manqiangrexue

Brigadier

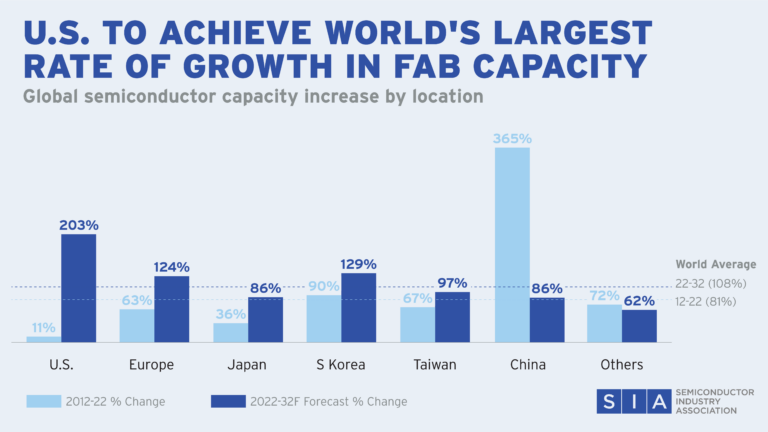

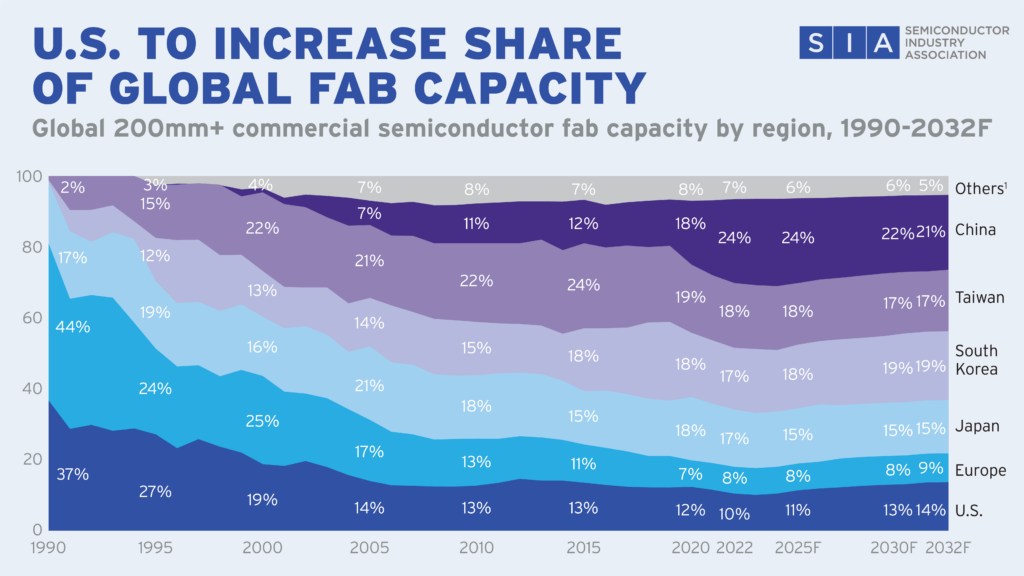

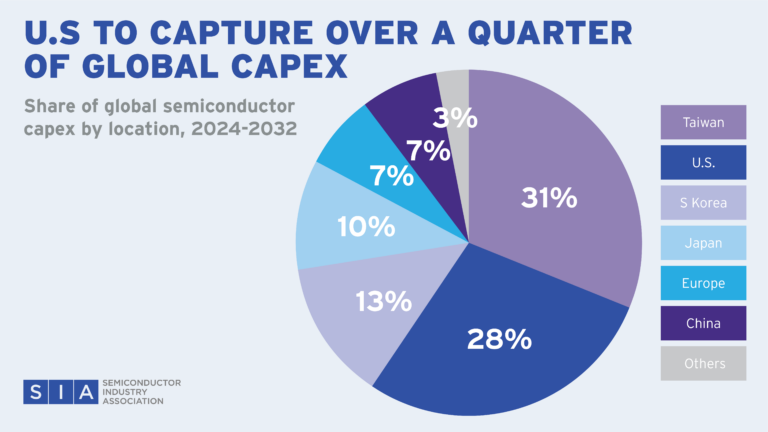

Eversince the COVID readiness map, I have never ceased to be amazed at America's propensity to imagine a future or scenario that is wildly favorable to itself and present it as if it were real and serious data as opposed to the amorphous random fantasies that they actually are. It's like the adult version of a kid drawing himself in a Superman costume with 30 inch arms a 70 inch chest standing next to the kid he doesn't get along with, who is actually taller, stronger and smarter than him in real life, as some hobbit-sized black and brown scribble scrabble ball of dirt with lines for arms and legs. The real data has China at 365% and the US at 11%. The instant we exit the realm of reality and cross into the realm of American imagination, America shoots up to 203% and China drops to 86%.Interesting stats on how CHIPS act is forecasted to impact US semiconductor production.

Last edited: