by on April 25, 2018 1:00 PM EST

|

Two more DRAM makers based in China, Innotron Memory and Fujian Jin Hua Integrated Circuit, are gearing up for volume production of computer memory in the coming month. Both manufacturers were founded with the help of the Chinese government, their output will initially be consumed locally.

Several years ago, the Chinese government announced plans to invest billions of U.S. dollars in the local semiconductor and adjacent high-tech industries and support appropriate companies directly and indirectly. Since the inception of the so-called Big Fund in 2014, not only over tens of billion were poured into various companies and initiatives (the plan is to invest $150 billion in the coming years), but the first actual results of their operations have started to show up. One of the industries that is developing fast in China is DRAM manufacturing. Earlier this year we reported about , which started to sell its DDR4 chips developed and produced in-house. Apparently, there are at least two more DRAM makers in China ready to start shipments of their memory modules in the second half of 2018 and the first half of 2019: Fujian Jin Hua Integrated Circuit (JHICC) and Innotron Memory.

completed construction of its 300-mm fab in November and started to move in production tools late in 2017. According to a media report, the equipment move-in will be completed by early July and the first phase of the fab will be able to start volume production of DRAM in the third quarter. JHICC reportedly partnered with Taiwan-based UMC to develop its 22 nm DRAM manufacturing technologies, but at this point it is unclear which types of memory the company is gearing up to make. Some previous reports indicated that JHICC was looking at various specialized DRAM products (namely LPDDR4), but the actual plans might be different.

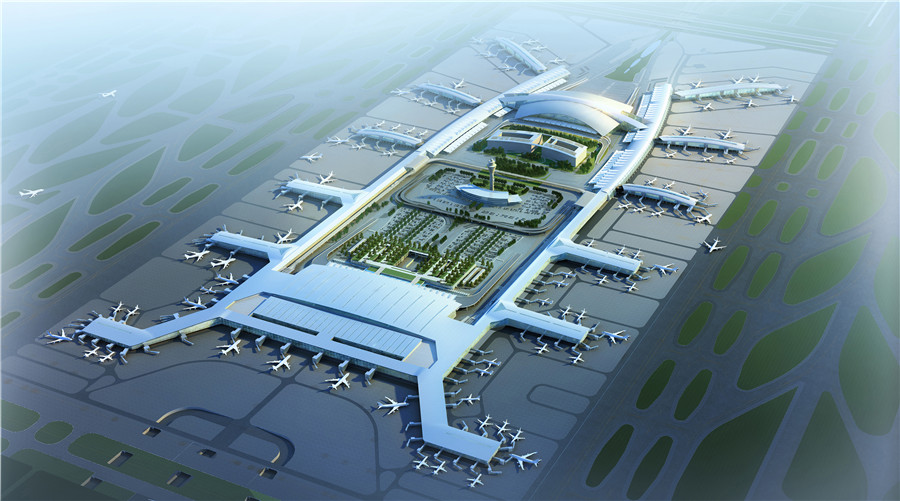

JHICC has already received the first phase of investment totaling $5.65 billion from the local authorities in Fujian, China. It is expected that aggregate investments in the Jin Hua DRAM fab will total $8 billion in the coming years. Manufacturing capacity of the JHICC’s memory fab is unknown, but the facility looks rather big on the picture.

Another China-based company that is getting ready to make DDR4 DRAM devices using its 22 nm fabrication process in the coming months is Innotron Memory (previously known as Hefei ChangXin and Hefei RuiLi). Innotron completed construction of its 300-mm fab in January and then started to move in production equipment. The company intends to start trial production of 8 Gb DRAM chips in late 2018 and then initiate volume production of these ICs sometimes in early 2019.

Innotron’s fab is not going to be very large: its initial capacity will be around 20,000 wafer starts per month in 2019, so in terms of volume it is not going to be a competitor for leading DRAM makers globally. Meanwhile, the firm intends to start building up the second phase of the fab in 2020 to boost its capacity. Furthermore, Innotron plans to complete development of its 17 nm process technology by 2021, the company announced recently.

Considering the facts that Innotron, Jin Hua, and Xi’an UniIC all had to start development of DRAM manufacturing technologies essentially from scratch, and their production capacities are not high, they are not expected to become viable competitors for companies like Micron, Samsung, and SK Hynix in terms of volumes, production efficiencies, or performance any time soon. In the meantime, there are more fabs incoming: in the recent years Tsinghua disclosed plans to invest $24 billion and $30 billion in memory chip production facilities near Wuhan and Nanjing, respectively. Furthermore, leading chip makers (Intel, Samsung, SK Hynix, etc.) already operate 3D NAND and DRAM fabs in China and invest in them to increase their capacities.

In the end, Chinese electronics industry will decrease their reliance on foreign volatile and non-volatile memory chips. Furthermore, it should be noted that it's questionable whether Chinese memory producers have all the patent/technology licenses they need to sell their products outside of China. Or for that matter with transnational semiconductor giants investing billions of U.S. dollars in China, whether they will be able to legally prohibit Chinese companies from building their presence on the foreign markets without facing problems from the Chinese authorities. The good news for the consumer is that with more 3D NAND and DRAM production in various parts of the world pricing of appropriate chips is going to decrease. The bad news is that without proper return-on-investments the progress of technologies may slow down.

Memory production is the first step towards establishment of a full-fledged self-sufficient semiconductor industry in China. Making memory ICs is relatively easy if you have appropriate process technologies, fabs, and clients to buy output. Designing competitive high-performance processors requires access to technology expertise and appropriate technology licenses from various companies. To boost its local SoC/CPU design industry, Tsinghua Unigroup Spreadtrum and RDA in 2013 (which have a license to build mobile SoCs based on select Intel’s x86 cores), then an agreement with Intel to co-develop semi-custom server solutions. Meanwhile, Tianjin Haiguang Advanced Technology Investment Co., Ltd (THATIC) an x86 joint venture with AMD in 2016.