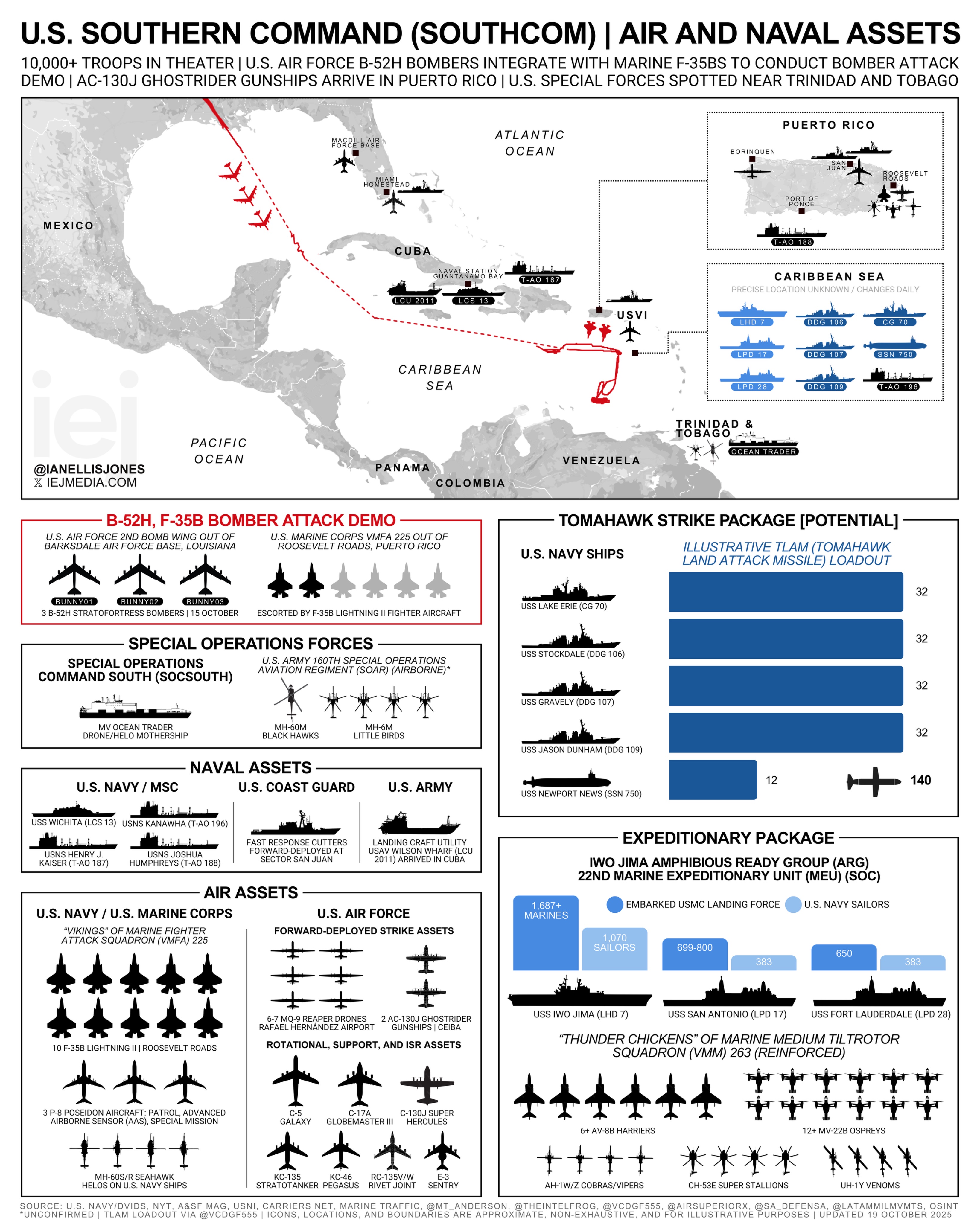

Sounds really dumb getting that close to practice some missile runs. Bread and circuses, so far.View attachment 162642

After long hours circling the Caribbean Sea, approaching within 300 km of Caracas, BUNNY01 and BUNNY02 are now heading back home to the United States. These maneuvers, which initially involved a third B-52, were likely a major exercise to practice launching long-range missiles at targets in Venezuela.

Central/South American Military News, Reports, Data, etc.

- Thread starter zuhe

- Start date