But the story serves the purpose of projecting a future Chinese naval base in Gwadar that might make India consider using diplomats instead of warships in this discussion.Article is a bit too alarmist on Indian intentions. It's clear India sees CPEC is a zero-sum game and objects to China building BRI through disputed territory, but India attacking CPEC, including Gwadar sounds farfetched at this point in time.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

China's overland Silk Road and Maritime Silk Road Thread

- Thread starter SampanViking

- Start date

timepass

Brigadier

SEDPL Brings 50MW Wind Power Project Online in Sindh

Sachal Energy Development (Pvt.) Ltd. ( SEDPL), a wholly owned subsidiary of of Arif Habib Corporation Limited, has achieved its Commercial Operations for 49.5 MV Wind Energy Project on 11th April 2017. In a notification to the Pakistan Stock exchange, the company secretary confirmed that the formal notification from the Central Power Purchasing Agency (Guaranteed Ltd) has been received by their subsidiary

SEDPL’s Wind Energy Project is the first Pakistani-owned early harvest project of CPEC. It has been constructed on 680 acres of land situated at Jhimpir Wind Corridor, Sindh and is committed to supply electricity to National Grid through National Transmission and Dispatch Company Ltd for 20 years under Energy Purchase Agreement.

Alternate sources of energy are the way forward. SEDPL will contribute to national development by reducing dependence on imported fossil fuels and producing 136.5 GWh yearly of clean energy.

The project comprises of 33 Wind Turbine Generators manufactured by Goldwind of China and Hrdrochina is the EPC and O&M Contractors for the project. The Project has guaranteed return on Equity of 17%and payback period of 5.9 years. Debt portion of the project has been financed by Industrial and Commercial Bank of China (Backed by SINOSURE).

The Company had acquired generation license and tariff determination by NEPRA and had received a Letter of Support from the Alternate Energy Development Board (AEDB). Similarly, the Company had executed its EPA with NTDC and IA with AEDB. Furthermore, foreign and local financing facility agreements with Industrial and Commercial Bank of China were signed in February 2015 and May 2015 respectively.

timepass

Brigadier

Hyundai to Set Up Auto Manufacturing Plant in Pakistan as - Economic Corridor continues to gain momentum.

South Korean Auto brand, Hyundai, and Al-Haj group have joined hands to introduce heavy commercial vehicles (HCV) in Pakistan. With an expected investment of around Rs. 4 billion, the company initially plans to assemble trucks and luxury buses.

The joint venture company has already purchased 30 acres of land outside Karachi and is expected to start production within the next 12 months. During the first phase, Al-Haj Hyundai (Pvt) Limited, a separate company of the joint venture, will invest Rs. 1.5 billion. When the two companies agree to move forward, Hyundai will invest in the production plant in 2019.

Al-Haj Hyundai will introduce a bunch of new trucks, buses and light duty vehicles in Pakistan.

Heavy duty truck Xcient will be assembled and sold here.

The South Korean auto maker plans to introduce other cargo and passenger handling vehicles as the production progresses.

Hyundai Global Motors Co Ltd Chairman, Kyung Sik, said that he was confident in the company’s partnership with Al-Haj Group and it will help both players as Pakistan is a huge market with a rapidly growing demand.

Competition Heats Up....Currently, there are four Chinese truck assemblers in Pakistan and have gained 40% of market share in just 10 years while the rest is held by Japanese companies who have been present in Pakistan for decades.

Chinese trucks are cheaper (at Rs. 7.8 million), Japanese are slightly expensive (at Rs. 12.6 million), while European trucks from Volvo go as high as Rs. 16.5 million. Hyundai will launch their vehicles with a price ranging between the Japanese and Chinese brands.

German truck maker, MAN SE, is also expected to set up its plant in Pakistan and other companies have also shown interest in Pakistan hinting at a much more competitive market in the coming years.

Both companies plan to tap into the growing heavy vehicles segment as the China-Pakistan Economic Corridor (CPEC) continues to gain momentum. The company will set up a completely new infrastructure to take advantage of the tax benefits provided with the Auto Policy 2016-21.

Truck sales have rebounded strongly after seven years of below par performance. Thanks to a higher demand, Pakistan produced a record 6,736 trucks and buses in 2015-16. 40 percent of the market has already been taken over by Chinese truck makers.

China Opens Delayed Myanmar Oil Pipeline to Get Mideast Crude Faster

Bloomberg News

April 10, 2017, 11:42 PM CDT April 11, 2017, 2:18 AM CDT

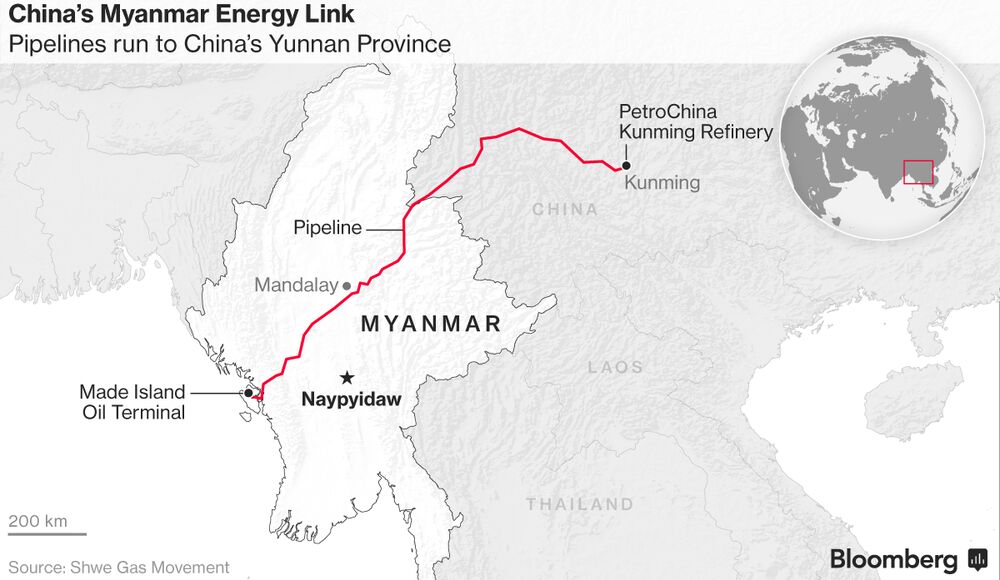

A crude pipeline to southwestern China through its neighbor Myanmar began operations after years of delays, allowing the world’s second-biggest oil user to receive supplies faster from the Middle East and Africa.

- Pipeline operations start as crude unloaded at Made Island

- Tanker United Dynamic arrived from Turkey on April 9: data

A Suezmax-sized tanker, which can hold 140,000 metric tons (about 1 million barrels) of crude, began offloading oil for the pipeline on Monday at Myanmar’s Made Island, to China’s official Xinhua News Agency. Operations on the line, which was completed in 2014 and scheduled to start the same year, are beginning after the government of Myanmar agreed to lower transit fees, Wang Dongjin, president of PetroChina Co., last month.

The link, which allows China to import crude from the Middle East and Africa without having to ship through the Straits of Malacca and into the South China Sea, is part of President Xi Jinping’s "One Belt, One Road" infrastructure and trade development plan stretching across Asia to Africa and Europe.

"It may send a message to those countries that are still hesitating about whether to participate that the initiative is China’s top national strategy and can bring economic benefits to participants," said Fan Hongwei, an international relations professor at Xiamen University who specializes in Myanmar.

Trial operations began in on the 771-kilometer (479-mile) pipeline, which is designed to carry 22 million tons of crude a year (about 442,000 barrels a day). Myanmar can take 2 million tons of crude annually from the line, Xinhua reported.

For Myanmar, the initial benefits are probably minimal, said Suresh Sivanandam, a senior research manager for Asia refining at Wood Mackenzie Ltd. The country may get a small amount of oil and some revenue from oil storage and pipeline tariff fees, while experience from China in building energy infrastructure will be a boon for the country later, he said.

Myanmar Benefits

“Myanmar is growing very fast, and sooner rather than later they might need more oil refineries,” Sivanandam said. “The process of building energy infrastructure should help them in the long run to meet growing domestic demand.”

The Suezmax tanker United Dynamic arrived at Myanmar around April 9 after loading oil from the Baku-Tbilisi-Ceyhan terminal in Turkey on March 5, according to data compiled by Bloomberg.

The pipeline ends in China’s Yunnan province, where PetroChina has built an oil refinery with the capacity to process 13 million tons a year (about 261,000 barrels a day) of crude. China’s biggest oil and gas company is in talks with Saudi Arabian Oil Co. about investing in the plant, which will begin operations in June, Wang said last month.

PetroChina finished building the refinery in the provincial capital Kunming about six months ago and has been waiting for pipeline deliveries to start, according to Sivanandam. It will take about 12 million barrels of crude to fill the pipeline before deliveries can start, he said.

Refinery Output

Once the refinery begins, it will sell products in southwest China, displacing gasoline and diesel from refineries in central and southern China, he said. That will likely increase the country’s net exports of refined products, which rose to a monthly record of 2.85 million tons in November.

China and Myanmar on Monday signed an agreement on the pipeline, as well as eight other cooperation documents, after talks between Xi and Myanmar President Htin Kyaw, who is visiting China from Thursday to Tuesday, state-run China Daily .

China’s crude imports rose almost 14 percent last year, the fastest annual pace since 2010, and touched a in December of 8.6 million barrels a day.

“It opens another channel for China to diversify oil imports,” said Tian Miao, an analyst at North Square Blue Oak Ltd. in Beijing.

pipeline that runs through Myanmar to Yunnan province, designed to carry 12 billion cubic meters annually. PetroChina’s parent company, China National Petroleum Corp., began to import gas from Myanmar in 2013, according to a on its website. Shipments totaled 2.86 million tons last year, customs data show, accounting for about 5 percent of the country’s total imports.

Companies including Total SA and are for resources offshore Myanmar. The country had about 18.7 trillion cubic feet of proven gas reserves as of 2015, or about 3.4 percent of the Asia-Pacific total, according to BP Plc data.

— With assistance by Ting Shi, and Jing Yang

Before it's here, it's on the Bloomberg Terminal.

China receives first oil from Myanmar pipeline

Updated: May 20,2017 7:13 AM Xinhua

A staff member inspects China-Myanmar crude oil pipeline in Ruili, Southwest China’s Yunnan province, May 19, 2017. The first crude oil from Myanmar has reached China via the China-Myanmar crude oil pipeline, China National Petroleum Corporation (CNPC) announced on May 19. [Photo/Xinhua]

BEIJING — The first crude oil from Myanmar has reached China via the China-Myanmar crude oil pipeline, China National Petroleum Corporation (CNPC) announced on May 19.

The oil reached Ruili, a city of Yunnan province bordering Myanmar, at 4 pm, according to the CNPC.

It will continue to flow through the pipe at a speed of about 50 kilometers per day for 650 km before reaching the city of Anning where the CNPC’s Yunnan petrochemical branch is located.

The branch has a designed processing capacity of 13 million tons per year.

The 1,420-km long cross-border pipeline is a part of the China-Myanmar oil and gas pipeline project.

The project, which comprises a crude oil pipeline and a gas pipeline, is a state-operated collaboration between China, Myanmar and international commercial partners.

Photo taken on May 19, 2017 shows the Ruili station of the China-Myanmar crude oil pipeline in Ruili, Southwest China’s Yunnan province. [Photo/Xinhua]

Staff members work in a control room of the Ruili station of the China-Myanmar crude oil pipeline in Ruili, Southwest China’s Yunnan province, May 19, 2017. [Photo/Xinhua]

A staff member of inspection and quarantine bureau tests sample at the Ruili station of the China-Myanmar crude oil pipeline in Ruili, Southwest China’s Yunnan province, May 19, 2017. [Photo/Xinhua]

timepass

Brigadier

timepass

Brigadier

World Bank Projects Pakistan's GDP Growth to be 5.2% in the current Financial Year Increasing to 5.8% in the next Financial Year.

timepass

Brigadier

- :

Construction work on the Gwadar International Airport first phase costing Rs22 billion would be completed in October. CPEC has also increased passenger traffic in the area. The Civil Aviation Authority has allocated 3,000 acres of land.