You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Chinese shipbuilding industry

- Thread starter tphuang

- Start date

Russia's ghost tanker fleet has shown us that it's completely useless, and in fact it's easier to circumvent rules than a container shipChina is stopping buying oil and natural gas from America. So any port charges hike is pointless as far as China is concern.

Foreign owned Chinese built tankers can simply diverted to destinations outside US, the World is a large place.

lcloo

Major

Sorry, I cannot understand what you are trying to convey? Can you post both in original Chinese and translated English?Russia's ghost tanker fleet has shown us that it's completely useless, and in fact it's easier to circumvent rules than a container ship

What I mean is that oil, being a liquid, can be easily transferred between ships. Russian "ghost tankers" evade Western sanctions by conducting ship-to-ship oil transfers with tankers of other nationalities on the high seas. The same tactic could be applied to Chinese oil tankers—simply transfer to tanker with non-Chinese producer on the high-seas would avoid port calls. Legally speaking, this approach would be far more legitimate than Russia's ghost tanker operations.Sorry, I cannot understand what you are trying to convey? Can you post both in original Chinese and translated English?

Some interesting points from the article:

Trump administration announces fees on Chinese ships docking at U.S. ports

The USTR acknowledged this change was made due to the public comments at the two days of hearings on the fines in March where over 300 trade groups and other interested parties testified. Many warned the government in letters and in testimony that the U.S. was in that placed ocean carriers using Chinese-made vessels in the middle. Soon, Chinese-made vessels will represent 98% of the trade ships on the world’s oceans.

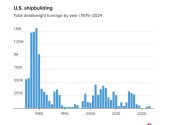

- The U.S. government began investigating China’s dominance in the shipbuilding industry, where it manufactures as much as 75%-80% of fleets, during the Biden administration.

lcloo

Major

China does not need to do as what the Russian do because Russian oil Export was banned by US and European countries and thus they have to resort tto such and China on the other hand is importing oil without being banned.What I mean is that oil, being a liquid, can be easily transferred between ships. Russian "ghost tankers" evade Western sanctions by conducting ship-to-ship oil transfers with tankers of other nationalities on the high seas. The same tactic could be applied to Chinese oil tankers—simply transfer to tanker with non-Chinese producer on the high-seas would avoid port calls. Legally speaking, this approach would be far more legitimate than Russia's ghost tanker operations.

China imports oil via land pipeline from Russia, and also sea routes from Middle East. China's previous import of oil and gas from USA was a move to reduce difference in balance of trade with US, so with decoupling China does not need to buy any oil and gas from USA any more.

As for other goods, use of transhipment ports to offload cargo from Chinese ships, and transfer to non-Chinese built ships is legal internationally and has been practised since ancient time. Example in 14th century, Chinese ships docked in Malacca port to off load their cargo and transfer to Arab ships sailing to Middle East and Europe - The maritime silk route. And from 19th century to present day, Singapore port has been a major transhipment port for international shippings between East and West.

The mega Peru port built with US$1.3 billion in Peru's coastal city of Chancay that was funded by Chinese shipping giant Cosco. They will use this port as transhipment port to Latin America as well as North America. Chinese shipping company COSCO is the operator of Chancay port.

Last edited:

escobar

Brigadier

Chinese yards largely unscathed from US port fees

“We continue to expect Chinese yards to maintain their leading position in most vessel segments,” HSBC maintained in a shipbuilding update, arguing that pending new orders for Chinese yards will resume especially with the price gap emerging versus their Korean and Japanese peers lately.

The competitiveness of Chinese yards remains intact, according to the global bank.

Hengli looking to add 30,000 workers to its new yard at Changxing island, with an eventual goal of 50,000. This being Changxing in Dalian, not the one in Shanghai with Jiangnan and Hudong-Zhonghua yards.

The newly inaugurated “Future Factory”, completed in just 153 days on , spans over 2m square metres of building space across 17 large workshops, said Hengli in a statement. Once fully operational, the facility will employ a total workforce of 50,000 and deliver impressive production capabilities allowing it to build high-value products, including very large crude carriers, ultra-large containerships, very large gas carriers and offshore drilling units, as well as alternative-fuel engines.

Hengli’s rapid rise began with the acquisition of the dormant assets of STX (Dalian) in July 2022 for Yuan 2.1bn ($288m). Once the world’s fourth-largest shipbuilder, STX Group had invested $3bn in 2006 to establish a shipbuilding base in Dalian, but left the facility unused for a decade. Hengli revitalised and rebranded the facility which officially launched in January 2023. The latest available data from Hengli shows that by October 2024, the company had secured 140 newbuilding orders worth approximately $10.8bn, spanning bulk carriers, VLCCs, very large ore carriers, and containerships, with deliveries scheduled through 2028.

Hengli looking to add 30,000 workers to its new yard at Changxing island, with an eventual goal of 50,000. This being Changxing in Dalian, not the one in Shanghai with Jiangnan and Hudong-Zhonghua yards.

For comparison, the entire SK shipbuilding industry employs <130,000 people. To come close to China's tonnage production and maintain profits they have to focus on larger, more lucrative ships, many of which American ports are not equipped to handle. You can make your own assessments based on these information.

How can they compete when they are having to import workers from central Asia ?For comparison, the entire SK shipbuilding industry employs <130,000 people. To come close to China's tonnage production and maintain profits they have to focus on larger, more lucrative ships, many of which American ports are not equipped to handle. You can make your own assessments based on these information.