At the same time, major economies from Saudi Arabia to Japan...but with the exception of UK, are dumping US Treasuries.

Yuan assets still alluring as investors oversubscribe central bank notes in HK

By Global Times Published: May 23, 2022 09:12 PM

The People's Bank of China (PBC), the country's central bank, issued 25 billion yuan ($3.75 billion) of central bank notes in the Hong Kong Special Administrative Region (HKSAR) on Monday, with the issuance 2.3 times oversubscribed by investors, showing the allure of yuan assets.

The issue, with 10 billion yuan of three-month notes and 15 billion yuan of one-year notes, was broadly welcomed by investors, including banks and funds from the US, Europe and Asia, with subscriptions approaching 58 billion yuan.

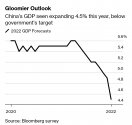

"The oversubscription indicates the allure of yuan assets and global investors' confidence in China's economy, despite the pressure of a geopolitical crisis, COVID-19 as well as monetary policy changes in major economies," Dong Dengxin, director of the Finance and Securities Institute of the Wuhan University of Science and Technology, told the Global Times on Monday.

On May 4, the US Federal Reserve announced the rise of its key federal funds rate by 50 basis points, the largest move since 2000 to tame inflation. The move, which may draw capital to the US, has aroused concerns about global economic stability, but "the yuan remains strong with the PBC's sufficient toolbox to boost its economy and fight against COVID-19 flare-ups," Dong added.

Regular yuan notes issuances in Hong Kong have broadened the range of yuan-denominated investment products and liquidity management tools in the HKSAR market, and prompted domestic financial institutions and enterprises to issue yuan bonds in the offshore market.

The number of offshore yuan-denominated treasury and corporate bonds is rising, and the methods and locations are increasingly diversified, showing that the yuan bonds issuances in Hong Kong have helped develop the financial market there.

Wang Jianjun, vice chairman of the China Securities Regulatory Commission, said that this year, long-term funds have maintained net inflows into Chinese mainland market, noting that the opening-up of China's capital market remains well-paced, orderly and risk-controlled despite global turbulences.

Yuan assets still alluring as investors oversubscribe central bank notes in HK

By Global Times Published: May 23, 2022 09:12 PM

The People's Bank of China (PBC), the country's central bank, issued 25 billion yuan ($3.75 billion) of central bank notes in the Hong Kong Special Administrative Region (HKSAR) on Monday, with the issuance 2.3 times oversubscribed by investors, showing the allure of yuan assets.

The issue, with 10 billion yuan of three-month notes and 15 billion yuan of one-year notes, was broadly welcomed by investors, including banks and funds from the US, Europe and Asia, with subscriptions approaching 58 billion yuan.

"The oversubscription indicates the allure of yuan assets and global investors' confidence in China's economy, despite the pressure of a geopolitical crisis, COVID-19 as well as monetary policy changes in major economies," Dong Dengxin, director of the Finance and Securities Institute of the Wuhan University of Science and Technology, told the Global Times on Monday.

On May 4, the US Federal Reserve announced the rise of its key federal funds rate by 50 basis points, the largest move since 2000 to tame inflation. The move, which may draw capital to the US, has aroused concerns about global economic stability, but "the yuan remains strong with the PBC's sufficient toolbox to boost its economy and fight against COVID-19 flare-ups," Dong added.

Regular yuan notes issuances in Hong Kong have broadened the range of yuan-denominated investment products and liquidity management tools in the HKSAR market, and prompted domestic financial institutions and enterprises to issue yuan bonds in the offshore market.

The number of offshore yuan-denominated treasury and corporate bonds is rising, and the methods and locations are increasingly diversified, showing that the yuan bonds issuances in Hong Kong have helped develop the financial market there.

Wang Jianjun, vice chairman of the China Securities Regulatory Commission, said that this year, long-term funds have maintained net inflows into Chinese mainland market, noting that the opening-up of China's capital market remains well-paced, orderly and risk-controlled despite global turbulences.