You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

American Economics Thread

- Thread starter Bernard

- Start date

Thank you for the kind words.

I'm trying to stay away from dunking on the American/Japanese economy because its too easy.

We are all well aware of the challenges (some of which are fixable some of which are in various stages of malignant/metastatic cancers) in the US/Japan.

In general it behooves us to avoid getting sucked into confirmation biases that simply confirm priors and instead look for ways that things could turn out different to consensus/popular beliefs.

It was hard to resist so I'll indulge myself once.

Societal expectations are unrealistic. Instead of settling within someone’s own league both men/women/trans/gays all want some ubermensch for a partner but have nothing to bring to the table themselves.

You can have kids nowdays without even having sex, so long as you have enough capital. You can retire and hire people to take care of you when you are older. In some countries retirement is guarenteed via the state pension. On the other hand, you have to pay for childcare and schooling fees yourself. Given these options, it's more of a surprise that this took so long to happen.

manqiangrexue

Brigadier

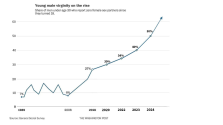

This can't be right, can it? It says 60% of men in the US in 2025 are virgins at age 30? That just can't be. I know it says celebate between 18 and 30 but the title says virginity honestly who has sex in high school then never again?

Part 61:American Dream!!!

Consumer sentiment in the U.S. continues to move in the wrong direction. In fact, U.S. consumer sentiment has just fallen to its second-lowest level ever…

---Concerns about the government shutdown surged in early November, pushing consumer confidence to its lowest level in more than three years and close to its worst historical level, according to a University of Michigan survey released Friday.

The university's Monthly Consumer Confidence Index registered 50.3 points for the month, indicating a 6.2% drop from the previous month and about 30% compared to last year. Economists polled by Dow Jones expected 53.0 points, after the index was 53.6 in October. The last time the index was this low was in June 2022, when inflation hovered around its highest level in 40 years. The November index was the second lowest since at least 1978.

For years, American consumers have recklessly accumulated enormous mountains of debt. Now, the average credit score in the U.S. is falling at the fastest rate we've seen since the Great Recession…

---In yet another indication of an economy in crisis, the average credit score in the U.S. fell two points compared to the same period last year.

Credit rating agency FICO reported Tuesday that the average credit score for all U.S. consumers is now 715, down from 717 in October 2024. According to separately released FICO data, this drop marks the first time since 2009, during the Great Recession, that the average FICO score has fallen two points in a year.

The job market is really tight across the country. If you're looking for temporary work for this holiday season, hiring is expected to be the lowest since the Great Recession…

----The National Retail Federation said Thursday that hiring for temporary holiday retail workers is expected to total between 265,000 and 365,000 jobs this year, the lowest number of seasonal workers in at least 15 years.

NRF CEO Matthew Shay said on the retail trade association's conference call that these hiring expectations "reflect the weakening and slowing labor market." This represents a significant drop compared to the previous year, when retailers hired 442,000 temporary workers, according to the association.

With hiring becoming more restricted, layoffs have increased considerably. Incidentally, we just witnessed the highest number of layoffs in a single month during the fourth quarter since 2008…

---A report from Challenger, Gray & Christmas, a job placement firm, showed that 153,074 job cuts were announced in October, a 183% increase over the cuts announced in September and a 175% increase over the same month in 2024.

“This is the highest total for October in more than 20 years and the highest total for a single month in the fourth quarter since 2008,” Challenger said in a statement. That year was a pivotal moment in the Great Recession, in which thousands of jobs were lost worldwide and the global economy faced a period of contraction.

Total household debt has just hit a new all-time high. Not even during the Great Recession did we face a crisis of this magnitude…

---Total household debt hit a record $18.6 trillion last quarter, and while most borrowers are keeping up with payments, young Americans are feeling the pressure.

I've been warning that Americans are falling behind on their debt payments. Now, the percentage of outstanding balances with serious delinquencies has reached its highest level in more than a decade…

---During the third quarter, 3% of outstanding balances became seriously delinquent — 90 days or more overdue — the largest quarterly increase since 2014, according to the Federal Reserve Bank of New York. Among young people aged 18 to 29, the rate was about 5% — more than double the previous year and the highest of all age groups.

The cost-of-living crisis seems endless. Aluminum prices are rising exponentially, and this isn't going to help at all...

---Aluminum prices in the US hit new records on Monday, with a sharp reduction in domestic inventories, driven by tariffs on steel and aluminum imposed by the Trump administration, aimed at strengthening and revitalizing the American industrial base.

According to Bloomberg, the total price of aluminum in the US, which combines the London Metal Exchange (LME) benchmark price and the delivery premium in the American Midwest, hit a record $4,816 per ton, almost double the level recorded in December 2023.

Manufacturing industry numbers generally indicate where the economy is heading. Therefore, the fact that US industrial production has fallen for eight consecutive months is certainly not a good sign…

---The US manufacturing PMI fell in October, dropping from 49.1 in September to 48.7 in October, marking the eighth consecutive month of contraction. Price pressure may have eased (from 61.9 to 58), but production (from 51 to 48.2), inventories (from 47.7 to 45.8) and deliveries (from 52.6 to 54.2) all declined.

Employment in the sector continued to decline (from 45.3% to 46%), and 67% of survey participants observed that companies are focusing on managing their current workforce rather than hiring new employees.

The technology sector has been one of the few bright spots for the US economy in 2025. But even the biggest tech companies have been carrying out absolutely brutal layoffs…

The scale of the layoffs is unprecedented: in October, more than 112,000 tech sector employees had been laid off at 218 companies. Amazon alone confirmed 14,000 job cuts, citing the need to "reduce bureaucracy" and reallocate resources. This trend is driven by rapid advances in automation and artificial intelligence, which are fundamentally changing the nature of work in the technology field.

“It seems that companies are prioritizing efficiency over human capital,” said a recently laid-off engineer, echoing the concerns of many affected workers. The ripple effects extend beyond individual careers, impacting families and communities as local economies absorb the shock of sudden unemployment.

Part 62:American Dream!!!

According to a recent survey, 55% of American workers fear losing their jobs soon…

---About 55% of employed Americans say they are worried about losing their jobs, according to a recent Harris Poll survey conducted for Bloomberg News. This anxiety comes after a series of layoff announcements by major companies, including Amazon.com Inc., Target Corp., and Starbucks Corp. The job placement firm Challenger, Gray & Christmas Inc. calculated the highest number of job cut announcements for an October in more than two decades.

This adds to families' exasperation with the cost of living. A majority of 62% in the survey conducted between October 23 and 25 stated that the cost of their everyday items increased in the last month, and almost half of those people said that the increases have been difficult to afford.

Now there are reports that “McDonald's Happy Meals are prohibitively expensive for some people due to high inflation”...

---McDonald's executives say that rising costs of essential restaurant items, such as beef and wages, have pushed food prices up and driven away low-income customers, who are already struggling with rising costs for food, clothing, rent, and childcare.

With prices rising for everything, consumer goods companies concerned about the pressures on low-income Americans include food companies, automakers, and airlines, among others, said analyst Adam Josephson. "The list is endless," he stated.

"McDonald's Happy Meals are prohibitively expensive for some people due to high inflation," Josephson said.

US Treasury Secretary Scott Bessent warns that beef prices could exceed $10 per pound by 2026…

---In an interview with Fox News Sunday, Bessent commented on reports that beef prices could reach $10 per pound next year, stating that it was a problem "inherited" by the government due to long-standing factors.

“Furthermore, due to mass immigration, a disease that we had eradicated in North America spread to South America as these migrants brought some of their cattle,” Bessent said.

He added, “Part of the problem is that we had to close the border to Mexican beef because of this disease called botfly.”

A woman who recently lost her employer-provided health insurance was horrified to discover that the cheapest plan her family qualified for cost $2,500 a month…

---

According to Zillow, 53% of all homes in the United States lost value in the last year…

---More than half of homes in the U.S. lost value in the last year, marking the highest percentage of devalued properties in more than a decade.

A Zillow survey revealed that approximately 53% of all homes in the U.S. have lost value since last year, a 14% increase over the previous year. This is remarkable, given that such a large percentage hasn't been seen since the end of the Great Recession – around 2012 – when home prices and household wealth began a significant recovery.

But now the average price of a Big Mac has risen to six dollars…

---In 2000, a Big Mac cost around $2.24. By mid-2025, the average price had risen to $6. Adjusting for general inflation, that $2.24 sandwich from 2000 would be equivalent to about $4.22 in current values. In other words, a classic McDonald's hamburger costs approximately 40% more than it did 25 years ago.

Other menu options have also seen significant price increases. An analysis by FinanceBuzz revealed that the price of a Quarter Pounder with cheese more than doubled in the last decade, rising from $5.39 in 2014 to $11.99 in 2024. Meanwhile, the price of a ten-piece McNuggets combo increased from $7.19 in 2019 to $9.19 in 2024.

According to Zero Hedge, by the end of October, the number of corporate bankruptcies in the US had already almost reached the total projected for the entire year of 2024…

First came the spectacular collapses of Tricolor, a vehicle finance company for customers with bad credit, and First Brands, an auto parts supplier. Then came the fiasco of regional banks, leading JPMorgan CEO Jamie Dimon to warn that more crashes at the end of the economic cycle may be coming. Add to that signs that low-income consumers are running out of money, inflated valuations in the artificial intelligence stock sector, and even Bitcoin falling below $100,000, and it's no surprise that many are beginning to wonder if the growing financial stress signals the early stages of a broader recession.

Another flashing red flag is the new data from S&P Global last week, which shows that, through October, 655 companies filed for bankruptcy, a number almost equal to the total of 687 for the entire year of 2024.

Data from S&P Global showed that, in October alone, there were 68 new corporate bankruptcy filings. In August, there were 76 filings, the highest monthly number since at least 2020.