.

Since the 1970s, Japan has encountered an up and down process that might be characterized as an "unstable bumpy landing" towards a long run growth path. The high growth rates achieved in the early 70s were followed by slower growth in the mid- to late-70s, and then relatively low growth rates in the early 80s that were followed by high growth in the mid- to late-80s. Unfortunately, then came the lost decades with virtually no growth in the 90s and beyond, which now looks like a long-run path for Japan.

However, we believe that this zero growth path was not inevitable but rather resulted from mishandling the unstable economic processes of the 1980s by the Japanese government and the Bank of Japan.

It appears that China may be entering a similar process today where economic and social policies can make a critically important difference. They could determine which camp, optimists or pessimists, is right; whether China can follow a positive and fairly high growth path, or alternatively a much lower one or even the zero growth path as found recently in Japan.

As the optimists point out, the Chinese economy has important advantages. These include an enormous labor force from which to draw upon, substantial savings from which to finance the projects and infra-structure needed for economic development, and considerable natural resources. All of these factors offer the potential for maintaining high growth rates for decades to come.

On the other hand, as the pessimists emphasize, China has encountered serious problems recently which, if left untreated, pose serious threats to future growth.

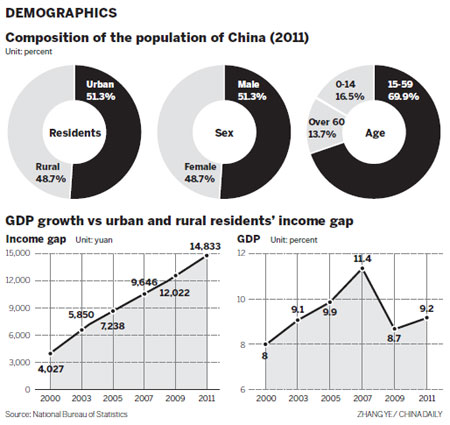

These problems include major economic disparities between the urban rich and the rural poor, political barriers between the privileged few and the suppressed general population, serious conflicts of interests between the central and local governments, a declining quality of life due to long working hours and environmental degradation which could retard the growth of its labor supply.

How these problems and advantages are balanced depends on the social and economic policies that are pursued. Among the most important actions to take is pursuing more flexible and responsive monetary and foreign exchange rate policies. These policies are linked since maintaining low values of the yuan leads invariably to increased foreign reserves which in turn expands the money supply and promotes inflationary pressures.

While such pressures could be countered by higher governmentally-imposed interest rates, such rates would tend to depress economic activity. The better solution would be to revalue the yuan which would make this problem less likely to appear in the first place. That would give policy-makers a more free hand to achieve economic growth and price stability simultaneously in the long run.

A second critical policy area is the need for more equitable distributions of income and wealth. Exchange rate re-valuations will invariably lead to making exports more costly abroad, which in turn will foster a partial transformation away from an export-driven economy. To make up for any decline in export demand, there must be an expansion of domestic demand, which in turn requires substantial demand growth from middle-class consumers.

Some measure of income redistribution is needed if Chinese effective demand for the products of its mills and factories will expand sufficiently. Although the Chinese middle class has expanded greatly in recent years, there is a question as to whether that has been sufficient to support an economy in transition from being largely export driven.

Finally, there is the question of governance. As an economy has become more complex, it becomes increasingly difficult to fashion solutions to such problems as pollution and environmental protection in a centralized manner where proposed solutions follows a "one size fits all" approach. Instead, expanded power and responsibility should be held by local governments who can fashion policies that are more responsive to local residents' needs and preferences.

Whether such policy shifts will occur is of course difficult to predict. For this reason, it is pointless to take either an optimistic or pessimistic view on the Chinese economy. Much depends on the course of actions taken by China's political leaders and policy makers. As is often the case, the adequacy and foresightedness of economic policy is critical.